Hong Kong's "Talent Rush" Gains Steam, Announces Several Measures

2023-10-27

What are the unique features of overseas real estate compared to domestic?

2023-11-02With the ever-changing macro-environment, significant volatility in the financial markets, constant trade friction, and frequent geopolitical conflicts, more and more Chinese HNWIs are eyeing theGlobal Asset AllocationBecause "one basket of eggs is safer than two."

The irresistible trend of offshore allocation throughHolding different currencies to diversify unknown exchange rate riskIt will become a consensus for asset planning.

Among them.the multi-currency nature of Hong Kong insurance policies.Able to meet the multi-currency allocation needs of HNWIs.Hedging single-currency risk, and thus highly favored.

01Diversified allocation of domestic and overseas assetsSpreading unknown risks

In the market risk aversion, Hong Kong, as one of the international financial centers, has once again demonstrated market sensitivity and forward-looking level, launching theMulti-Currency Policy PlanIn addition, it breaks the original Hong Kong policy USD/HKD option to meet more of the life and financial needs of high net worth individuals.

Hong Kong insurance has introduced a multi-currency plan, which allows policyholders, regardless of their location, to, according to their needs at various stages of life.Flexibility to switch policy currenciesFor exampleStudy Abroad, Work Abroad, Retirement, etc.. Having different portfolios in different currencies also provides more effective risk diversification and more robust returns.

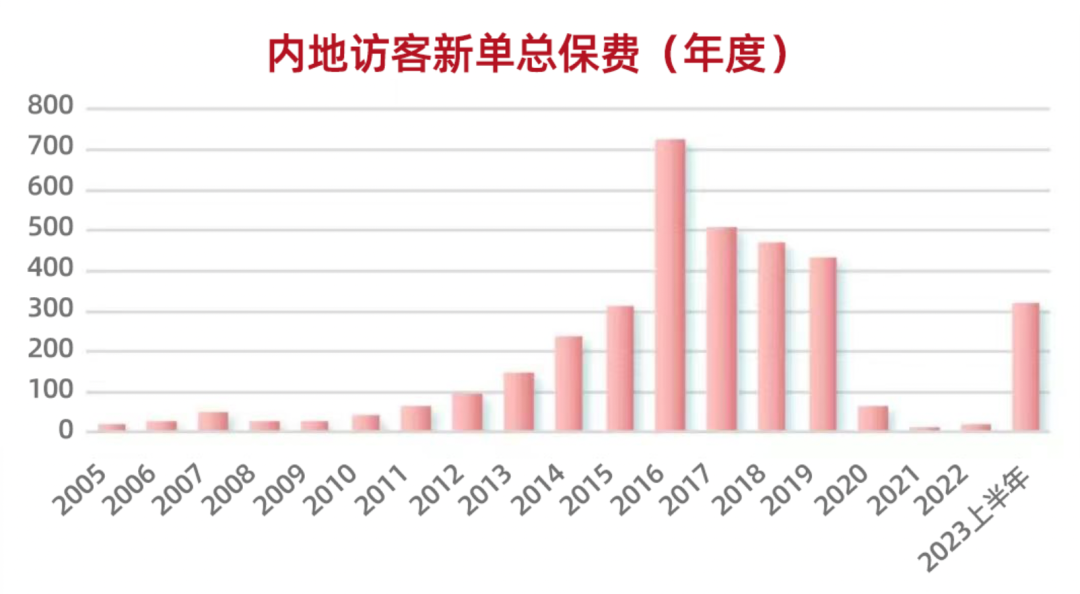

According to the data.In the first half of 2023, mainland visitors took out HK$31.9 billion in insurance premiums in Hong Kong(Of which HK$9.6 billion in Q1 and HK$22.3 billion in Q2, doubling the Q1 figure). New policy premiums of HK$31.9 billion in the first half of the year exceeded the level of the same period in 2019 before the epidemic (HK$26.3 billion), and also surpassed the "peak" level of Hong Kong insurance in 2016 (HK$30.1 billion), setting a record for the first half of the year.All-time high since 2005.

02 Why do HNWIs favor Hong Kong policies?

(i) Global investments

Hong Kong is one of the freest financial centers in the world and has long played the role of a super-connector between the Mainland and international connectivity. Hong Kong insurance companies can invest in the global market, with a high degree of marketization, and the allocation of funds can be coordinated and pooled globally, which is an important support for the stable dividend payout of savings policies.Hong Kong's insurance industry has over US$4.5 trillion in assets under management, ranking first in Asia and second in the world.

Potential return range6%-7%(math.) genus[Dividend]This is one of the major advantages of Hong Kong and Macau Savings Insurance, which allows the insurance company to continuously adjust the proportion of asset allocation according to the economic situation.

(ii) Locked/unlocked dividends

Lock in reversionary and final dividends. Turn non-guaranteed dividends into guaranteed, withdraw cash at any time, or leave it in the insurance company's account to earn a certain amount of interest, providing flexible cash flow while steadily increasing value.

Dividend unlocking function. That is, if you need cash, you lock the dividend, if you continue to increase in value, you unlock the dividend, if the economy is down, you lock it, if the economy is up, you unlock it, and you make different choices for different economic cycles.

(iii) Splitting of policies

insurance policiesSupporting a split.Split policy has a new policy number but all dates are the same as the original policy, the policy value is transferred to the split policy at %, which can be split into different currencies, split to multiple family members, split for different purposes, etc. LetPolicies are more flexible and have a stronger legacy function.

For example, customers who have both retirement and inheritance purposes can use a split policy, combined with the unlimited change of insured/backup insured feature, where part of the wealth is used for retirement and part for inheritance, making the policy more flexible.

(iv) Direct policy creation if no benefit trust is established for the time being

which can be received in a lump sum or in installments.The policyholder can customize the death benefit payment method and can change the payment arrangement at any time.Preventing the usurpation of minors' assets by others and their squandering by the second generation.The form of distribution and payment of funds is carried out according to the wishes, so that wealth can be passed on efficiently and easily.

(v) Asset segregation

extremelyAsset segregation, privacy protection advantages.Different jurisdictions, good confidentiality of information, the possibility of information disclosure is greatly reduced; litigation is difficult, international litigation is often time-consuming, difficult to implement and more difficult to be selected. Effectively segregates insurance assets legally and facilitates flexible use of funds.

On the whole, taking out Hong Kong insurance is indeed a more secure means of overseas asset allocation;Advantages of risk diversification, steady appreciation of value, convenient insurance, flexible conversion, multi-currency, US dollar-denominated, etc..It can help high net worth families realize more possibilities in wealth inheritance, marriage planning, asset segregation and taxation!