Fund investment how to "stable win"?

2022-01-21Asset allocation is a concept we hear a lot about in investing.

🔹 一方面,是指在资产管理人在投资中针对不同资产类别的分配;

🔹 另一方面,也可以是我们普通投资者在家庭生活理财中的一种财务分配。

Why Asset Allocation?

Like the basket that holds the eggs, most assets, such as stocks, bonds, real estate, and gold have a certain amount of volatility in their yields.

If all assets are invested in a single asset, it may be very profitable when the market for that asset is good, but when the market for that asset is not good investors tend to face a greater risk of loss, and investment returns fluctuate more.

"Don't put your eggs in one basket."This is a phrase that you have certainly heard before, and what is revealed behind it is a typical asset allocation mindset.

Instead of investing all your money in a single asset or product such as a house, stocks, deposits, bonds, etc., diversify across different classes of assets or products.

As an important object of asset allocation for residents, long money for investment has always been an area where we need to focus. So how do we allocate assets for ourselves inside the investment pockets of long money?

Depending on your return objectives and risk appetite

As the saying goes, to each his own. It is because of the crowd's taste that it needs to be customized.

For example, younger investors have a higher risk tolerance and, in general, a higher risk appetite and a longer investment horizon;

Older investors, on the other hand, have a lower risk tolerance and, accordingly, a lower risk appetite, and have clearer investment horizon requirements.

In addition, some investors would like to be able to allocate to alternative assets such as commodities and real estate, while some investors consider alternative assets such as commodities to be more complex and difficult to understand, and do not like to invest in that type of asset.

Develop a long-term strategic asset allocation program based on risk-return objectives

A strategic asset allocation program primarily refers to determining the appropriate allocation pivot and range for each major asset class, such as stocks, bonds, and commodities, i.e., how many eggs to put in each basket over the long term.

The main steps include:

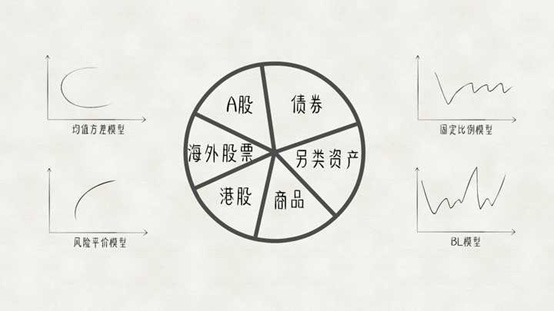

1️⃣ Selection of appropriate asset classes based on investors' investment objectives and constraintsThe following are some examples of such assets, such as A-shares, bonds, Hong Kong stocks, overseas stocks, commodities, alternative assets, etc., andInitial range of ratios for each asset classThe

2️⃣ Adoption of an appropriate asset allocation model(e.g., mean-variance models, risk parity models, fixed-ratio models, BL models, etc.), combined with the return, risk, and correlation characteristics of the major asset classes, and ultimately obtained with theA long-term strategic asset allocation program that matches the investor's investment objectivesThe

Develop a tactical asset allocation program

Simply put, it is to analyze and judge the short- and medium-term investment opportunities of subsequent assets according to the changes in the market environment, and actively adjust the proportion of major asset classes.

Because of the potential for prejudicial error in forecasting asset prices and the potential for excessive deviations to result in return risk off-target, tactical asset allocations need to be adjusted in proportions that are commensurate with investment objectives and constraints.

rebalance

As the market rises and falls, the risk-return characteristics of each asset may deviate significantly from the risk-return characteristics of the original program.

It is therefore necessary to revert the proportion of assets to the originally set levels of the strategic and tactical asset allocation program, i.e.Reset the eggs in each basket to the planned ratio.

Most asset prices tend to have cyclical fluctuations of mean reversion, for example, equity assets tend to have a big fall after a big rise, and the proportion of equities in the portfolio after a big rise tends to be substantially higher than the set proportion of the strategic asset allocation program, and the reduction of the proportion of equities through rebalancing can reduce the portfolio investment loss caused by the subsequent big fall of equities.

In other words, rebalancing operations can reduce investment risk without losing returns.

Performance review and adjustment

The performance review, in layman's terms, is a review thatReview the returns and risks of your own asset allocation portfolio.

1If the portfolio's return and risk characteristics are found to be inconsistent with the investment objectives, the asset program will need to be realigned;

2. If the investment objectives are met, no adjustment is required, but it is necessary to consider whether there is room for further optimization of the allocation plan and to continuously improve the asset allocation plan.

By the end of this article, I'm sure you've gained some insight into asset allocation. Asset allocation may seem simple, but in practice, every change in the details has the potential to change the return and risk of the final investment.

For individual investing, it is difficult to have the time and energy to master all aspects of asset allocation and understand more about the concept of broad asset allocation.Professional things are left to professionals to do, you can help individual investors to arrange asset allocation by selecting excellent investment institutions.