Hong Kong Insurance Knowledge | Hong Kong Insurance Terminology

2024-04-12

What is the most lucrative field of study in Hong Kong?

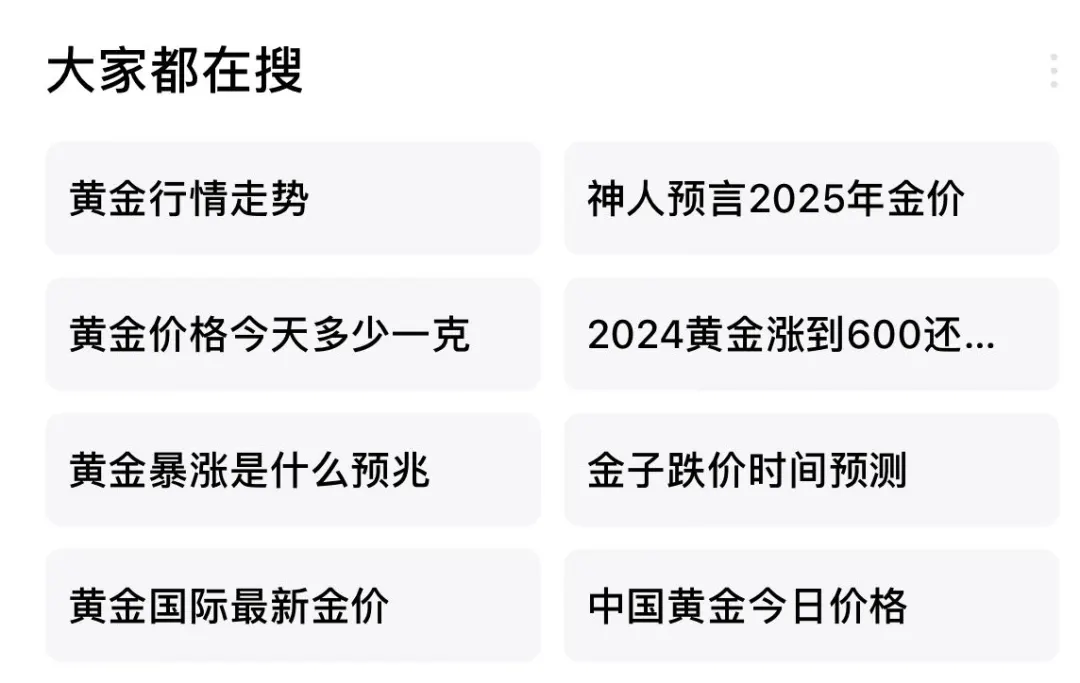

2024-04-19Recently, the topic of "rising gold" has been on the hot search.

From March this year, international gold futures and spot prices have both climbed to record highs, with spot gold prices rising from less than $2,050 per ounce all the way toUp to $2383/ozThe price of gold jewelry in China's domestic gold jewelry stores has also risen by more than 161 TP3T.Breaking $700.The Big Pass.

act asRisk-averse quality assets - goldIts price is affected by theGlobal supply and demand, geopolitical risks, economic data, etc.The impact of multiple factors. For investors, is gold suitable for long-term investment? Which is more suitable compared to Hong Kong insurance?

01

The investment value of gold in the long term

Gold has traditionally been regarded asinflation proofcap (a poem)devaluate a currencyeffective tool, especially in times of economic turmoil or rising political risk, and its safe-haven attributes make it likely that its price will rise.

However, many professionals believe that gold does not have investment value, for exampleWarren Buffett (1930-), the US investor and philanthropist, principal owner of the companyThe practical and investment value of gold is considered to be very low, like a hen that can't lay eggs, it just sits there and has to keep eating.

Looking at the historical performance of gold.The value of gold is mainly in the period of riskWhenever there is a risk event in the market, the safe-haven value of gold will come to the fore, when the market is panicked, that is, when the light of gold shines the brightest. However.When placed in a longer time cycle, gold's return on investment is not really outstanding.

what is calledBuy gold in troubled times, except for historical levels of chaos, for most of the rest of the time, gold hasn't done too well.It doesn't even beat inflation in the long runThe

In the early 1980s, the price of gold is about $850, and now the price of gold is about $2300, more than 40 years of increase of only 1.7 times, which may be greatly exceeded many people for gold can preserve the traditional impression of the value.

Not only does such a rise fail to outrun inflation, it is even less than a bank deposit, which can be compounded to more than three times after 40 years if the deposit rate of 3% is used as the basis for calculation.

02

Hong Kong insurance may be a better long-term option

Whether it is gold, stock market or futures and other markets, shock and uncertainty are the biggest characteristics.

Hong Kong Savings and Participation Insurance, in contrast, hasLong-term, stable and sustained returns, suitable for most investors in the long term.

Purchasing a Hong Kong insurance policy is like buying aportfolioThe assets are managed by a team of experienced institutional investors, who have been working together for more than a century. Relying on Hong Kong's mature financial system and the insurance company's management mechanism that has been continuously optimized and upgraded over the past hundred years, and leveraging on the rich experience of institutional investors, the assets have aLow risk, high returnThe excellent place to go.

Hong Kong Participating Savings Insurance has multiple advantages:

- Currency Conversion: Multiple currencies, unlimited conversions;

- Considerable returns: long term potential returns 6%-7%;

- Open branching: unlimited flexibility to split the policy;

- Dividend Lock: Lock in potential returns and withdraw them at any time;

- Wealth Inheritance: Continuous growth of wealth and unlimited change of insured persons to ensure the perpetual inheritance of wealth.

Therefore, Hong Kong Savings and Participation Insurance is a very suitable product for long-term investment. It canmeeting the need for long-term sound investment appreciation and stable future cash flows.It can also be flexibly adjusted and diversified to suit individual needs, making it a wise and right choice.

If you are interested in Hong Kong insurance, please feel free to contact Timeless Group!