Macau joins the war for talents with two new talent admission programs!

2023-11-15

Difference between Business Registration Certificate and Certificate of Incorporation of a Hong Kong Company

2023-11-30Due to the high return on Hong Kong savings insuranceCompound interest up to 6%~7%It is also highly sought after because it supports useful features such as multi-currency conversion, policy splitting and unlimited change of insurer.

However, as we all know, Hong Kong has gathered nearly 200 insurance companies, and there is a wide range of savings insurance products, which is dazzling to the eye, so how can we pick the most suitable product among the many products?

What is Hong Kong Savings Insurance?

Hong Kong Insurance

Hong Kong Savings Insurance is categorized intoTerm Savings Insurance, Short to Medium Term Savings with Profits Insurance, Traditional Savings with Profits + Multi Currency Savings with Profits InsuranceThe

Type I: Term Savings Insurance (3 to 5 years)

The return is comparable to the Hong Kong fixed deposit! Currently Hong Kong dollar fixed deposit, although high interest rates, but short time, high threshold, fluctuations, 10% above the interest rate is basically only 7 days, 3 months general interest rates in 5% ~ 5.5%, 12 months interest rate down to 4.5%.

In contrast, Hong Kong's short-term fixed deposits, with 2 years' contributions, 3 years' capital return and 8 years' protection, have a lower threshold, starting from US$6,000.Guaranteed irr of 3.18% in year 3 with a return of 4.14% at the end of the termIn addition, there are death and accidental death benefits, which are more stable and secure than bank fixed deposits!

Type II: Short- to medium-term participating savings insurance (≤ 20 years)

In Hong Kong, in addition to the long-term compound 7% savings participating insurance, short- and medium-term savings products are also very popular.

For example, LIBOR Life, which specializes in short- to medium-term savings products, has launched "Interest Enjoy Yearly 2", which guarantees cash flow for 20 years.

This is a product where customers are guaranteed to receive 2% of paid premiums every year from the 1st policy anniversary until the end of the 20th year.

In addition, these products pay an annual dividend from the 1st year and a final dividend in the 6th year, enjoying a substantial dividend income based on a stable cash flow.The expected return at the end of the term is up to 4.7%.

Value-added services are also provided1 to 2 times leverage on deathProvidesSavings + Cash Flow + Life3-fold guarantee!

Type III: Traditional participating savings + multi-currency participating savings insurance (whole life)

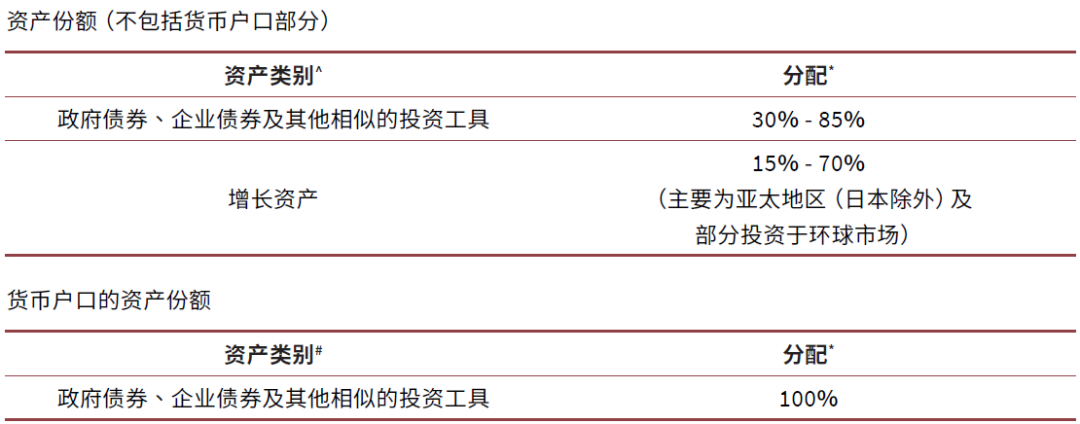

In terms of value-added services and overall returns, Multi Currency Savings With Profits Insurance differs very significantly from traditional Savings With Profits.

Multi-currency savings with-profits insurance, which further protects assets as they rise steadily whileOptimized for wealth transfer, asset segregation, small trusts, premium holidays, premium financing, tax planningIt is more suitable for the middle and high-end customers who want to allocate overseas assets, such as high-end functions.

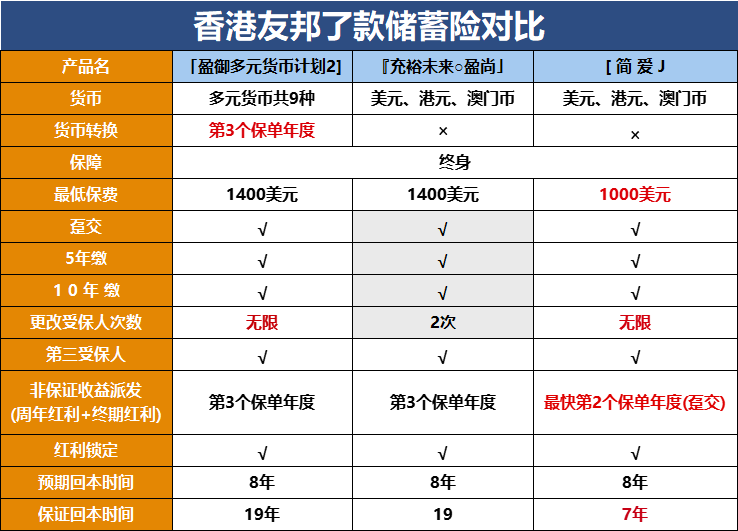

以香港友邦为例👇

So which of these types of savings insurance is better for us? How should we pick one?

How to choose Hong Kong Savings Insurance?

Hong Kong Insurance

1️⃣ Insurance company branding

We shop around for the most secure and reliable manufacturers when picking out ordinary products, not to mention a policy that may be with us for life.

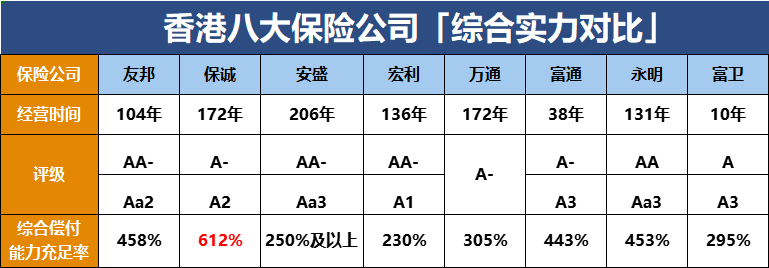

Therefore, it becomes necessary to choose as large an insurance company as possible.You can pick an insurance company based on its ratings and rankings, theAfter all, it's a lifetime policy, and an insurance company's investment capabilities and size still matter.

Below are the combined solvency and ratings of the top 8 insurance companies in Hong Kong for reference only:

2️⃣ Product Yield

The return on the Hong Kong Savings Insurance is made up of two components:

1) Guaranteed returns, usually around 0.3-0.51 TP3T;

2) Expected earnings, up to 5%-7%.

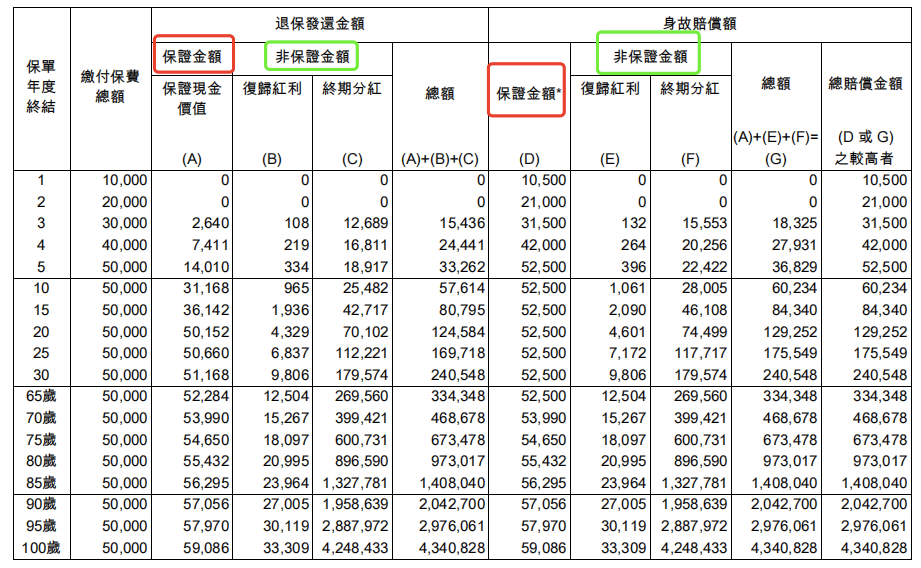

To understand it intuitively, it is the red and green columns in the diagram below:

With these 2 gains, naturally the higher the better.

3️⃣ Dividend realization rate

Hong Kong savings insurance compound interest up to 5%-7%, the most critical is the expected return, and can not achieve the expected return, it depends on the Division dividends realization rate.

To put it bluntly.The higher the dividend realization rate, the higher the expected return.

- Dividend Realization Rate = 100%, indicating that the demonstrated return is consistent with the actual return;

- A dividend realization rate > 100% indicates that the actual return exceeds the demonstrated return and is more profitable;

- Dividend realization rate <100% means that the actual return is less than the demonstrated return and the future return of the product is yet to be seen.

The dividend realization rate, which is published once a year by the Department of Insurance, can be found on the official website.

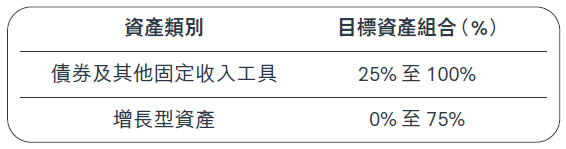

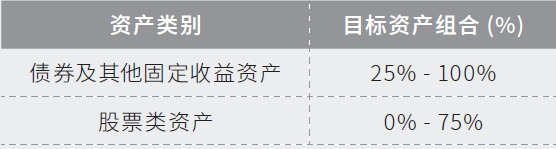

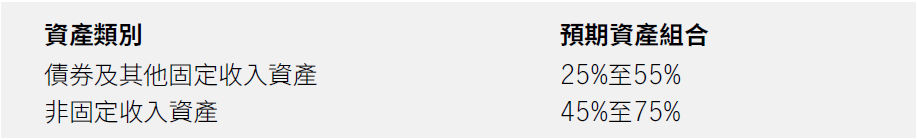

4️⃣ Investment Philosophy and Strategy

ally

prudential

AXA (Tianjin Economic Development Area)

Vantone

macro (computing)

5️⃣ Premium Discount Effort

There is another important reason why people favor Hong Kong savings insurance:There are offers!

And mainland insurance is very strictly regulated in this respect and no such operation is allowed.

Common discount strategies for savings insurance in Hong Kong, including but not limited to:

1) Pre-payment discount

Savings insurance is the most rewarding form of lump sum (single premium) payment, but only a very few HKFI products are available in lump sum. In order to meet this demand, HKFI has introduced a "prepayment" policy with favorable incentives.

Customers can give their premiums for the next 2-3 years to the Insurance Division in advance, which will be entered into the policy reserve account and then rolled over to generate interest at the guaranteed interest rate of ×%, and then automatically deducted from the premiums when the payment period arrives.

2) Discounted premiums

Directly reduce a certain amount of premium at a discounted rate. For example, XX Insurance Division is entitled to a premium discount of 1% if you enroll by September 30th.

3) Premium Rebate

It can be interpreted as a "delayed gratification version of a discounted premium."

For example, if you pay $10,000 in annual premiums and get a rebate of 20%, the first year you pay $10,000, the second year you only have to pay 80% (i.e. $8,000) in premiums. Some insurance companies offer up to two years of premium rebate, the first year premium rebate up to 15% + the next year premium rebate up to 9%.

6️⃣ Extraction Programs

Whether early withdrawal is required or if there is any requirement for the first year's surrender present value. Most of the savings insurance policies are explosive in the middle and later years, and it is generally recommended that it is appropriate to make withdrawals after 10-15 years, but there are a few insurance companies that can provide short-term withdrawal features.

Overall, although Hong Kong savings insurance is highly profitable, there is a big difference!

The above points summarize the experience of selecting Hong Kong savings insurance for reference only, and I hope they are helpful to you.

Which product to choose will also be combined withOur age, current offers, premiums, etc.Make measurements.

The right product at the right time will provide better returns and protection!