The Rise of China's Mrs. Watanabe: Where is the Money Going in the Age of Low Interest Rates?

2025-05-16

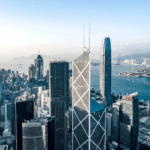

Hong Kong stocks into the "value of the depression" new track, these assets are worth focusing on→

2025-05-23As one of the world's major financial centers, the Hong Kong stock market, with its highOpen Market Mechanismscap (a poem)Flexible trading system, attracting the attention of global investors.

It should be noted that the trading rules and trading methods of the Hong Kong stock marketSignificantly different from A shares.Understanding these rules and how they operate is important for investors to rationalize their strategies and avoid risks.

01

Hong Kong Stocks Core Trading RulesTrading Schedule

Hong Kong stock trading days are from Monday to Friday (except public holidays), and daily trading is divided into four sessions:

- Pre-opening session (9:00-9:30): Includes bid limit order filing and summarization, which may not be withdrawn after 9:15.

- Morning market (9:30-12:00)together withLunch market (13:00-16:00): Continuous trading session, orders can be declared or withdrawn.

- Closing bidding session (16:00-16:10): It is divided into phases such as reference price pricing, inputting buy and sell orders, and randomizing the market close to finalize the closing price.

Under special circumstances (e.g. typhoon), trading of Hong Kong stocks may be suspended.T+0 Rollover and T+2 Settlement

Hong Kong stocks are practicedT+0 trading systemThe stock bought on the same day can be sold on the same day, and the number of times is unlimited, suitable for short-term operation.

However, the actual settlement of funds and shares needs to be made inCompletion on the second business day after the transaction (T+2)For example, trades made on Friday need to be settled on the following Tuesday.No up/down limit and cooling-off period mechanism

Hong Kong stocks do not have a single-day limit on price increases or decreases, and stock prices may fluctuate dramatically, but the introduction of theMarket fluctuation adjustment mechanism (cooling-off period): If an individual stock moves more than 10% in 5 minutes, a 5-minute cooling-off period is triggered, during which trading is limited to a specific price range.

Trading Units and Quotation Rules

- Trading Units:The basic unit is the "lot", and the number of shares per lot is set by the listed company (usually 100 shares or a multiple thereof).

- Quotation Rules:The smallest unit of price change is HK$0.01, but high priced stocks (e.g. Tencent Holdings) may use a finer unit of quotation.

Transaction cost components

Hong Kong stock trading fees include:

commissions(ranging from 0.03%-0.25%),non-residential property(0.1%, paid by both buyer and seller),Transaction levy(0.0027%).

Other costs such asShare Delivery Fee(0.002%, minimum HK$2),Trading system usage fees(HK$0.5/stroke), etc.

02

Ways for Mainland investors to invest in Hong Kong stocks

Investing through Hong Kong Stock Connect

HK Stock Connect is one of the major channels for Mainland investors to invest in Hong Kong stocks, includingShanghai and Hong Kong connectioncap (a poem)Shenzhen-Hong Kong Stock Connect. Investors can open Hong Kong Stock Connect privileges through mainland brokerage firms to directly purchase certain stocks listed on the Hong Kong Stock Exchange.

Scope of investment: The HK Stock Connect covers constituent stocks of the Hang Seng Composite Large Cap and Mid Cap indices, as well as some A+H stocks.

fig. knack or trick (esp. scheme get sth cheaper): Investors are required to fulfill the asset requirement of RMB 500,000 yuan.

Trading Mechanisms: Settlement in RMB, subject to daily quota.

Open a Hong Kong Securities Account

Investors canChoose to open a securities account with a broker in Hong KongIn addition, you can directly participate in Hong Kong stock trading with a wider investment scope and without the restriction of Hong Kong Stock Connect. However, you need to handle foreign exchange by yourself and need to comply with the regulatory requirements of the Mainland and Hong Kong.

Documents such as proof of identity and proof of address are usually required, and some brokers support online account opening.

Investments through the Fund

Investment in Hong Kong stocks through the Fund meansInvestors purchase fund products that specialize in investing in the Hong Kong stock marketThe Government has been participating in the Hong Kong stock market indirectly.

This approach is suitable for investors who do not want to trade Hong Kong stocks directly, or are not too familiar with the Hong Kong stock market, but wish to participate in Hong Kong stock investment, common ones areQDII(Qualified Domestic Institutional Investor) Fund and Hong Kong Stock ETF (Exchange Traded Fund)The

The fund company will invest these funds in stocks, ETFs or other financial instruments in the Hong Kong stock market, and investors will enjoy the returns of the Hong Kong stock market through holding the fund shares.

The Hong Kong stock market, with its open institutional design and efficient trading mechanism, offers a wealth of investment opportunities for global investors.However, its high volatility and differences in rules also require participants to have adequate risk perception and strategy preparation.

By understanding the trading rules, choosing the right instruments, and building a rigorous risk control system, investors will be able to move steadily in the international market. Welcome to contact us