Family Trusts for Your Wealth Management and Legacy

2022-01-21

Master the power of compound interest and get richer together!

2022-01-31When the cannon goes off, there's ten thousand taels of gold.

Affected by the Russia-Ukraine situation, the recent global market fluctuations have been dramatic. In the commodities market, safe-haven assets such as gold and crude oil have ushered in a wave of gains, with oil prices rising above $100 per barrel for the first time in more than seven years.Spot gold touched a high of $1973.96 per ounce.

In addition to spot gold, the offer of physical gold also ushered in a wave of rise. Domestic market mainstream brand physical gold offer generally exceeded 500 yuan / gram mark, theIt rose as high as 505 yuan per gram.

With the current global epidemic and all kinds of risky events surrounding us, one can't help but think of the old adage-"Buy gold in troubled times."The

Can gold really be an effective "hedge"? What is the best investment? Today to talk to you

Can gold really "hedge"?

When it comes to hedges, many people's first thought may be gold.

The so-called safe-haven instruments, which can also be called "inflation-resistant assets", as the name suggests, are mainlyAn asset deposited to hedge against the risk of sovereign currency inflationThe

For a long time, especially during the gold standard era, every time a major risk event occurred in human society, theGold's position as the premier safe-haven (anti-inflation asset) has been very stable.

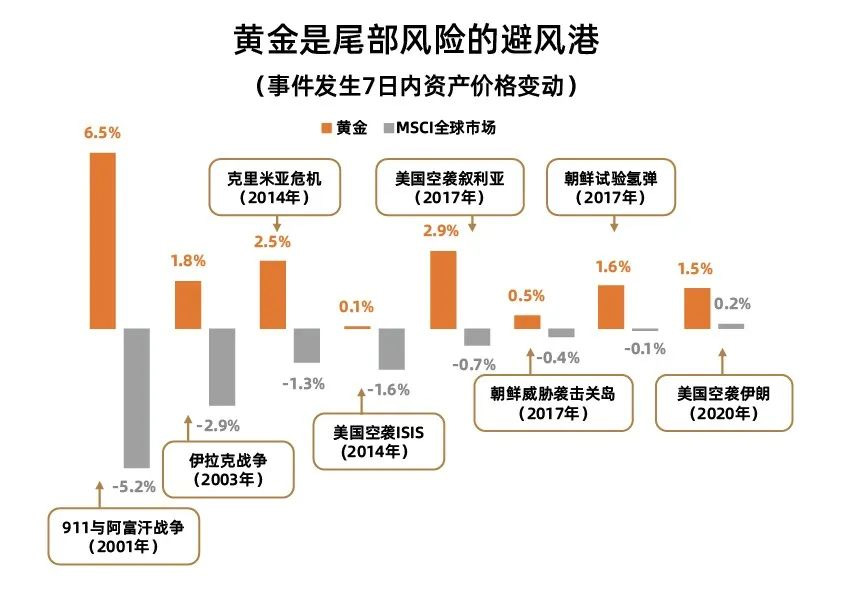

From an investment perspective, the outbreak of conflict generally has an 'impulse shock' on equity markets in the short term, and from past experience, gold has been a realA safe haven in case of riskThe

In the 21st century, the war in Afghanistan, the war in Iraq, the Crimean crisis and other major events have come and gone - the

Gold returns have generally been good, while global markets have been mostly down over the same period.

However.Waiting for the conflict to break out or for the situation to become clear.The price of gold does not necessarily rise.

It is indeed a comfort zone for investing in gold at a time when market sentiment is more fragile and there has been a general major deflation in various countries.

How should I invest in gold?

First of all, gold is not a suitable investment for large proportions.

There are two main reasons for this:

1️⃣ Over the long term, assets like gold aremodest value-added.Investing in large proportions affects the rate at which we can grow our wealth.

2️⃣ In the short term, gold'sMore volatile, although safe-haven, but also not absolutely lying down the variety.

So, if you're planning to start investing in gold, it's a good idea to develop aUpper limit on the proportion of investments, for example, don't exceed 5%.

Second, gold isn't really suited for long-term holding either.

In the book "Stock Market Long-Term Magic," statistics on the performance of the United States over the past 200 years for each major financial asset class show that over a 210-year period, from 1802 to 2012, gold had an annualized rate of return of 2.141 TP3T.0.72% after adjusting for inflationThe

That is, you held $1 in gold in 1802, which after 210 years equaled about $4.52 net of inflation. This long term yield can only be said to be approximately equal to the rate of inflation, as the default inflation target for the Fed and multiple central banks is now right around 2%. ThisThe returns are really not considered high.

At the same time, if daily necessities, such as bread and beer, are taken as the standard of valuation, then for the past hundred years, theThe purchasing power of gold has not really changed in a particularly significant way.

Over the long term, gold prices don't rise and fall as dramatically, and the upward and downward movements last for long time periods, usually over a decade or even decades in one big cycle.

Gold is not the best in terms of investment returns, and long-term investments in the stock market are somewhat more profitable.

Also, it is important to note that gold investment itself is not low-risk: over the past decade or so, it has been even more volatile than the U.S. S&P 500.

If you think gold is a 100% safe asset for preserving value, you may be hurt when it goes down.

The greatest value of gold, for us ordinary investors, lies in thesupplyproduction configurationThe

It's like different foods are healthier and more nutritious when they're paired well - stocks, bonds, gold, and other different assets in different proportions will lower your investment risk while potentially boasting higher returns.

For example, when stocks go down, gold many times doesn't go down with them and even goes up.

So, if you have a modest allocation of gold in your investments, it's like adding shock absorbers to your car with lower overall volatility.

Identity planning is the best investment

American investment guru Jim Rogers once said:

"It's dangerous to have just one passport, with the volatile situation ahead, it's important to have Plan B, and having a second passport gives you the chance to survive."

Becoming a "global citizen" with "multiple identities", as opposed to having a "single identity", is a more difficult task.It's safer and one of the most important strategies for wealth preservation.

✅ A high-quality second identity, with its advantages of global access, asset distribution, tax planning, and educational shortcuts, can give you an additional choice and protection when the unexpected comes.

For the importance of second identity, check out:

With the volatile situation in Russia and Ukraine, we can't help but think that you never know which comes first, tomorrow or the unexpected, and we all want to make sure that our families have a safe and stable environment, so that when the crisis comes, the whole family has a PLAN B in case of emergency.This is another confirmation that identity planning is the best investment.