Hong Kong investment migrants heat wave is high, an article to explain the investment rules!

2024-03-29

One month after the "withdrawal", what has happened to the Hong Kong property market?

2024-04-08Recently, the Hong Kong Insurance Authority (HKIA) has released the latest statistics on insurance in Hong Kong, and in 2023, the annual premiums paid by mainland visitors to Hong KongHK$58,971 millionYear-on-year surge28 timessecond only toHK$72.7 billion in 2016's all-time peak, surpassing the pre-outbreak 2019 level ($43.4 billion)!

With the re-clearance of customs in 2023, taking out insurance in Hong Kong has once again become a craze, and the Hong Kong insurance market has once again ushered in the era of glory and prosperity after a lapse of three years. In March, after customs clearance, the number of insurance policies grew by leaps and bounds. Coupled with the fact that the major insurance companies in Hong Kong launched the most favorable offers and industry-shaking new products one after another, Hong Kong insurance once became a popular place to take out insurance.

PART 01

Mainland visitors taking out insurance in Hong Kong

The second highest in history

The total premiums paid by mainland visitors to Hong Kong reached HK$59 billion, a figure second only to the peak year of 2016 and surpassing the pre-epidemic year of 2019, which reachedThe second highest peak in historyThe premiums paid by mainland visitors accounted for about 40% of the overall premiums paid for Hong Kong insurance.32.6%This percentage is also the highest in the history ofSecond highest peak after 2016The

PART 02

Whole life insurance reigns supreme

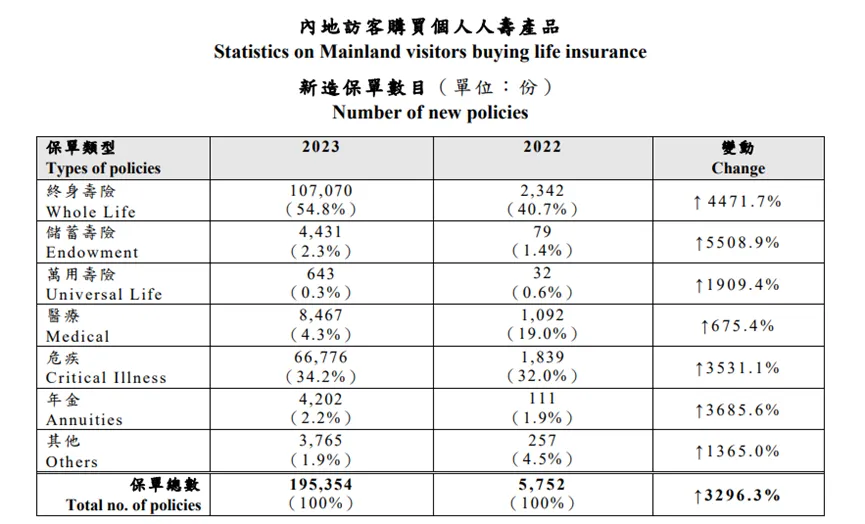

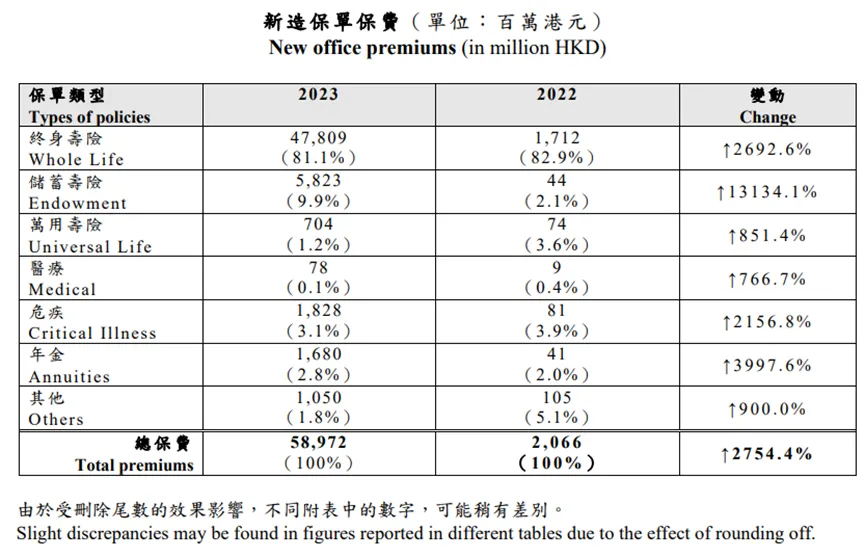

New policy life insurance accounted for the highest proportion of new policies, with the main products taken out by mainland customers being whole life and savings life insurance. total premiums taken out on the mainland in 2023 wereHK$58,971 millionThe total number of policies is as high as195,400 copiesThe average premium is as high asHK$302,000The

Image source: Hong Kong Insurance Authority

For the full year of 2023, the new policy count was 54.81 TP3T for Whole Life and 34.21 TP3T for Critical Illness.

Image source: Hong Kong Insurance Authority

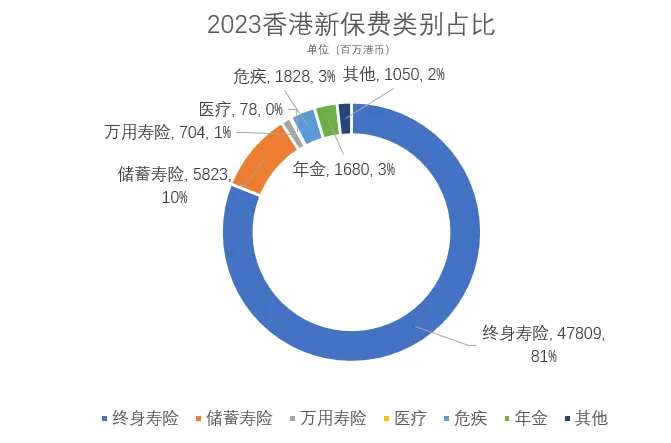

For the full year 2023, by new policy premiums, whole life accounted for 81.11 TP3T and critical illness protection accounted for 3.11 TP3T.

Source: Hong Kong Insurance Authority

Intuitively the share of premiums from mainland customers lookswhole life insurance(including the diversified savings with-profits product, which is the most widely deployed product) reaches81.07%The percentage of thesavings insurance(generally understood as short-term savings) to9.87%.;Annuity insurance 2.85%.;Critical illness insurance up to 3.10%The

Overall, in terms of both the number of policies and the total amount of premiums, the most preferred by mainland customers are concentrated in thewhole life insurance, including the fireworks of recent yearsMulti-Savings Participating ProductsThe

surname CongHK$302,000 average premium per caseCome and see.The trend of HNW clients taking out overseas insurance remains in Hong Kong.Allocating Hong Kong policies is the first choice for middle and high net worth clients to invest overseas.

PART 03

Ranking of Major Insurance Companies in Hong Kong

Personal lines new policy rankings

Based on the full year 2023 data, the top 15 Hong Kong insurers in terms of individual new business have a market share of 97.61 TP3T. The top 5 insurers wereHSBC Life, AIA, Manulife, Prudential and FortisThe

Among them.FortisThe growth has been ferocious, with year-on-year premiumsGrowth of up to 2,321 TP3T, the highest in the industry.

Source: Hong Kong Insurance Authority

Brokerage Rankings

The top 5 Hong Kong insurance companies in terms of gross new premium income wereFortis, Manulife, AIA, Sun Life, and F&WThe

Fortis market share up to 28.1%It is the first choice of Hong Kong insurance customers.

Source: Hong Kong Insurance Authority

With their versatility and high returns, Hong Kong insurance products have always attracted many middle and high net worth individuals in theAsset allocation, risk diversification and investment concepts better suited to market needsTherefore, the Hong Kong insurance market still has an optimistic market outlook.

If you would like to learn more about Hong Kong insurance and realize your asset allocation goals, please feel free to contact Timeless Group!