Hot | Hong Kong Announces: Proposed 15% Global Minimum Tax Rate

2023-12-29

How are tax residents recognized after obtaining Hong Kong status?

2024-01-12Since the resumption of full customs clearance between Hong Kong and the Mainland, the demand for insurance in Hong Kong, which has been suppressed for three years, has been rapidly released, and the dormantHong Kong Insurance MarketWelcome back the dawn.

Review of the Hong Kong insurance industry in 2023:The Mainland has once again set off a boom in taking out insurance in Hong Kong; new legislation to protect the interests of policyholders; the establishment of the Hong Kong Insurance Service Centre for the Greater Bay Area; Hong Kong's major insurers have achieved a dividend realization rate of more than 1,00% for their products, and have launched superb product offers, prepaid guaranteed returns as well as innovative insurance products.

In this article, we have compiled a list of 10 key things to do in Hong Kong insurance in 2023!

01Mainland visitors to Hong Kong to take out insurance is growing rapidly

In the first three quarters of 2023, Mainland visitors to Hong Kong insured HK$46,849 million, up 4,575.5% from the same period last year (HK$1,002 million).

Among them, HK$9.6 billion was insured in the first quarter, HK$22.3 billion in the second quarter and HK$15 billion in the third quarter, representing a drop of 32% YoY. Premiums insured by Mainland visitors accounted for one-third of the territory's total new policy premiums (HK$146.3 billion) at 32%.

The rise in new business premiums from Mainland visitors was mainly driven by demand for whole life insurance and critical illness protection. The two together accounted for 881 TP3T in terms of new policies written, with Whole Life accounting for 541 TP3T and Critical Illness Protection for 341 TP3T.

Source: Hong Kong Insurance Authority

In the first three quarters of 2023, total new policy premiums for mainland visitors amounted to HK$46.8 billion, already exceeding the HK$43.4 billion for the whole of 2019 before the epidemic!

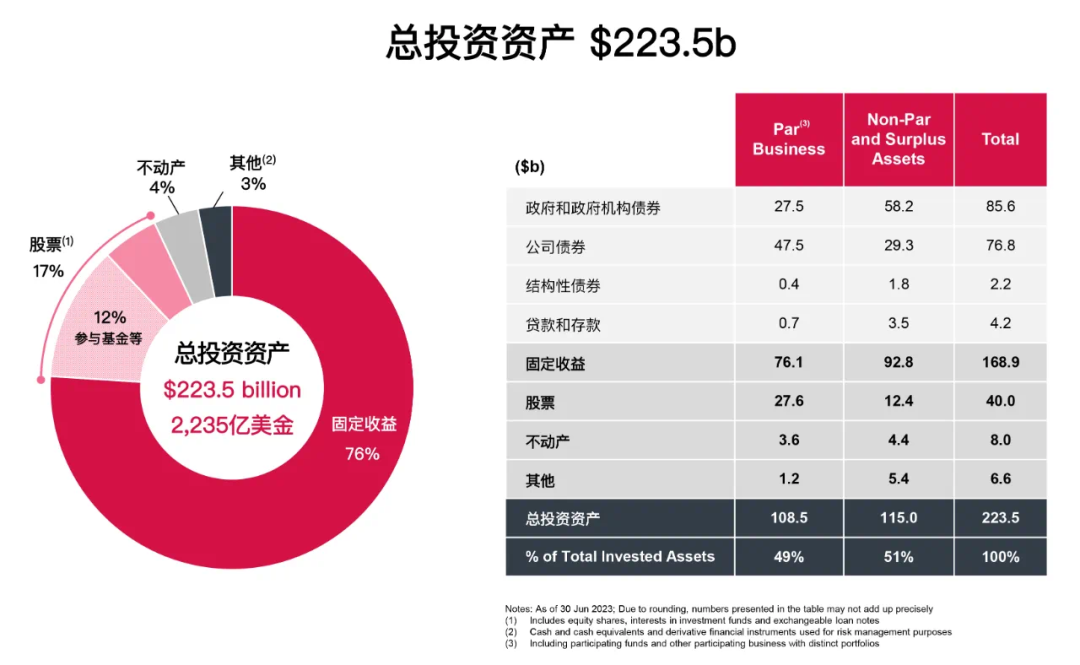

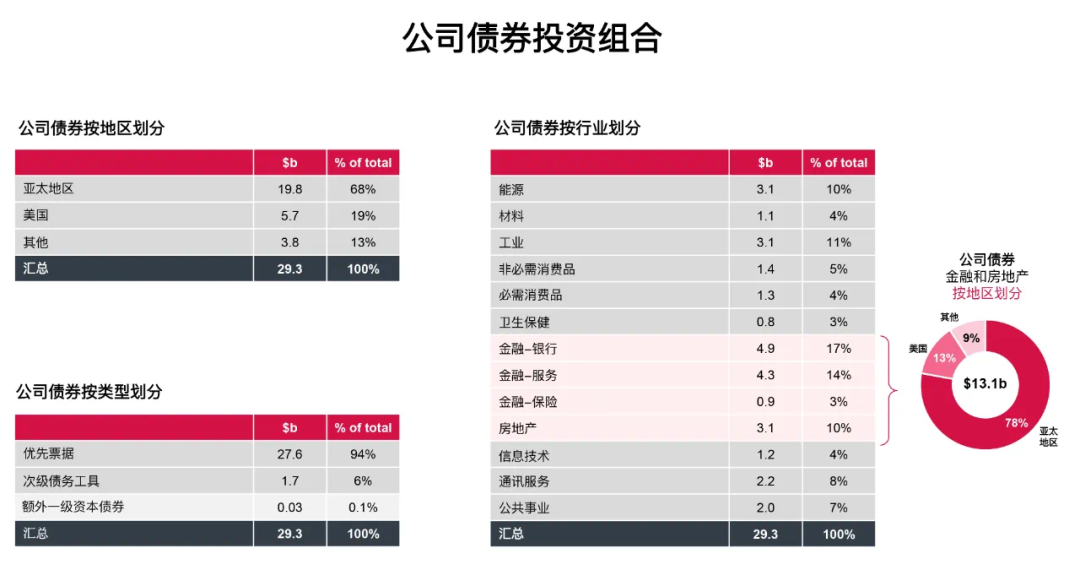

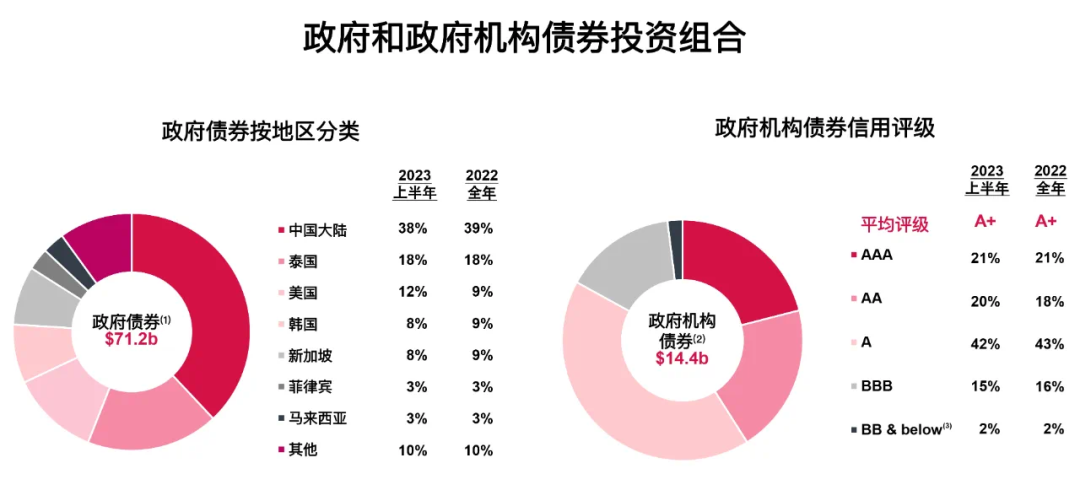

The reason why people are willing to fly all the way to Hong Kong to take out insurance policies is that Hong Kong policies use the lowest cost to dollarize and internationalize RMB and participate in global investment. This kind of global investment with extreme risk diversification is handed over to the best asset management company that has been in the international financial center for decades, so that the policy returns can achieve long-term stability and security.

02New rules on dividend realization rates take effect in January

The Hong Kong Insurance Authority (HKIA) has revised its guidelines, which will come into effect in January 2024, to require major insurers to disclose with-profits realization rates and past dividend payout ratios for new policies that have been issued after 2010, as well as with-profits policies or universal life product lines with in-force policies still in existence.

Hong Kong insurance companies will publish the dividend realization rate of participating products every year, up to 100% is the same as the plan demonstration value, higher than 100% is more than the plan demonstration value, this data is also considered to be one of the important references for choosing Hong Kong insurance.

Transparency of information to policyholders and strong regulation of insurance companies will become the new normal in the future Hong Kong insurance market, it is recommended to check the past dividend realization rate of similar products of this company before taking out a policy, the longer the year the more meaningful reference.03Income smoothing mechanism to ensure stability

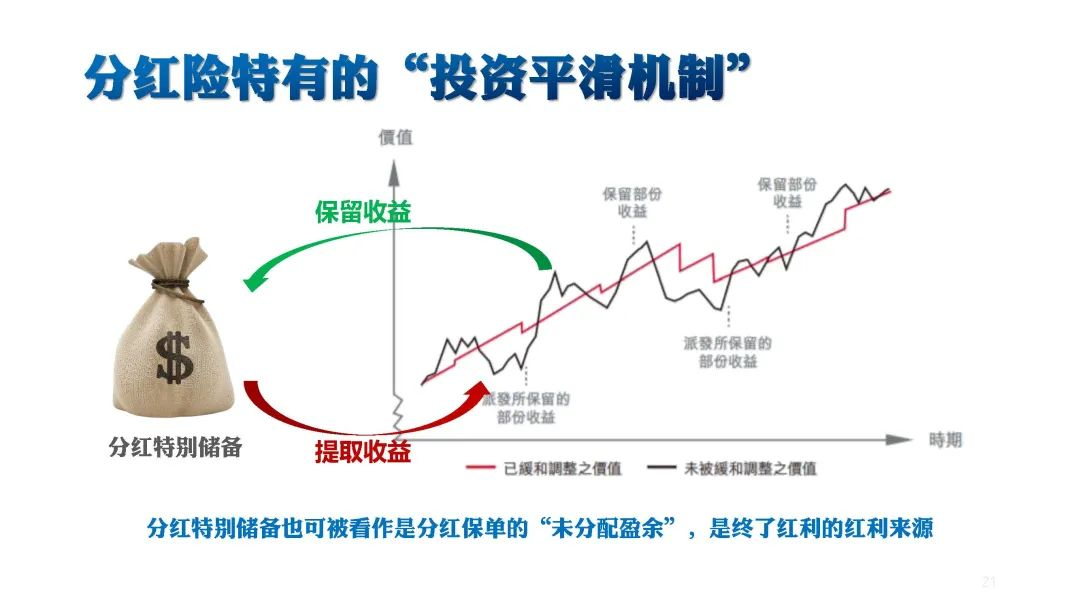

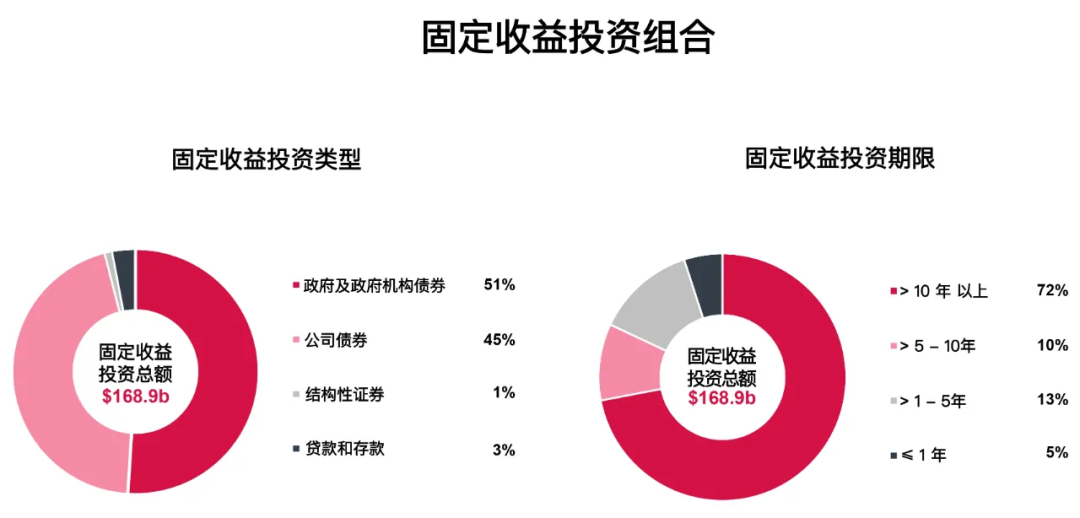

One of the key reasons for the remarkable success of Hong Kong insurance companies in long-term low-risk, long-cycle investments is their strong capital smoothing mechanism. This mechanism allows insurers to compensate policies in years of poor investment returns, including a portion from legacy assets and provisions in years of better investment returns.

The core idea of this mechanism is that in years of good investment returns, part of the surplus is "stored" in an account called the "special reserve for dividends" for use in unfavorable years.

When it is no longer possible to meet the expectation of dividend payout by relying only on the investment spread of that year, the insurance company will withdraw a little money from the dividend special reserve account to make up for the full payout. This allows customers to receive stable dividend payouts even in years when the overall investment returns of the market are not performing well.04Hong Kong insurance companies protect customers' interests

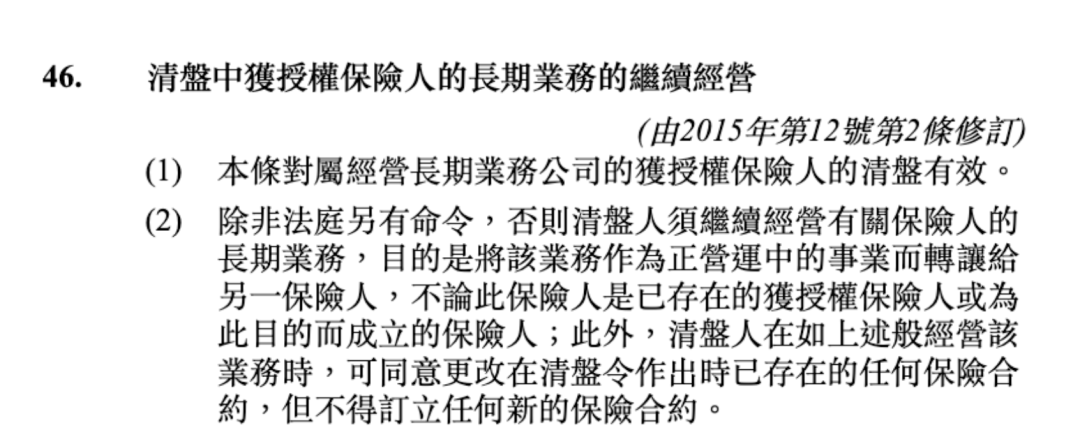

Section 46 of Chapter 41 of the Insurance Companies Ordinance of Hong Kong states that unless the court orders otherwise, a liquidator shall continue the long term business of an insurer for the purpose of transferring it to another insurer as a going concern.

In other words, the legal regulation in Hong Kong stipulates that an insurance company which is not doing well will be transferred to another financially capable insurance company for continuation of operation to ensure the interests of clients.05Hong Kong insurance company's solvency cannot be less than 150%

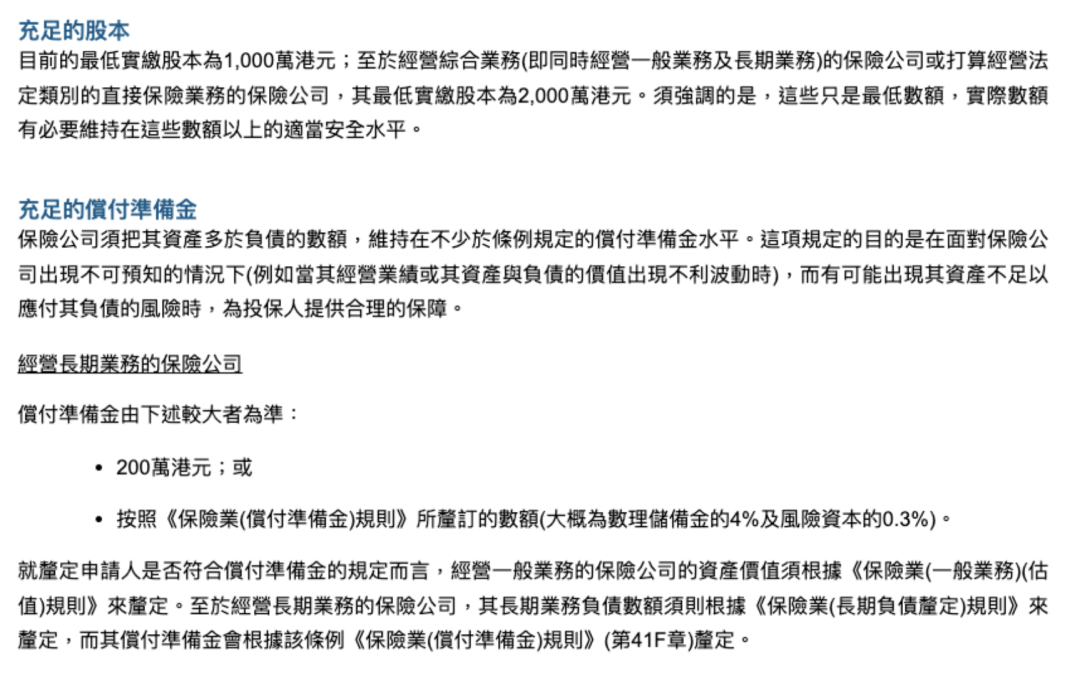

As shown in the chart, the Hong Kong Insurance Authority stipulates that the minimum share capital requirement for the operation of general and long term insurance business is HK$$20 million, although this is only a minimum requirement and it is necessary to maintain an appropriate level of safety above this figure for the actual amount.

The Hong Kong Insurance Authority (HKIA) requires that the solvency of Hong Kong insurance companies must not fall below 150%. If the solvency falls below 100%, it will be forced to stop new business. All normally operating insurance companies will be in the process of maintaining above 150%.06Adequate reinsurance coverage

The Insurance Ordinance of Hong Kong requires an insurer to have or to make adequate reinsurance arrangements in respect of the risks of the classes of insurance in which it proposes to carry on business. The HKFI has developed a Reinsurance Guideline (Guideline 17) which sets out the general guiding principles adopted by the HKFI in assessing the adequacy of an insurer's reinsurance arrangements.07Excellent international rating

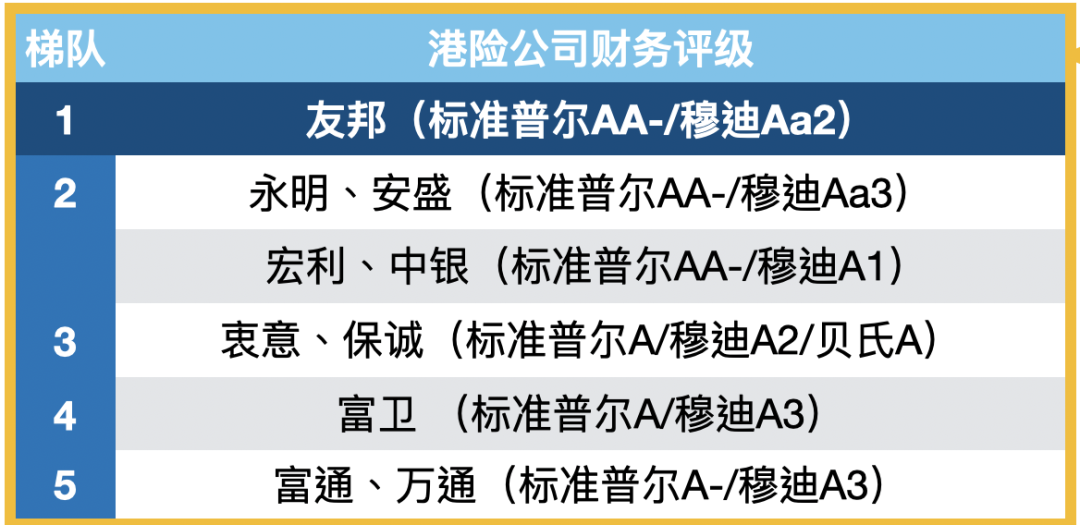

As shown in the chart, the financial ratings of Hong Kong's insurance companies by the world's three major rating agencies, namely Moody's, S&P and Fitch, are mostly of the extremely high international financial ratings of "excellent creditworthiness, virtually risk-free" and "excellent creditworthiness, basically risk-free". The majority of the financial ratings assigned to Hong Kong insurance companies by Fitch and Fitch are of two very high international financial ratings, namely "excellent creditworthiness, almost risk-free" and "excellent creditworthiness, basically risk-free".08It's better to open a bank account sooner rather than later

Many mainlanders who go to Hong Kong to open accounts find that the conditions for opening accounts in Hong Kong seem to have become more and more stringent, and there are even obvious signs of tightening.

The original account only need ID card, pass, customs clearance ticket, but now a number of banks will ask the purpose of opening an account and the source of funds, large banks such as HSBC, Standard Chartered, etc., Bank of China Hong Kong is also tightening, Hong Kong bank account opening should be sooner rather than later.

09Establishment of Hong Kong Insurance Greater Bay Area Service Center

On December 6, 2023, the Hong Kong Secretary for Financial Services and the Treasury, Mr. Rafael Hui Ching-yu, said that preparations for the establishment of insurance after-sales service centers in Nansha, Shenzhen and Qianhai, which will provide policy inquiry and administration, renewal and claims services to Hong Kong policyholders, are in the final stage.

Once the Hong Kong Insurance After-Sales Service Center for the Greater Bay Area is established, it will bring convenience to mainland policyholders in various aspects:

1. Insurance claims and other services can be handled at the service center.

2. You can check the policy, management and medical service support in the service center.

3. Renewal premiums can be paid at the service center.

10Hong Kong insurance is the lowest cost way to invest in RMB internationalization

It is important to recognize that Hong Kong insurance is the lowest cost way to invest in the internationalization of the RMB. As an investor, you can have access to global quality assets through the window of Hong Kong insurance.

Hong Kong insurance is not hot from 2023, nor will it be hot only in 2023.

2024, full of anticipation!