Mainland ⇋ Hong Kong remittance in seconds! Cross-border Payment Gateway Practical Guide

2025-06-27

It's 2025, why is Japanese real estate still attractive?

2025-07-04As the global economy grows and the number of high net worth individuals continues to increase, theFamily OfficeAs a high-end form of wealth management, it has seen explosive growth in Hong Kong in recent years.

Recently, the Financial Secretary of Hong Kong, Mr. Paul Chan Mo-po, disclosed at an event that the number of family offices in Hong Kong has now reached 2,700 (with a management scale of over US$10 million).It's expected to exceed 3,000 rooms soon., with more than half of them having more than $50 million in assets.

Source: Sing Tao Daily

This data visualizesHong Kong is active and attractive in the family office space.

01

fact

"Global Home Office Capital"

In recent years, the family office sector in Hong Kong has continued to stage the "migration of the rich and powerful" drama.

For example.Zhang Yiming, founder of mainland tech giant ByteDance, takes Hong Kong's No. 9 asset management license through his Cool River Venture fundtake (a photo)The company's investment team has been quietly formed in Hong Kong, which is widely regarded as a key step in the globalization of its family office.

Source: chinadaily

In addition, Invest Hong Kong disclosed that of the new family offices to be created in 2024, theMore than 30% from European and American ultra-high net worth familiesThe company's portfolio includes descendants of Canadian energy giants and Swiss financial families.

These movements not only confirm theAttractiveness of Hong Kong as a "Global Home Office Capital"The more reflexiveDeep changes in the wealth management industry.

02

Advantages of the Hong Kong Family Office Structure

1️⃣ Tax benefits at the legislative level

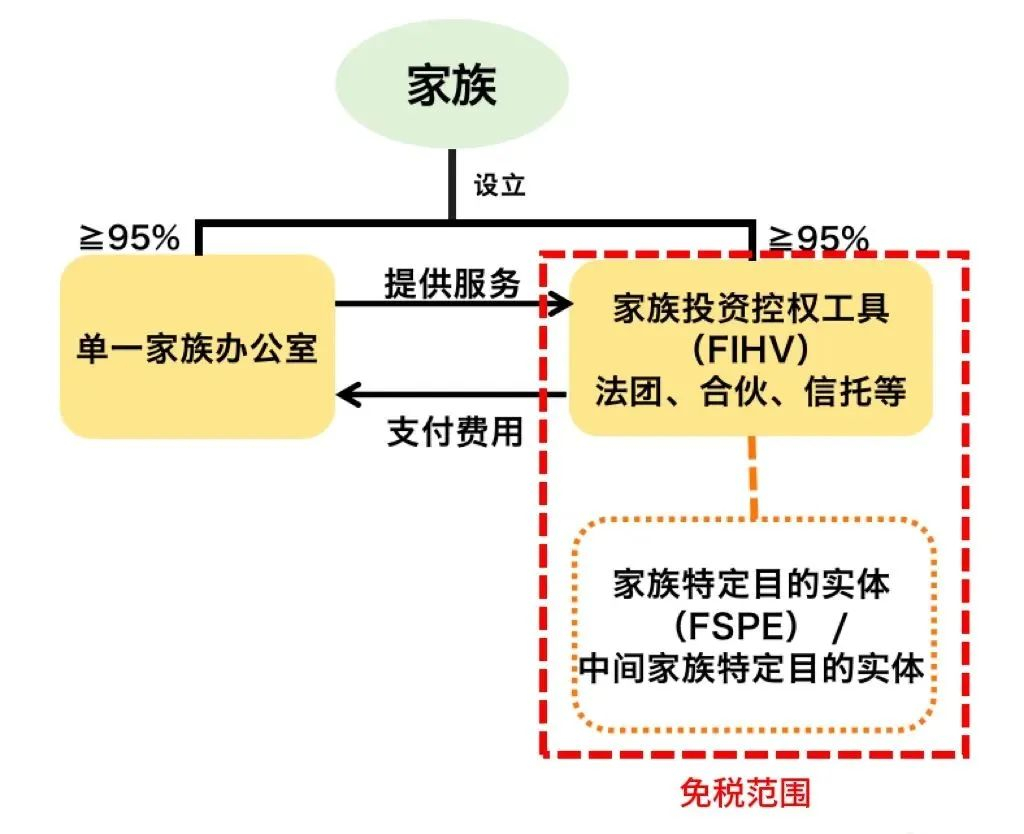

The Hong Kong Family Office Tax Incentive Bill will provide tax relief for qualifying income from qualifying family office structures -For years of assessment beginning on or after April 1, 2022, the rate of profits tax on assessable profits from qualifying transactions and incidental transactions of a family-controlled vehicle or family-specialized body is 0%.

It is important to note that the tax exemption applies only to qualifying transactions and incidental transaction proceeds of family-controlled vehicles or family-specific bodies, and fees for services charged by a single family office are not included.

Scope of Tax Exemption for Hong Kong Home Office

2️⃣ Ongoing policy support

On March 24, 2023, the Financial Services and the Treasury Bureau of Hong Kong issued the "Policy Statement on the Development of Family Office Business in Hong Kong" to provide strong support for the development of family offices in Hong Kong, which includes, but is not limited to, the introduction of a new Capital Investment Entrant Scheme (CIES), expansion of the scope of CIES applicants, tax concessions, suitability assessment and disclosure processes for intermediaries for high-end clients or ultra-high-net-worth individuals. These include but are not limited to: the introduction of the new Capital Investment Entrant Scheme (CIES) and the expansion of the scope of CIES applicants; tax relief; and the suitability assessment and disclosure process of intermediaries for high-end clients or ultra-high net worth individuals.

New Investment Entry Program Option (Effective March 1, 2025)

Applicants can invest HK$27 million in eligible family offices.

▶ Needs to be met:

- Home Office registration ≥ 6 months, wholly owned by the applicant;

- Employing ≥ 2 full-time staff and annual operating expenses ≥ HK$2 million;

- Assets under management ≥ HK$240 million.

With the strong support of the Hong Kong Government, the continuous development of family office business in Hong Kong is even more desirable and more favorable policies may be further introduced.

3️⃣ Diversification of investment options

Hong Kong is a leading global center for banking, asset and wealth management.

According to Invest Hong Kong, Hong Kong brings togetherNearly 80 of the world's top 100 large banks, about 70 of the top 100 asset management firmsIt has established the world's premier stock exchange and the world's largest offshore RMB business center.

Hong Kong has a vibrant financial scene with a wide range of investment choices, includingBonds, stocks, trusts, art collections, philanthropy, etc.

At the same time, the financial links between Hong Kong and the Mainland have been further strengthened."Shanghai-Hong Kong Stock Connect", "Shenzhen-Hong Kong Stock Connect", "Bond Stock Connect"Strengthened links between the financial markets of Hong Kong and the Mainland.

4️⃣ Securing Infrastructure and Talent

According to the data of the Hong Kong Investment Promotion Agency (HKIPA), Hong Kong currently hasOver 42,000 asset and wealth management practitioners,Over 45,000 Certified Public Accountants in Hong Kong,Over 13,000 practicing solicitors and barristers(including registered foreign lawyers from 33 jurisdictions),transcendOver 90 registered offshore law firmsThe

Meanwhile, as disclosed by the Financial Services and the Treasury Bureau of Hong Kong, Hong Kong willEstablishment of the Wealth Transfer AcademyThe company organizes ongoing training and knowledge exchange events for industry practitioners and wealth inheritors to build a rich talent pool.

The functions of InvestHK's dedicated FamilyOfficeHK team will also be further expanded.Convening and establishing a new network of family office service providersIt provides a wide range of services to high net worth individuals, including charitable business and information understanding.

Hong Kong, as one of the world's most important financial centers, is known for itsSound rule of law, stable financial environment, close connectivity with the Mainland, and world-leading financial marketswhich provides a wealth of investment options for family offices.Become the preferred location for family offices worldwide.

If you are interested in a family office, please feel free to inquire!