Why are more and more people investing in Japanese real estate?

2024-01-19

Learn these 4 practical asset allocation methods and reap the benefits of steady happiness!

2024-01-25Hong Kong Savings Insurance is highly profitable.Compound interest up to 6%~7%It is also highly sought after because it supports useful features such as multi-currency conversion, policy splitting and unlimited change of insurer.

Savings insurance in Hong Kong is mainly based onaward a bonusbased, it's really more of a stock and bondFlexible Allocation Fund.. Guaranteed returns generally do not exceed 1%, but theExpected dividend income up to 6%-7% annualizedThe

Most of the financial products in the Mainland arefixed incomeIt's like making a deposit.The compounded fixed rate is 3%.

Therefore, in terms of returns, there is still a certain gap between insurance policies in the Mainland and those in Hong Kong. The reason for the large discrepancy between the returns of the products is largely due to the fact that the two places aresupervisorycap (a poem)Investment modelThere is a difference.

PART.01

Investment varieties

In Hong Kong, where regulation is relatively lax and there is no pre-set interest rate cap, insurance companies are not subject to a maximum predetermined interest rate.

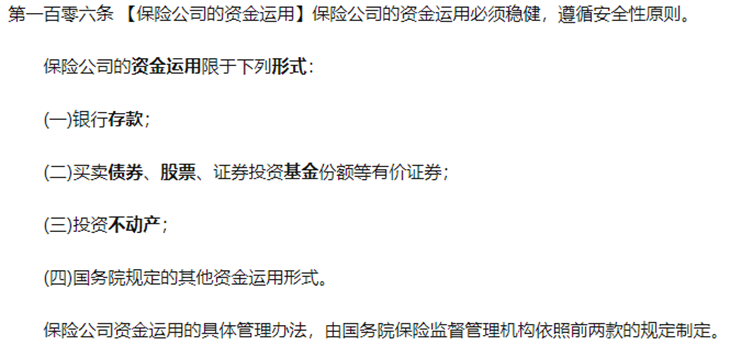

Mainland insurance companies are strictly regulated and are only allowed to use their funds for low-risk and stable investments. The main focus is on "debt" and generally no equity investment is made.

Insurance companies in Hong Kong, on the other hand, are not subject to these restrictions.

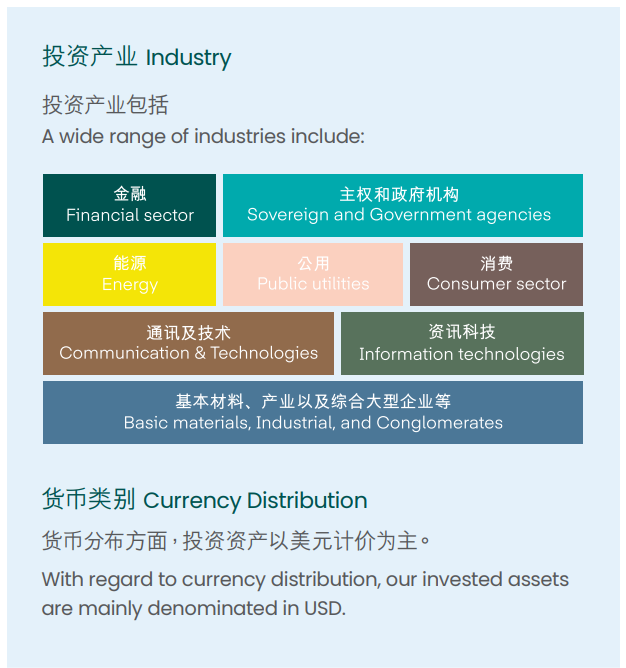

Hong Kong insurance funds are invested in two main categories: fixed-income assets, including treasury bonds, corporate bonds and other fixed-income assets; and equity assets, including listed stocks, hedge funds, mutual funds, private equity and real estate.

PART.02

Scope of investment

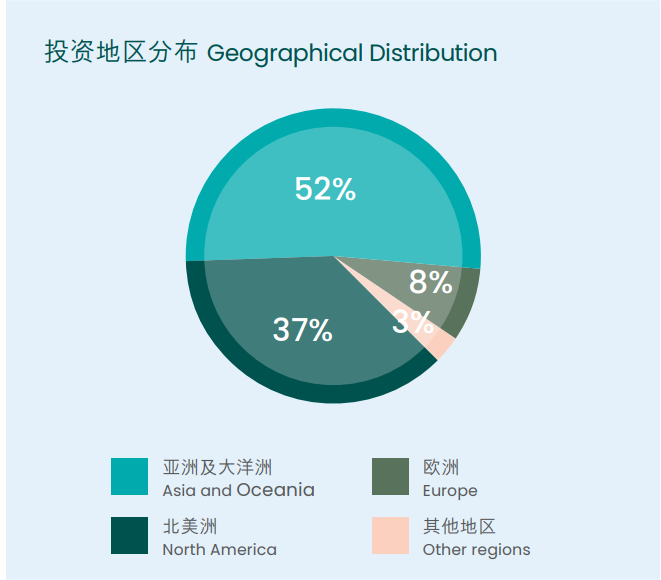

The investments of Hong Kong insurance companies are diversified with asset allocation as the starting point and can be diversified globally.

On the one hand, it can take into account both the types of investment products and diversify into various fields such as equity, bonds and alternative investments, and at the same time, it can also take into account different geographic regions and different types of monetary assets, so as to capture high-quality investment opportunities in the world across different currencies and countries, fully enjoying the considerable returns brought about by various types of high-quality assets around the globe, as well as reducing the negative impacts caused by the fluctuations of the economy in a certain geographic region.

PART.03

Profit sharing for insurance companies

In 2020, the CBIRC issued the Circular on Matters Related to Strengthening Actuarial Supervision of Life Insurance.Explicitly states that "the model dividend distribution rate is harmonized at 70%."The

Compared to domestic insurance companies, Hong Kong is home to more than 160 international insurance companies, the market competition is quite fierce, therefore, "concessions" naturally become the main means for insurance companies to strive for an advantageous position and favorable conditions. Hong Kong Savings Insurance, such as Prudential, AXA, and other insurance companies in the United Kingdom, have become the most competitive insurance companies in the market.Commitment to provide at least 90% of "distributable profits" to the policyholder.

PART.04

Differences in the payment of proceeds

In the Mainland, savings insurance is a guaranteed return, currently at 3%, while in Hong Kong, it consists of "high expected return + low guaranteed return".

That is to say, the figures in the Benefit Presentation Table of a Hong Kong policy will not be exactly the same as the actual corresponding policy anniversary and will be subject to fluctuation.

According to the return dividends of major insurance companies in Hong Kong over the past six years, the actual dividend realization rate is generally between 98% and 1,02%, and the income is generally between 6% and 7%.

PART.05

Earnings and Payouts

High returns and payouts require strong protection to give policyholders peace of mind. To this end, the Hong Kong Insurance Authority has formulated a series of stringent regulatory policies, and insurance companies have introduced innovative systems to protect returns.

▶ Adequate solvency reserve

The Insurance Authority of Hong Kong requires insurance companies to maintain an excess of assets over liabilities at a level not less than the solvency margin required by the Ordinance. The purpose of this requirement is to provide reasonable protection to policyholders against the risk that an insurer's assets may not be sufficient to meet its liabilities in the face of unpredictable circumstances (e.g. adverse fluctuations in its operating results or the value of its assets and liabilities).

▶ Adequate reinsurance arrangements

The Insurance Ordinance requires an insurer to have or to make adequate reinsurance arrangements in respect of the risks of the classes of insurance that it proposes to carry on. The IIA has developed a Reinsurance Guideline (Guideline 17) which sets out the general guiding principles adopted by the IIA in assessing the adequacy of an insurer's reinsurance arrangements.

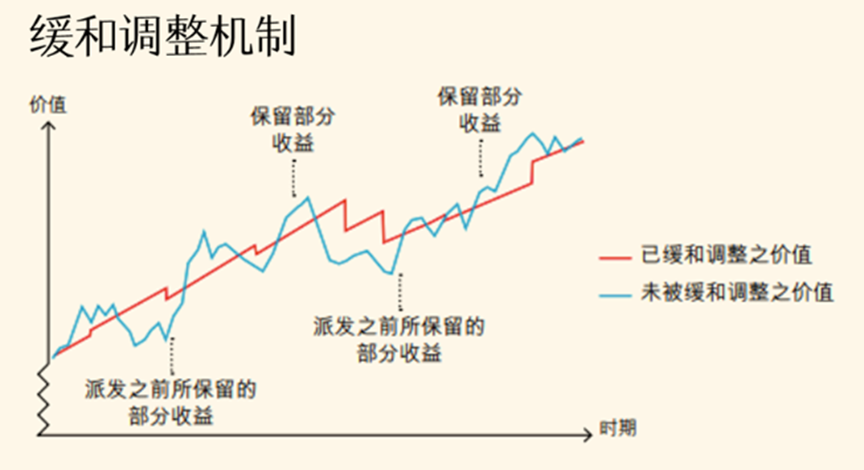

▶ Mitigation Adjustment Mechanism

As the investment portfolio of insurance funds contains equity assets and the market itself is characterized by various risks, there may be unpredictable fluctuations in investment returns, and such fluctuations will inevitably affect the stability of investment returns. Therefore, Hong Kong insurance companies have adopted an adjustment mechanism to smooth out the returns.

When investment returns exceed expectations, the company will save the excess and wait until the market environment is poorer and investment returns are difficult to meet expectations, and then take out this part of the funds to subsidize customers. The undistributed over-expected returns accumulated by the insurance company are like a cistern, storing water in times of abundance and releasing it in times of drought, so that the return curve obtained by the customer maintains a smoother trend.

▶ Pooling of insurance policies

It is common for Hong Kong insurance companies to pool identical or similar policies so that a larger group of policyholders can share the risk. "The purpose of pooling is to allow policyholders to diversify and share risk across policy groups and to have larger amounts of capital, thereby increasing investment flexibility.

To ensure fairness amongst policyholders of participating insurance products, insurers usually categorize policies into groups such as product, product turnover, currency, investment life, etc. to ensure that each group of policies will receive a fair return that best reflects the performance of their policies.

PART.06

summarize

From the perspective of investment return, Hong Kong savings insurance is suitable for the following categories of people:

(i) Varieties that have been allocated with basic Mainland insurance and wish to increase their returns;

② Concerned about single-currency exchange rate risk and have plans for overseas asset allocation;

(iii) Lack of investment channels and investment knowledge;

④People who recognize stable returns from long-term investments.

✨ Warm reminder:When choosing a specific product, you also need to consider the details of the product and choose a policy plan that suits your actual situation and needs.

If you would like to know more, please feel free to contact Timeless Group!