2024 Why Chinese investors are keen on Japanese real estate?

2024-09-13

Delayed Retirement Policy, Realize "Retirement Freedom" with Hong Kong Insurance!

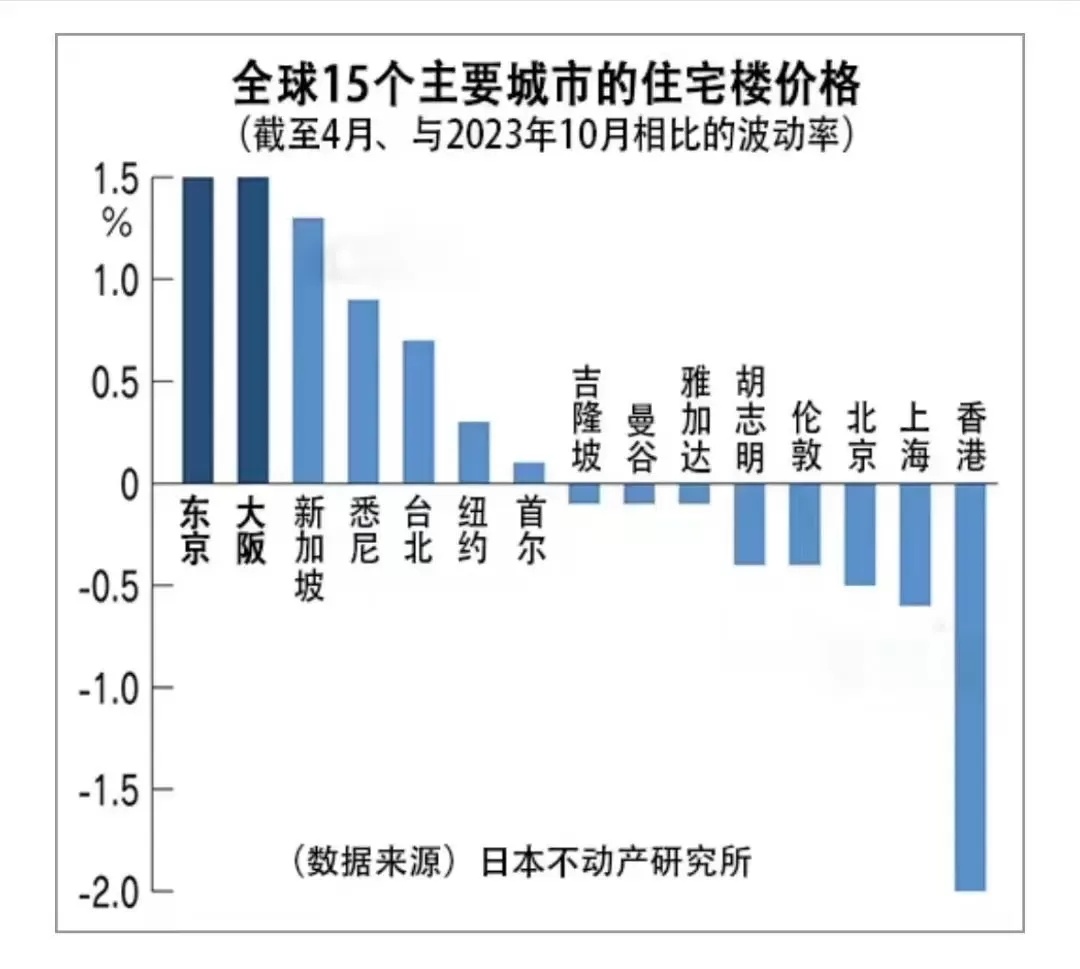

2024-09-20The Real Estate Research Institute, an authoritative Japanese organization, has released the results of a survey of property prices in 15 cities around the world, with Tokyo and Osaka topping the list. This is the first time since the survey began in 2010 that both Tokyo and Osaka have topped the list.

In addition to this, because Japan also hasLarge rental market, high returnsas well asFeatures such as freehold and no common areaPlusdepreciation of the Japanese yenThis has attracted a large number of investors from all over the world to Japan to buy and invest in real estate.

Buying a home in Japan comes with various complicated fees, especially taxes. This article organizesTaxes and fees at each stage of buying, holding, and selling a home in Japan, suggested collection!

home purchase phase

The stamp duty, real estate registration exemption tax and real estate acquisition tax are usually paid when purchasing a home in Japan, and are usually around 3% of the price of the home.

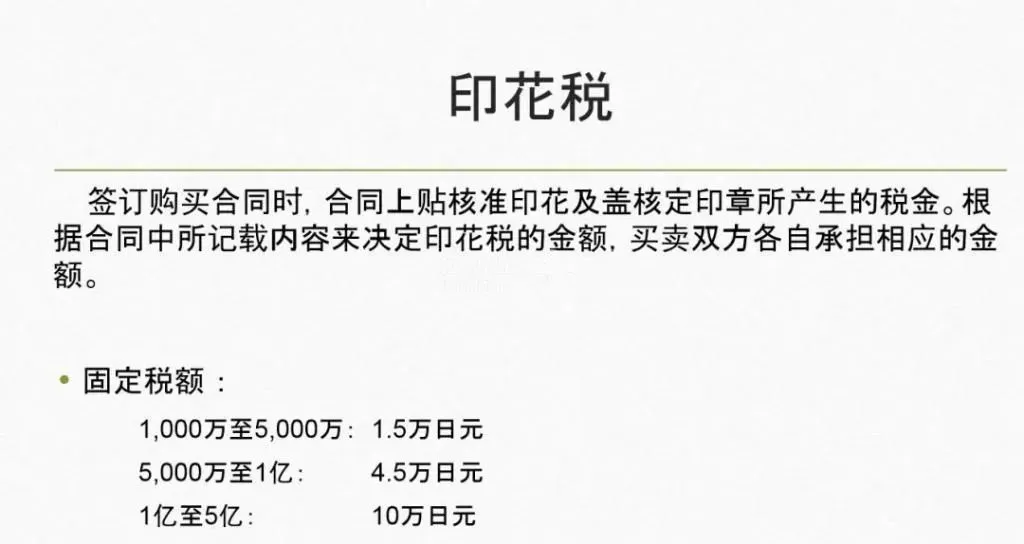

1. Stamp duty:The amount of tax is determined based on the amount stated in the contract of sale and purchase of the house.

2. Agency fee (no agency fee for new homes):Real estate transaction price x 3% + 60,000 yen.

3. Real estate acquisition tax (payable three months after purchase):Land Fixed Asset Valuation x 3% + Building Fixed Asset Valuation x 4%, between 3-6 months after the acquisition of real estate, a "Notice of Tax Payment" will be received, and the non-resident must set up a tax administrator.

4. Real estate registration is exempt from permit tax (paid after purchase):Land fixed asset appraisal × 2% + building fixed asset appraisal × 2% + remuneration for a judicial scrivener (called a lawyer in Japan) (in Japan, there is a person in charge of the handling fee for the registration of transfer of property rights, which is estimated to be about 100,000-400,000 yen, depending on the case).

5. Insurance costs:Fire insurance is about 50,000 yen (one-time for 10 years).

6. Attorney's fees for registration of title transfer:Judicial scribe's compensation, transportation costs, etc. for doing all of the above on your behalf. Usually accounts for about 1% of the transaction amount.

holding period

Taxes and fees for owning property in Japan include fixed assets tax, city planning tax and property fees, which usually account for 1%-1.5% of the price of a home.

1. Fixed assets tax/year:Valuation price of fixed assets x 1.4%.

Notices are usually sent out around April each year, and payments are made in four annual installments beginning in June. New homes are eligible for tax breaks for five years after purchase.

2. Metropolitan program tax/year:Valuation price of fixed assets x 0.3.

3. Property fee/year:Charged on a case-by-case basis.

4. Property Repair Fund:Repair money, maintenance fees, etc. This fee is usually collected on behalf of the property management company. A single-family building is not required to pay it.

5. Lease management fee/year:A fee paid for entrusting a home to a rental management company. Typically 5% of the annual rent charged for the home.

6. Income tax/year:Net Income x Tax Rate (5% ~ 40%) x Revival Special Income Tax (2.1%), Rental Income - Necessary Provisions = Net Income.

7. Tax and Revenue Commissioners' fees:The tax agent will pay the service fee for filing and paying the above fees, and the cost of filing a return is about 20,000 to 30,000 yen.

In Japan, property and land are jointly subject to fixed asset tax. Similarly, if the floor area of a house is larger and the cost is higher, the tax will be higher. In addition, all taxes related to fixed assets, all owner-occupied housing, small houses, etc. are basically eligible for certain benefits.

Selling phase

In Japan, the sale of a house mainly consists of brokerage fees, transfer income tax, attorney's fees for title transfer registration and other taxes:

1. Agency fees:The tax rate for selling a house is the same as for buying a house. Property transaction price x 3% + 60,000 yen.

2. Income tax on transfers:Revenue amount (sale of house) acquisition fee - {acquisition fee (when purchased) + transfer fee} - special control exclusion amount.

Sale of real estate within 5 years of acquisition (short-term transfer tax).

- Income tax: amount of transfer proceeds x 30%

- Residence tax: amount of transfer proceeds x 9%

- (Non-resident exemption)

When real estate is acquired for more than 5 years and sold (long-term transfer tax):

- Acquisition tax: amount of transfer proceeds x 15%

- Residence tax: amount of transfer proceeds x 5%

- (Non-resident exemption)

3. Attorney's fees for registration of title transfer:Same as buying a house.

Japanese taxes and fees are certainly complex, but taken together, theThe tax percentage is not particularly high, theJapanese real estate investment moreThe focus is on the rent-to-own ratioThe

Due to the huge demand for housing such as B&Bs and hotels in Japan as a major tourist country, the average property, after deducting all expenses, isRent-to-own ratios can be around or above 4-6%.The house can be rented out for a quick payback.

If you are in need of Japanese real estate or have questions about taxes and fees for purchasing property in Japan, please feel free to contact us!