Hong Kong Family Office|Asia's Wealth Management Center, the Best Place for Ultra-High Net Worth Individuals to Locate

2023-08-11

Compound interest up to 7%! How does HK Savings Insurance do it?

2023-08-25factAs one of the three major international financial centers, it is a hub for international companies to expand into the Asian market and a transit point for Asian companies to go international.

factalways been known for"Simple tax system, low tax rates" as one of the core competencies, known as"Low Tax Paradise"The name.

Today, let's find outHong Kong's tax system

Main taxes

01 Profit tax (16.5%)

02 Salaries tax (progressive rates: 2%, 7%, 12%, 17%, lower of standard rate 15%)

03 Property Taxes (15%)

04 Cenotaph (0.2%)

Note: Profits tax, salaries tax and property tax all have in commonProvisional tax liabilitiesThe

not levied in Hong Kong: Turnover taxes (VAT, sales tax, consumption tax), inheritance tax (suspended in February 2006), import and export taxes (except for special items such as cigarettes and alcohol), and capital gains tax (e.g., dividends, distributions).

01

profit tax

Profits Tax is a tax levied on all profits arising in or derived from Hong Kong from any business carried on in Hong Kong, and is only payable in respect of each tax year.1 tax returnThe

If the reporting individual is in a loss position, no tax is due and the loss amount can be offset against the next tax year's profit, minimizing the tax pressure on the business owner.

⭐ favorableTax adjustments

Hong Kong's two-tier profits tax system will apply for years of assessment on or after April 1, 2018 The profits tax rate will be reduced to 8.251 TP3T for the first $2 million of a corporation's profits, while profits thereafter will continue to be taxed at 16.51 TP3T. The two-tier profits tax system will benefit qualifying businesses with assessable profits, regardless of their size.

The Hong Kong Inland Revenue Department (IRD) will issue a profits tax form about 18 months after the establishment of a new company, and the company will have three months to process the tax form after receiving it.

A Hong Kong company filing tax returns must go through an accounts audit. The new Companies Ordinance clearly stipulates that a Hong Kong company has to undergo an annual audit before filing a tax return with the Inland Revenue Department (IRD).

The first year of auditing the accounts of a Hong Kong company shall not be greater than 18 months; subsequent years shall be 12 months. If the first year is greater than 18 months, a qualified audit report will be issued, the report does not affect the tax return, but may have an impact on the enterprise investment and financing.

Losses of a Hong Kong company with a business year can be made up indefinitely in subsequent years. Losses incurred in a non-operating year cannot be carried forward to future years.

▶ Collection of provisional taxes

Profits tax is levied on assessable profits for each year of assessment, which can only be determined after the completion of the relevant year.

Provisional tax will therefore be levied by the Inland Revenue Department before the end of the relevant year. When IRD subsequently assesses the assessable profits for the relevant year of assessment and makes a tax assessment, the provisional tax paid will be used to offset the profits tax assessed.

Audit reports and bookkeeping audit information need to be retained for at least 7 years.

⭐How to file profits tax returns

▶ No operational audit

The company has not had any business transactions and has not had any bank entries or exits related to business transactions during the assessment year for which the IRS has requested a return.

The auditor's report will disclose that the company did not operate during a certain tax period, that there were only a few necessary expenses (e.g., incorporation fees, annual audit fees, etc.), and that the net profit was negative and not taxable, but that no deferred losses were allowed.

▶ Bookkeeping, auditing, and tax preparation (with operations)

Submission of company accounts, issuance of financial report, completion of profits tax return and submission to the Inland Revenue Department. Upon receipt of the Profits Tax Return issued by the Hong Kong Inland Revenue Department (IRD), the tax return must be completed and submitted to the IRD within the deadline, together with the audit report audited and signed by a Hong Kong accountant.

▶ Offshore Exemption

Specifically, the following points can be used to verify that business is taking place in Hong Kong:

◆ Neither the supplier nor the customer is a Hong Kong client;

◆ None of the order signing process takes place in Hong Kong;

◆ No customs clearance, receipt or shipment has taken place in Hong Kong;

◆ Not having a physical office in Hong Kong and not employing Hong Kong staff;

◆ Failure to keep any business records, etc. with the Hong Kong Government.

Note: The company needs to pass an audit before applying for an offshore exemption.

02

provisional tax

Salaries tax is payable on all positions, employment and pension income, share awards and rental subsidies (reimbursements) arising in or derived from Hong Kong. Only income derived from employment or services rendered in Hong Kong or remuneration received as a director of a company controlled and managed in Hong Kong is subject to salaries tax.

⭐ Tax deductions

Under salaries tax and tax under personal assessment, individuals may claim deductions in their Individual Tax Returns to reduce their taxable income if they have incurred the following expenses during the year of assessment:

⭐ basic allowance

The basic allowance is HK$132,000/year and the full amount is tax-free if the individual receiving the remuneration does not provide services in Hong Kong and can claim offshore. The exception to this is directors, i.e. directors who exceed the sum of the HK$132,000 and other qualifying allowances are taxable regardless of whether they are in Hong Kong or not.

⭐ Tax rate and calculation method

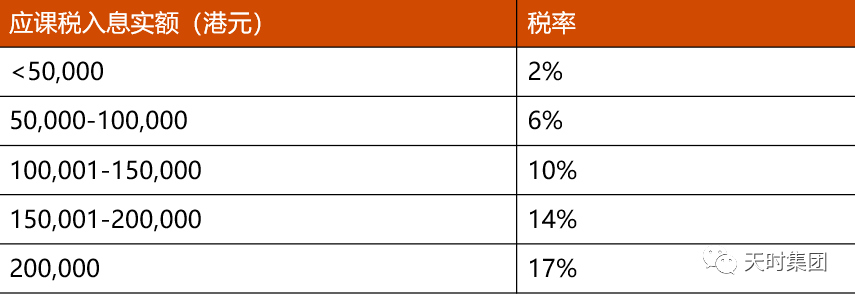

Salaries tax is levied on the lower of the individual's taxable income in the year of assessment in real terms after deducting personal allowances at the progressive rates of 2% - 17%; or the net income (before deducting personal allowances) at the standard rate of 15%.

⭐ Submission of employee information

Companies have to submit employee information to the Inland Revenue Department, which issues tax forms; if the employer fails to do so, the individual has to take the initiative to file a return. Hong Kong companies do not have withholding obligations.

property tax

Property tax is a tax levied on owners of land and/or buildings in Hong Kong and is calculated by applying a standard rate to the net chargeable value of the property. The net taxable value of a property isAmount of actual income (rent) from the property, less tax allowances, the current standard tax rate is 15%.

The main tax item for Hong Kong companies is corporate profits tax. Even if there is rental income from property, there is no need to pay property tax. Property tax in Hong Kong is levied on the rents of individual rental properties and is actually a component of the income of individuals. The tax is only payable if the individual has a rental property.

customary tax

Stamp Duty (CD) is a tax on leases of immovable property situated in Hong Kong, on instruments of sale or transfer of immovable property, and on instruments of transfer of Hong Kong securities.

All non-Hong Kong permanent residents, including limited companies, are also subject to Buyer's Stamp Duty (BSD) at the rate of 30% for the purchase of residential properties, but non-Hong Kong permanent residents can apply for a refund after they have changed to permanent residents.

factRegionally ownedWell-developed and clear tax systemwhich has always been popular among different categories of talents, coupled with the advantages of a global financial center and the free flow of capital.factIt is undoubtedly attractive for personal identity choices and asset allocation.

Hong Kong is currently in a window of attracting talents and enterprises on a large scale, if you are interested, please feel free to enquire.