Chinese in Japan to exceed 1 million! The growth rate is unbelievable

2025-03-21

Want to live in Japan for a long time? These two ways can be realized

2025-03-28The Hong Kong stock market, as a mature international capital market, attracts the attention of global investors.

Compared with the A-share market, there are significant differences between Hong Kong stocks in terms of trading rules, market style and investor structure.

For investors who plan to participate in Hong Kong stock investment, they need to fully understand its operation logic and potential risks.

01

Exchange rate risk:

The Invisible Earnings Killer

Hong Kong stocks are denominated in Hong Kong dollars and Mainland investors need to exchange Hong Kong dollars for Renminbi to participate in trading.

The Hong Kong dollar is pegged to the US dollar, and the actual return from investing in Hong Kong stocks will be eroded if the exchange rate risk is not hedged during the RMB appreciation cycle. For example, if an investment of HK$100,000 in stocks earns 10%, but RMB appreciates 5% during the same period, the actual return is only 5%.

Hedging Strategies:

- QDII funds: Avoid personal operational risks by automatically exchanging foreign currency through the Fund.

- forward contract (finance): Locking in future exchange rates, suitable for investors with larger amounts of capital.

- diversify: Limit the proportion of Hong Kong stock assets to 30% of total assets to reduce the impact of single market volatility.

02

Transaction costs:

Hidden costs eat into profits

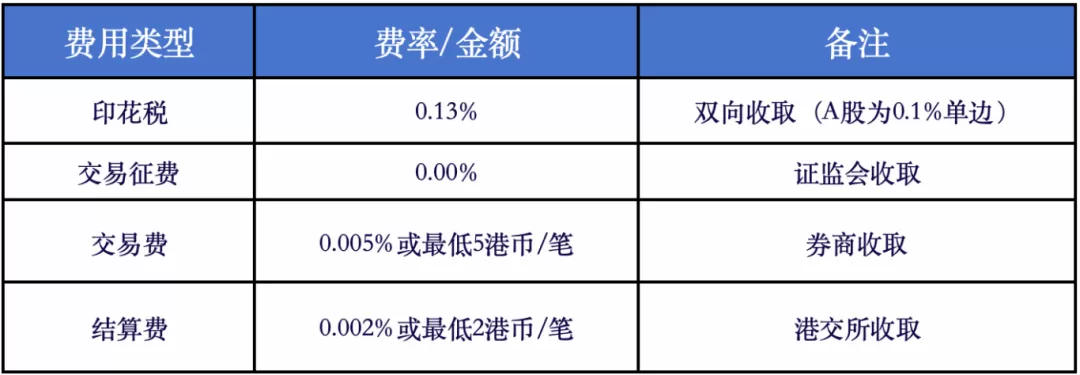

Hong Kong stocks have complex trading fees and generally higher comprehensive costs than A-shares:

Examples:

The total cost for an investor to trade HKD10,000 shares is ≈ HKD13 (stamp duty) + HKD2.7 (levy) + HKD5 (transaction fee) + HKD2 (settlement fee) = HKD22.7 (~0.23%).

Note that if traded frequently, the annualized cost could exceed 101 TP3T, far more than A-shares (about 0.051 TP3T).

Therefore, investors are advised to recommend a single transaction amount of not less than HK$5,000 to reduce the expense ratio percentage and avoid short-term speculation with a holding period of at least 1 month.

03

Trading rules:

The double-edged sword of T+0 and flexible lot sizes

T+0 trading

You can buy and sell multiple times on the same day, but you need to be wary of extreme volatility. Some stocks have risen or fallen more than 50% in a single day, and novices are prone to lose money by chasing the market.

👉 建议:设定单日交易次数上限(如≤2次),避免情绪化操作。

Number of flexible hands

The number of shares per lot varies greatly (e.g. 100 shares/lot for Tencent, 400 shares/lot for some small-cap stocks), and the actual purchase amount needs to be calculated.

👉 示例:某股票股价10港币,每手400股,最低买入金额为4000港币(不含费用)。

no limit on daily price variation

Individual stocks fluctuate violently, need to set a stop-loss line (e.g., a single day loss of more than 5% will be sold).

black market trading

The IPO can be traded from 16:15-18:30 on the day before listing, which is an important window to observe market sentiment. If the dark market breaks more than 10%, it is recommended to apply for the purchase with caution.

04

Newbie Survival Strategies:

Starting with a solid marker

Prioritize Blue Chips & ETFs

👉 蓝筹股:如腾讯(00700.HK)、港交所(00388.HK),流动性高且业绩稳定。

👉 ETF:恒生ETF(2800.HK)、恒生科技ETF(3032.HK),分散风险且紧跟指数。

Avoid high-risk targets

👉 仙股:股价低于0.1港币,成交低迷,易沦为操纵工具。

👉 老千股:频繁合股、供股,大股东低持股比例(如汉能薄膜)。

position management

👉 港股通资金占比建议≤30%,单只个股持仓≤15%。

👉 保持20%现金仓位,用于极端市场波动时补仓。

Hong Kong stock investment provides investors with the opportunity to participate in the international market. Opportunities and challenges co-exist, and only with an in-depth understanding of the rules can you navigate through them.

Hopfen Group accompanies you, provides you with professional financial knowledge and services, and makes investment more warm. Welcome to contact us!