Hong Kong's tax system in one article!

2023-08-11

What are the advantages of Hong Kong bank accounts?

2023-08-25Since the resumption of full customs clearance between Hong Kong and the Mainland, MainlandTaking out insurance in Hong KongThe heat continues to rise.

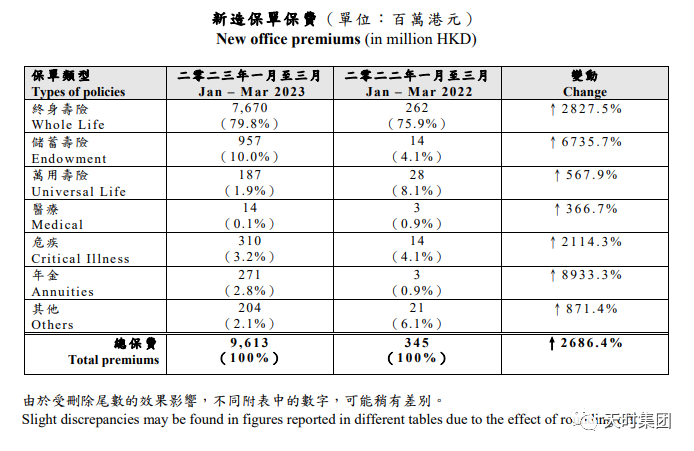

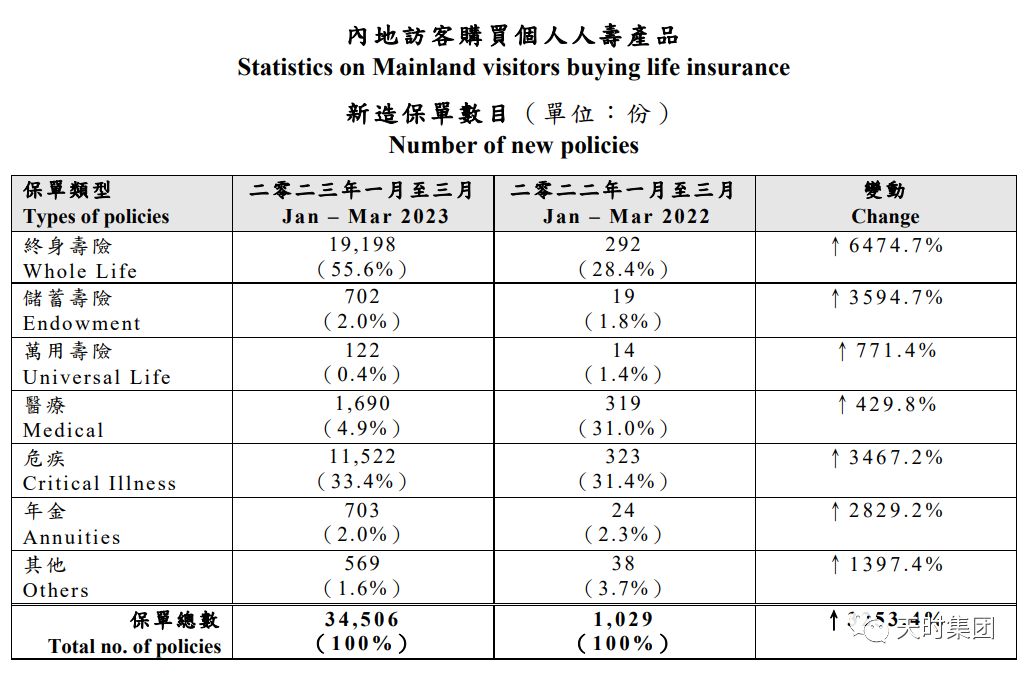

The Hong Kong Insurance Authority (HKIA) has released provisional statistics on Hong Kong's insurance industry for the first quarter of 2023: in the first quarter, the mainland took out HK$9.6 billion of insurance premiums in Hong Kong.It rose 2,686.41 TP3T year-over-year, a 27-fold jump!

Backlogged demand from the epidemic was quickly released, and Hong Kong insurance went wild, returning full blooded!

Mainland customers favored by number of new policies"Whole life insurance." The share was 55.64%, with premiums amounting to HK$7.6 billion, accounting for about 80% of premiums taken out by Mainland customers.

It is worth noting that the "whole life insurance" referred to by the Hong Kong Insurance Authority does not specifically refer to life insurance with death leverage in the traditional sense, but also to the "specialty" of the Hong Kong insurance industry - the "whole life insurance".Savings and dividend insuranceThe

What is the magic of Hong Kong "participating insurance" which is highly sought after by mainland customers?

#01

Hong Kong Participating Savings Insurance

Hong Kong is one of the freest financial centers in the world and has long played the role of a bridge between the Mainland and international connectivity. And with its unique advantages, Hong Kong insurance is often the first choice for overseas investment by mainland investors.

As a long-term investment plan, Hong Kong Participating Savings Insurance, with the security of a long-term return of capital, is a safe option.Expected internal rate of return can be as high as 6%-7%, this type of insurance is low risk and very popular.

Most savings insurance policies cover a long period of time, and at the end of the contribution period, theWithdrawal is flexible and can be used as children's education fund, wedding fund, and your own pension, and estate planning.It is a rational choice for high net worth individuals to use to diversify risk by truly realizing one policy to support three generations.

Multiple advantages

- Currency Conversion: Multiple currencies, unlimited conversions;

- Considerable returns: long term potential returns of up to 7.05%;

- Open branching: unlimited flexibility to split the policy;

- Dividend Lock: Lock in potential returns and withdraw them at any time;

- Wealth Inheritance: Continuous growth of wealth and unlimited change of insured persons to ensure the perpetual inheritance of wealth.

follow or pursueexpense or outlaymanswarm

❶ High Net Worth Individuals who want high leverage + high sum assured protection

❷ Investors who value asset diversification and want to diversify risks

❸ People who want to save for a rainy day and plan ahead for their children's education and their future retirement

❹ Rational investors who do not make high-risk quick money and seek steady appreciation and safe capital preservation

❺ Investors who want long-term high yield compounding effect + short-term cash flow

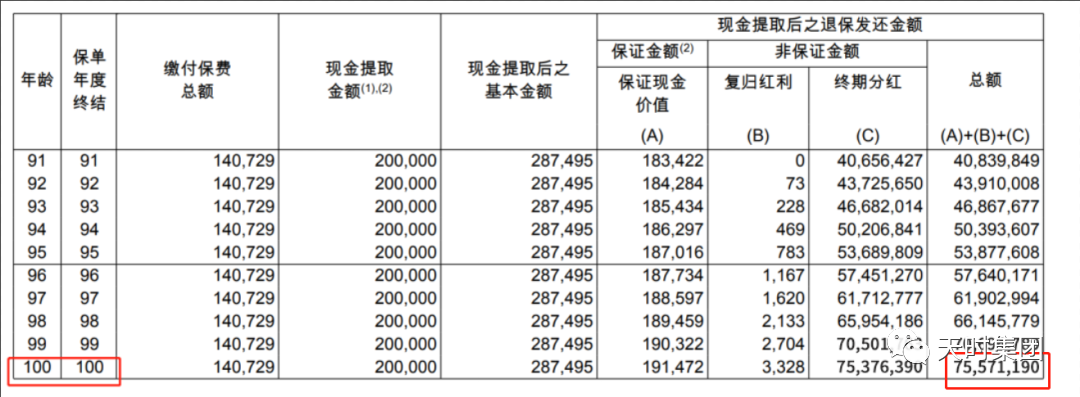

A mother has taken out a Hong Kong Savings and Dividend Insurance policy for her newborn child. Assuming that she saves $100,000 per year for a total of five years, she can do so for three generations to benefit from the policy:

❶ Child receives $200,000 per year from age 19-22 as an education benefit

❷ Receive $300,000 as a homeownership, wedding allowance when the child is 30 years old

❸ Child receives $20 per year as a retirement pension from age 65-100 [pre-paid by parents].

❹ After the child is 100 years old, there is $75.57 million left for his next generation. A total of $500,000 was saved and 20*4 + 30 + 20*36 + 7557 = $83.87 million was taken back.

#02

Hong Kong Savings & Participation Insurance - Compound Interest Allocation Tool

Compound interest, also commonly known as "interest rolling", utilizesGains and time snowballed into wealth creation.

If the initial investment is $1 million.At a compounded annualized return of 4%:After 10 years it becomes $1.48 million and earns $480,000; after 20 years it becomes $2.19 million and earns $1.19 million; after 30 years it becomes $3.24 million and earns $2.24 million; after 40 years it becomes $4.8 million and earns $3.8 million.

Under 4%'s unilevel:In 10 years it's $1.4 million, earning $400,000; in 20 years it's $1.8 million, earning $800,000; in 30 years it's $2.2 million, earning $1.2 million; and in 40 years it's $2.6 million, earning $1.6 million.The difference is huge compared to compounding interest.

As time grows, the further back you go, the more wealth grows like a snowball. The compound interest effect, then, can be simply understood as"The effect of adding to wealth by time to keep it expanding."

The advantages of Hong Kong Participating Savings and Dividends Insurance are very obvious: compound interest, risk diversification, steady growth, flexible financial management, easy to enroll, and denominated in US dollars.

Therefore, the purchase ofHong Kong Participating Savings Insuranceis a very suitable choice. It can meet the needs of long-term steady investment appreciation and future stable cash flow, and also has various advantages such as flexible investment portfolio options, unlimited policy splitting and dividend reinvestment.

Choosing the right financial instrument is very important and buyingHong Kong Participating Savings InsuranceIt can help people realize long-term steady investment appreciation and future stable cash flow, while also allowing flexible adjustment and diversified allocation according to individual needs, which is a wise and right choice.