Hong Kong, a strong return to the world's top three!

2025-06-20

Explosive growth of family offices in Hong Kong! Four Engines Drive Global Wealth Convergence

2025-06-27Mainland ⇋ Hong Kong Cross-border Payment GatewayIt's officially online!

From now on.Residents of the Mainland and Hong Kong can transfer funds across the border anytime, anywhere and in real time with just a phone number/bank account number.

What is Cross Border Payment Gateway?

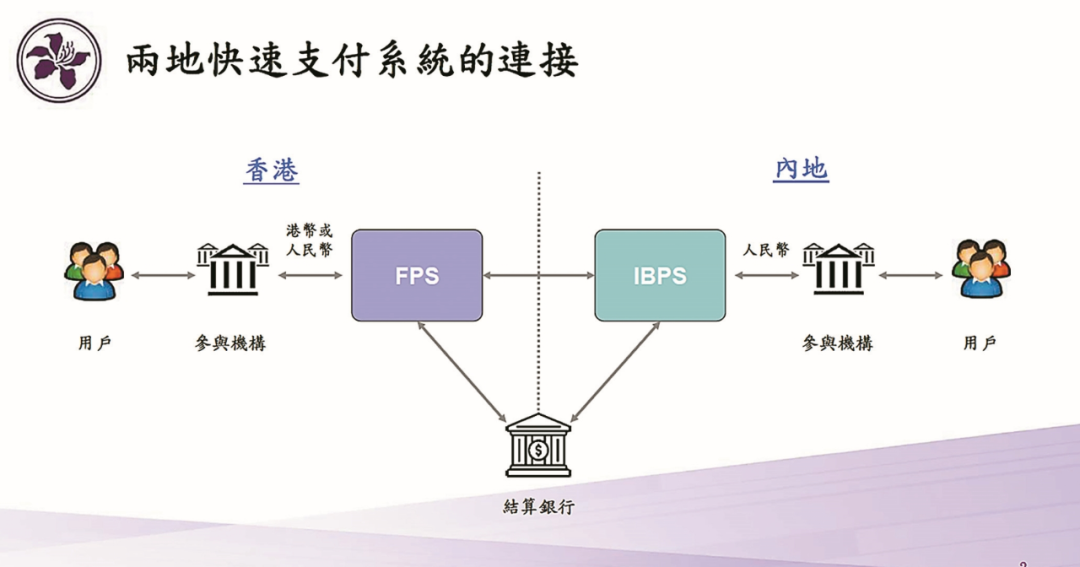

Cross-border PayPass is the process by whichMainland online payment inter-bank clearing systemtogether withHong Kong's fast payment system, "Quick Transfer"connectivity to provide real-time cross-border payment services to residents of the two places on the premise of complying with the relevant laws and regulations of the two places.

Simply put, it's based onPhone Number/Bank Account NumberCross-border remittance with fast arrival.

The traditional cross-border remittance, you need to purchase foreign exchange before remittance, remittance, in addition to fill in the account, the name of the payee, but also fill in the address, swift code and other information, it is very cumbersome.

These details must be known!

What are the requirements for the use of funds traveling via cross-border payments? What are the limitations on the amount? What are the areas requiring special attention?

The information published by the Hong Kong Monetary Authority and the Hong Kong Interbank Clearing Limited has answered the question:

01

Remittance from Hong Kong to the Mainland

- Remitter Requirements:Hong Kong Identity Card holders.

- Cap:Daily limit of HK$10,000 per person and annual limit of HK$200,000 per year (per participating organization). This limit is independent of the existing daily limit of RMB 80,000 for same-name remittance.

- Documentary proof of remittance:Proof of remittance documents are not required (payees are limited to individuals).

- Service time:24×7.

- Supported account designators:Cell phone number or bank account number.

02

Remittance from Mainland to Hong Kong

- Remitter Requirements:Mainland identity card holders.

- Cap:The current annual individual foreign exchange purchase facilitation limit is US$50,000.

- Documentary proof of remittance:No documentation of remittances is required.

- Service time:16×7 (current service hours are 7 a.m. to 11 p.m. daily).

- Supported account designators:Cell phone number, email address, FPS ID or bank account number.

03

application scenario

- personal contribution, such as tuition, medical bills, and utility payments (for more on study abroad fee transfers, see today's third tweet).

- Institution-to-person remittancesFor example, the payment of salaries.

- It will be operated on a pilot basis and remittances can be arranged according to actual demand.

The HKMA emphasized that northbound remittancesCannot be used to invest in Mainland financial productsThere are also special arrangements for cross-border remittances for Hong Kong residents who purchase properties in cities in the Greater Bay Area.

04

Applicable banks

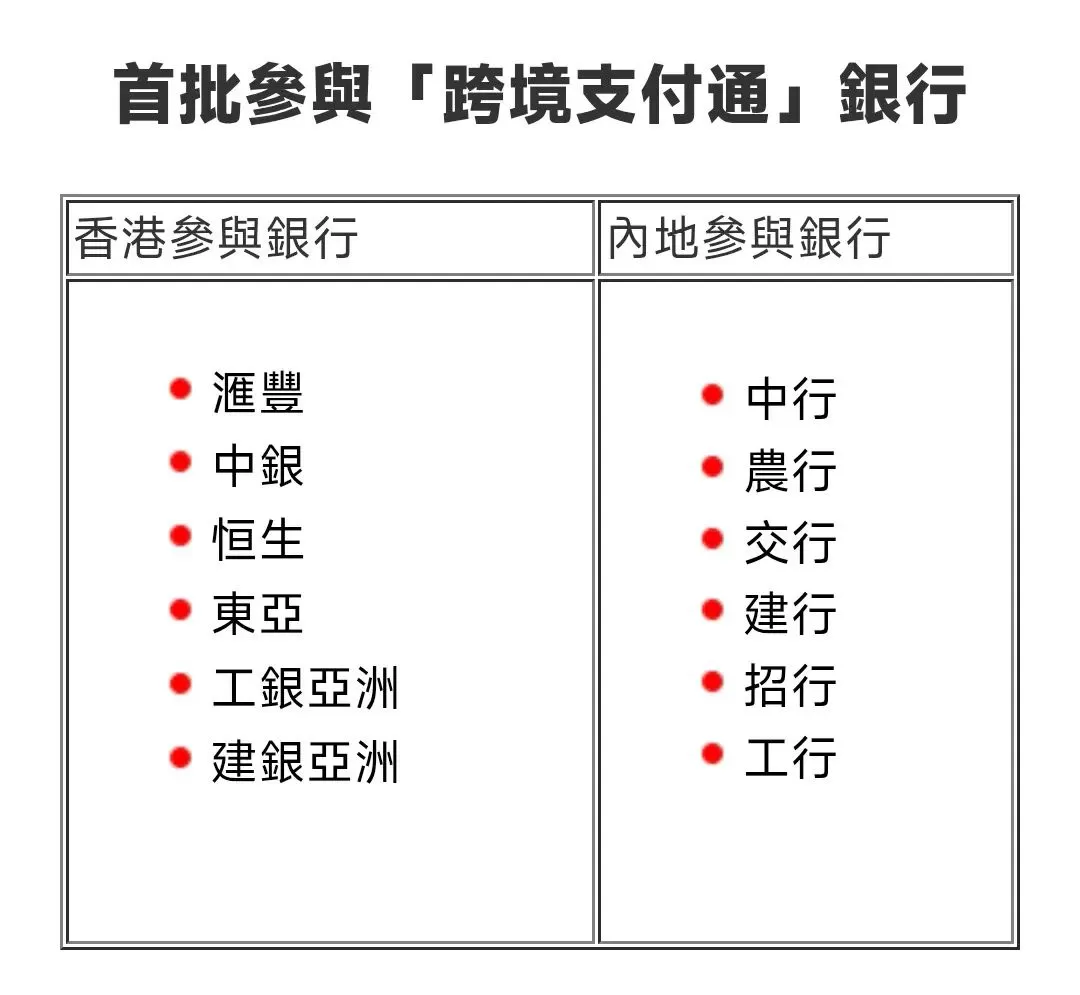

At the initial stage of the launch of the "Cross-border Payment Gateway", there were six participating organizations in the Mainland and Hong Kong respectively, and 10 banks were waiting in line to join the "Cross-border Payment Gateway".

► Mainland organizations include: Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, Construction Bank, Bank of Communications, China Merchants Bank;

► Hong Kong organizations include: BOC Hong Kong, Bank of East Asia, CCB Asia, Hang Seng Bank, HSBC, ICBC Asia.

Tips for use✨

- Confirm that the banking app has been updated to the latest version;

- Before transferring funds, check whether the payee has registered his/her cell phone number for cross-border collection;

- If you are transferring funds using an account number, enter the English name of the payee as it appears on the payee's bank record for verification;

- Confirm the payment details with the payee and double-check the transaction information before transferring the money;

- If you want to receive money transferred from a mainland payer, you have to make sure that your receiving account can support HKD/RMB first.

"Cross-border Payment GatewayThe launch is another milestone in the history of financial cooperation between the Mainland and Hong Kong, building a more efficient, secure and convenient cross-border payment bridge for residents of the two places!

Easier flow of funds between Hong Kong and the MainlandThe Government has also made it more convenient to pay premiums and receive dividends, especially for mainlanders who own Hong Kong insurance policies.

In the future, with the continuous improvement of the system, "Cross-border Payment Gateway" is expected to become an important engine for the integrated development of the Guangdong-Hong Kong-Macao Greater Bay Area, and inject new vitality into the economic integration of the Guangdong-Hong Kong-Macao Greater Bay Area!