Stamp duty has been cut after almost 15 years! What's the impact?

2023-08-29

How do Jack Ma and Li Ka-shing use Hong Kong insurance to realize wealth inheritance?

2023-09-06A new round of deposit rate cuts has landed on the mainland.

Starting Sept. 1, several national banks will again cut their deposit listing rates by 10-25 basis points.

After the cut in deposit rates in early June this year, a new round of cuts landed again after more than two months, and the magnitude is greater than the previous one.

01

Mainland deposit rates, down again and again

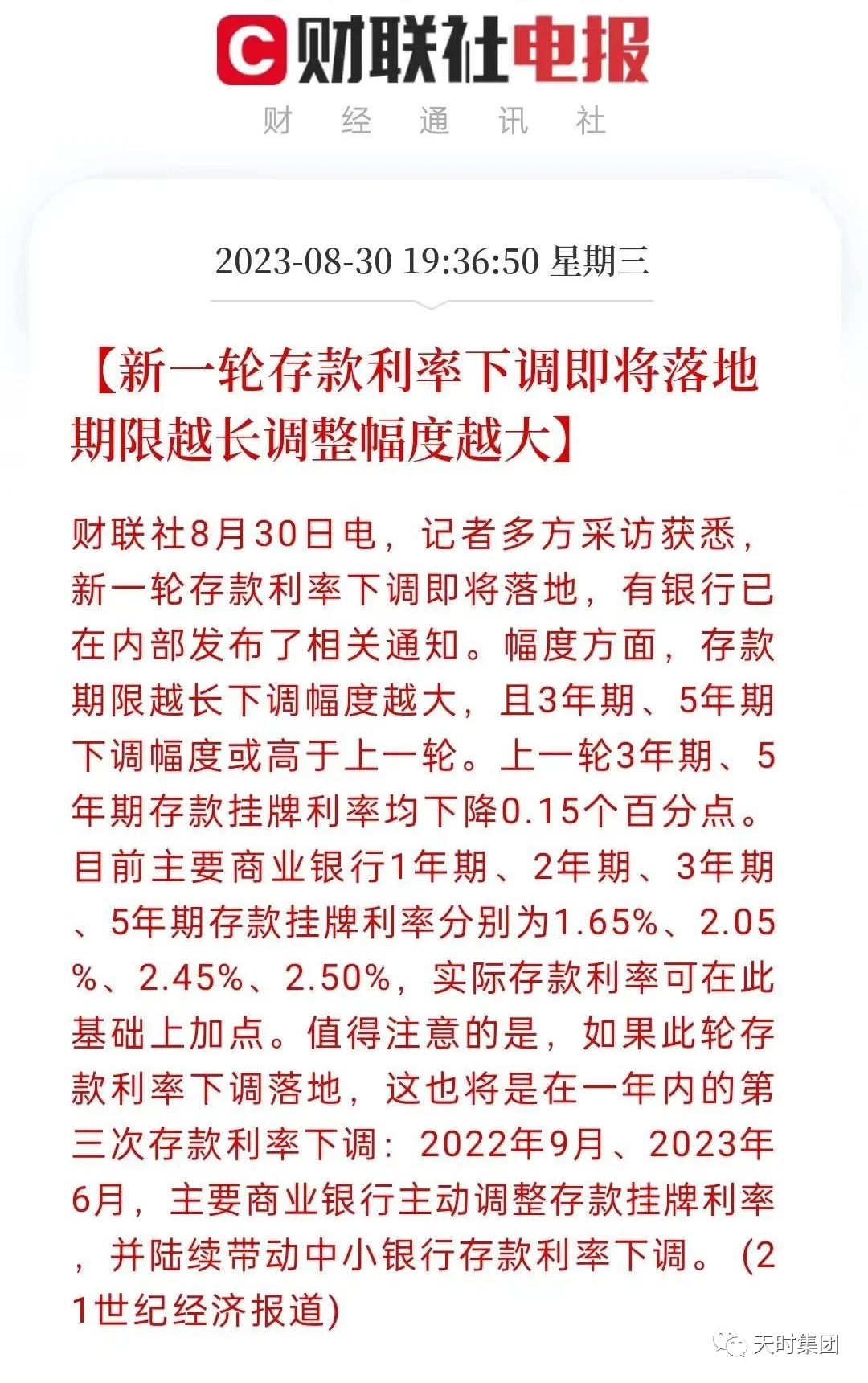

this round (of negotiations)deposit rateThe downward adjustment landed on the third deposit rate cut within a year: in September 2022 and June 2023, major commercial banks took the initiative to adjust their deposit listing rates and successively drove down the deposit rates of small and medium-sized banks.

Compared to the downward revision of the JuneThis time the deposit rate cuts are generally bigger, and mainly for time deposits and large certificates of deposit, individual banks have also publicized the lowering of parameters in advance:

The one-year period is proposed to be reduced by 10 basis points, the two-year period is proposed to be reduced by 20 basis points, and the three-year and five-year periods are proposed to be reduced by 25 basis points.

02

Hong Kong deposit rates, up to 4.8%

Contrary to the downward trend in Mainland bank interest rates, theHong Kong banks have performed very well in terms of deposit rates for new deposits.

Taking the US dollar as an example, the current interest rates given by HSBC, BOC and Standard Chartered for new money US dollar deposits are:3.91 TP3T for 3 months, 41 TP3T for 6 months, and 41 TP3T for 1 year.

And DBS, China Merchants Wing Lung and ICBC Asia offer somewhat higher interest rates on dollar deposits for new funds, including 4.45%, 4.65% and 4.55% for DBS; China Merchants Wing Lung and ICBC Asia's interest ratesIt can reach up to 4.8%!

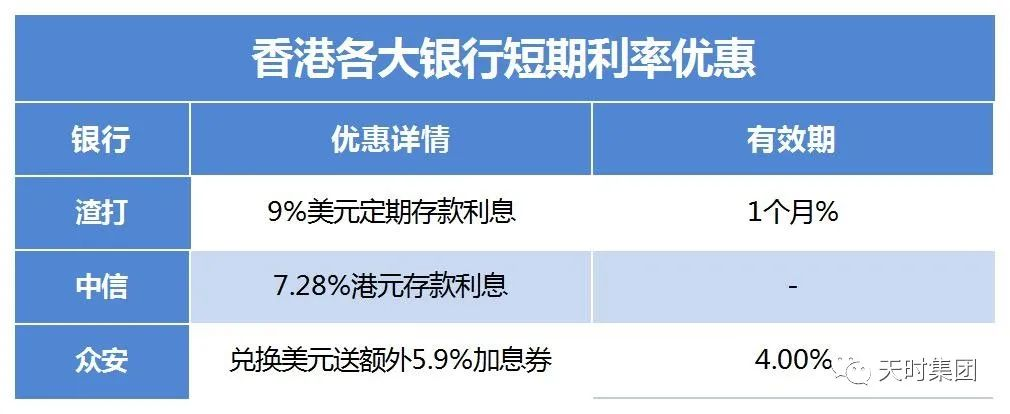

Also, there are some additional banks that offer short-term APR promotions, for example:

Standard Chartered Bank offers Cross-Border Banking clients9%'s USD Time Deposit Offer; CITIC Bank gives eligible new customers HK$7.28% interest on deposits; and so on.

As the Fed continues to raise interest rates, theInterest rates in Hong Kong are also at a high level under the design of the linked exchange rate system in Hong Kong.The Hong Kong Monetary Authority has raised its benchmark interest rate several times, from 0.5% in 2022 to the current 5.75%. Against the backdrop of rising benchmark interest rates, the interest rates on deposit products of major banks in Hong Kong are also on the rise.

Hong Kong Insurance Prepayment Guarantee Rate, up to 6%

Not only are account opening in Hong Kong and deposit taking in Hong Kong popular, but taking out insurance in Hong Kong is also sought after.

compared to a time deposit.Savings insurance is a more medium to long term investment vehicle with long term expected returns 6%-7%.

Savings insurance usually has a variety of contribution periods such as single payment, 3 years, 5 years, 10 years, etc. Nowadays, Hong Kong insurance companies mostly have 3%-6% guaranteed interest rate concessions for prepaid premiums of 5-year products, some of which are higher than the deposit interest rates of banks and also lock in the interest rates for the next 4 years in one go.

At present, Hong Kong insurance companies are full of sincerity. In addition to prepayment offers, there are also premium rebate/discount offers, and the two offers are stacked to provide even greater benefits. With such preferential policies, many customers choose to prepay, saving the cost of insurance and effectively enhancing the efficiency of capital utilization.

Whether it's a short-term Hong Kong bank fixed deposit or a medium- to long-term Hong Kong insurance policy, it's not just about chasing higher returns, it's also aboutSeek to diversify your asset allocation.

As deposit rates in the Mainland continue to fall, it is difficult to achieve sufficiently high returns in pure interest rate assets. In a prolonged low interest rate environment, it is important to construct a diversified investment portfolio and allocate assets to different currencies, different asset classes, different time horizons and different geographic markets to diversify risks amidst the ups and downs of the market and to achieve a more robust investment return.

Single investments often fail to withstand the market, and diversification is the only way to profit from market fluctuations over the long term.