It takes 30 years to get your money back, so it's no longer cost-effective to buy a house in Japan?

2025-06-13

Hong Kong Stocks Investment|Why Hong Kong stock ETFs are suitable for most investors?

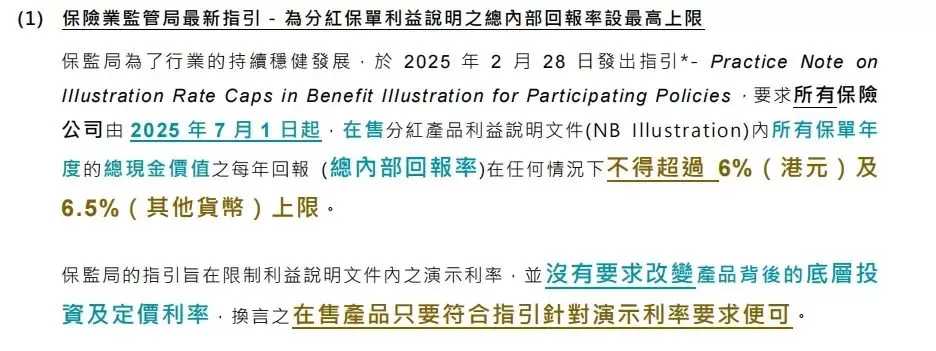

2025-06-20As the Hong Kong insurance "height restriction order" enters the final stage of implementation, the Hong Kong insurance market in June ushered in an unprecedented insurance boom.

Against the pressing backdrop of a policy window of less than 20 days left, insurers' signing centers continue to fill up, as investors scramble to lock in high-yield products that are about to be adjusted.

Behind this phenomenon is a fundamental reshaping of the product mix as a result of the new regulatory rules:According to the requirements, major insurance companies in Hong Kong have one after another stopped selling or adjusted their 7% income demonstration products, adjusted the maximum expected rate of return (IRR) demonstration for non-Hong Kong-dollar policies to 6.5%, while Hong Kong-dollar policies are not allowed to exceed 6%.

Countdown to Shrinking Earnings: what does missing 7% mean?

Take a policy with an annual contribution of $50,000 and five consecutive years of contributions as an example. If the expected compound interest decreases from 7% to 6.5%, which seems to be a difference of only 0.5%, the final difference in return will be as high as 65 million dollars after a hundred years of compounding effect!

In addition to the earnings advantage, theLong-term value of Hong Kong insuranceIt's more than worth dissecting in depth:

01

Multi-currency flexibility

Hedging of exchange rate risk

Against the backdrop of the Federal Reserve's interest rate hike and the intensification of geopolitical games, Hong Kong insurance offers the free conversion of nine mainstream currencies such as the US dollar, Hong Kong dollar, British pound, etc., thus realizing the "global circulation of a single insurance policy".

▶ U.S. Dollar Policies: No foreign exchange control, direct access to overseas medical, education and retirement needs;

▶ Multi-currency configuration: Hedge the risk of single-currency depreciation through regular currency swaps, especially suitable for families with cross-border living plans.

02

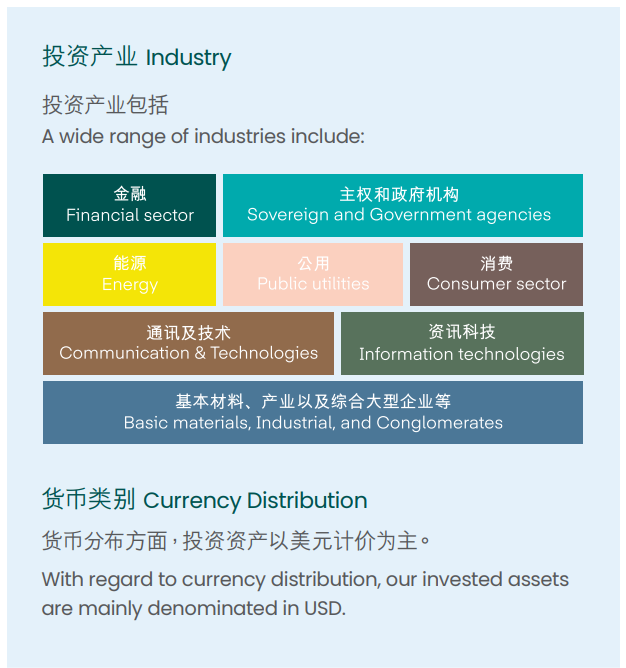

Global Asset Allocation

Diversification of investment risk

Relying on Hong Kong's status as an international financial center, insurance funds can be allocated to global stocks, bonds, private equity and other quality assets.

By allocating Hong Kong insurance, policyholders can indirectly participate in the investment of these quality assets and share the dividends of global economic growth.

Compared with individual investors, insurance companies, by virtue of their professional investment and research capabilities and scale advantages, can achieve cross-market and cross-cycle return capture at lower costs, and build a truly globalized asset defense for policyholders.

03

Tax Planning Advantages

Worry-free wealth transfer

The tax advantages of Hong Kong insurance present a "three-dimensional exemption":

▶ Investment side: Proceeds are exempt from VAT and capital gains tax;

▶ Passing on the end: Claims and dividend income are temporarily excluded from China's estate tax;

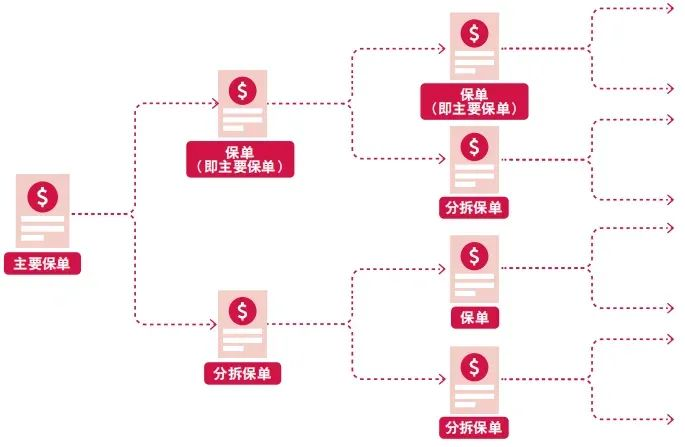

▶ Architecture EndThe policy can be split and the insured can be changed unlimitedly, thus realizing "zero-tax" intergenerational inheritance.

Compared with mainland insurance, the flexibility of Hong Kong policies in tax planning makes them the preferred tool for HNW families to preserve their wealth.

04

The policy is feature-rich

Meeting Diverse Needs

Hong Kong insurance policies are rich in features. In addition to the basic protection and savings functions, a wide range of additional features and options are provided, such as policy splitting, unlimited change of insured, dividend locking and unlocking, and so on.

▶ Splitting of insurance policies: Split a single policy into multiple portions on a pro rata basis for scenarios such as children's education, retirement, and inheritance;

▶ Dividend Lock: Convert non-guaranteed dividends to guaranteed cash at market highs to hedge downside risk;

▶ Unlimited change of insured personBreaking through the traditional policy's "one generation" restriction and realizing the perpetual inheritance of family wealth.

05

Strict legal and regulatory safeguards

Safer policies

Hong Kong's regulatory system for the insurance market has undergone a number of reforms and improvements. Since the late 1970s, the Hong Kong Government has continued to strengthen its legislative and regulatory efforts in response to growing internationalization requirements and in order to move towards becoming an international insurance center.

▶ Solvency regulation: Hong Kong insurance companies are required to maintain statutory solvency margins above 200%, which is much higher than the Mainland standard;

▶ Transparency of information: The new GN16 regulations for 2024 require insurers to disclose with-profits realization rates annually, and consumers can access historical attainment data on the official website;

▶ Legal safeguards:Hong Kong's Insurance Ordinance makes it clear that policy rights and interests are protected by law and that policy assets are independent of personal liabilities in the event of insolvency.

The countdown to the "height restriction" is essentially a regulatory upgrade for the insurance industry to return to its protection roots, rather than negating the value of Hong Kong insurance.

For mid-to-high net worth individuals seeking global allocation, tax optimization and family legacyInsurance in Hong Kong remains an irreplaceable wealth management tool.

In this investment boom, Hopfen Group suggests that investors need to tailor the program based on their own needs in order to achieve"Risk Hedging + Income Enhancement + Legacy Planning"The Triple Aim. Inquiries are welcome!