Li Ka-shing, Jack Ma, why HNWIs are allocating Plan B?

2024-02-16

Heavyweight! Hong Kong's latest Budget released, involving property and stock markets ......

2024-03-01Warren Buffett once said: "Life is like a snowball, the key is to find enough wet snow, and long enough slope." Here the "snow" is the point where the wealth is stored, "wet enough" is the income, "long slope" is time.

Warren Buffett's snowball theory illuminates two keys to compounding: one is theearningsTwo.timingThe

Hong Kong Savings and Participation Insurance.It fits right in with this point.

When parents love their children, they plan far and wide.

If parents plan a Hong Kong Savings and Participation Insurance policy at the birth of their child as the child'seducation grant(math.) genusdowryand their ownpensionsandestate planningthat will be a very substantial asset to truly realize theOne policy to support three generations!

Lifetime cash flow

Take the AIA Surplus Royal Multi-Money Plan 2 as an example.

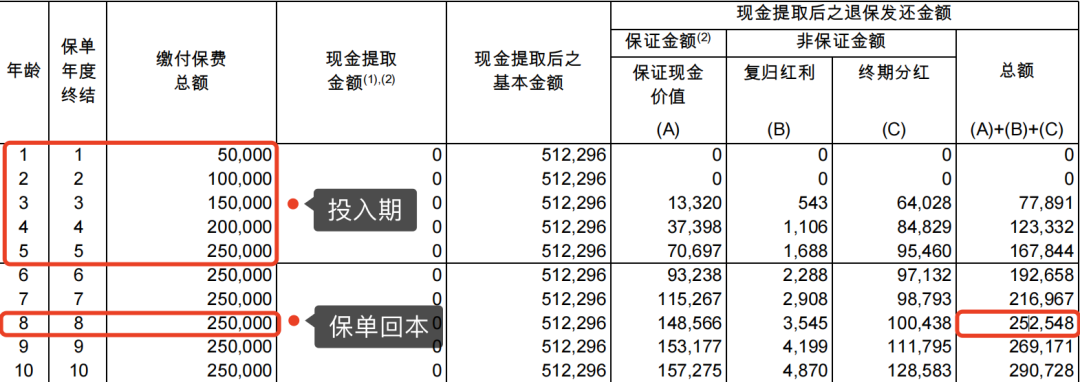

Assuming that you purchase the AIA Surplus MultiCurrency Plan 2 for your child at birth: $50,000 per annum for 5 years, with a total of $250,000 in premiums.

Develop 3 extraction plans, respectively:Education, marriage and pension.

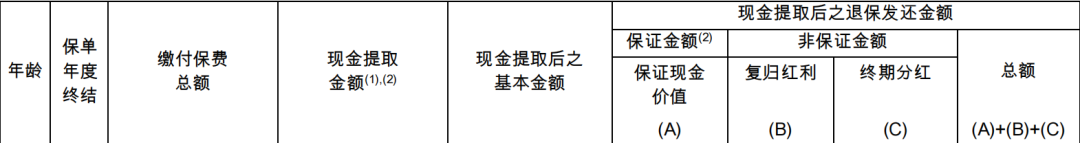

Children's education benefits

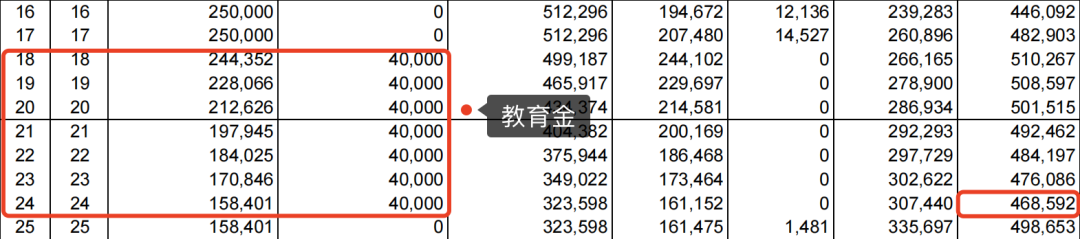

👉 Child 18-24 years old: Withdrawal of $40,000 per year from the policy for study abroad expenses. Over a four-year period, a total of $280,000 is withdrawn, leaving a balance of $460,000 in the account after four years of withdrawals;

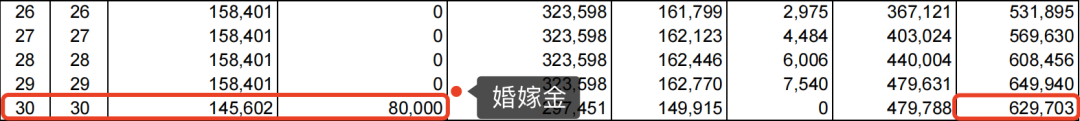

Children's wedding money

👉 孩子30岁Marriage age, withdraw $80,000 at a time for "three gold," "bride price," "wedding banquet," etc. ... After withdrawing $80,000, the account still has $620,000 left. After the withdrawal of $80,000, there is still $620,000 left in the account.

Pension cash flow

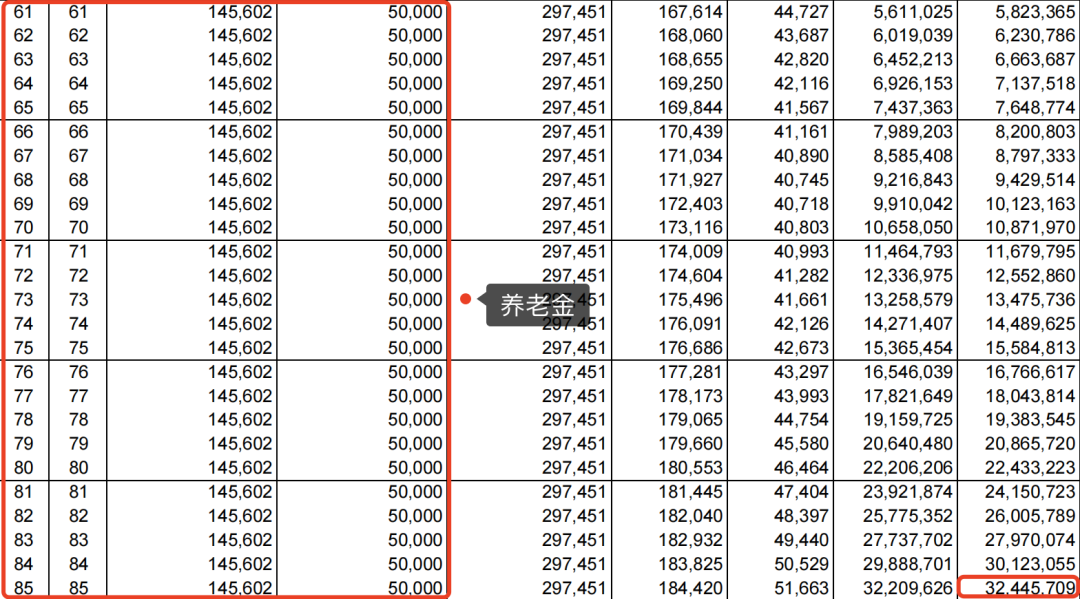

👉 Child 61-85 years oldWithdraw $50,000 from the policy every year for 24 years to enhance the quality of life in retirement, you will get an average of RMB 30,000 more per month for discretionary spending, realizing the ultimate freedom in retirement and traveling all over the world.

👉 At 85.: After 24 years of consecutive withdrawals, the account still has a surplus of$32.44 millionThe

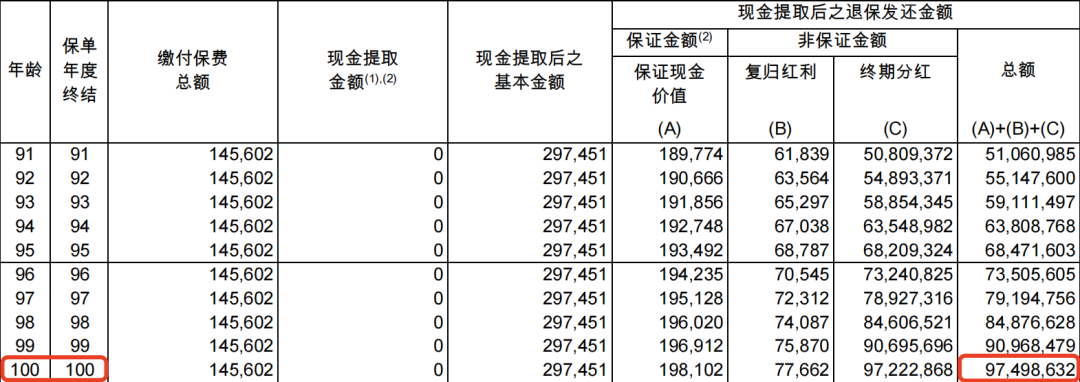

👉 如果After 85No more cash withdrawals, allowing the account to continue to compound, and by the time the child is 100 years old the account will be at$97.49 millionThe

👉 To summarize:Withdrawals totaled $280,000 during the child's four-year study abroad period, $80,000 in a single withdrawal during the marriage phase, and $1.25 million in total withdrawals over the 24 years of the pension, for a total of $98 million, counting the account balance of $97.49 million!

This near-hundred-million dollar return all stems from a total of $250,000 in premiums paid from the child's 0-5 years of age. Realized gains392 timesAnnualized Returns6.27%!

That'stimingcap (a poem)compound interestof power, realized during this 100-year period of thesnowball!

Hong Kong Savings Insurance is the best tool for education planning

dollar-denominated assets

Hong Kong Savings and Participation Insurance products are highly flexible, with a single policy covering multiple currencies, which can be converted into a variety of currencies, such as US dollars to pounds, US dollars to Renminbi, and so on, in an offensive and defensive manner.

Long-term stable income

Hong Kong insurance adopts the method of dividend compounding. General compound interest is 6-7%, equivalent to single interest at least 10% or more, and this part of the income is continuously and steadily generated, to the late funds will show exponential growth, much higher than bank interest and domestic financial products.

Unlimited Policy Transfers

Hong Kong insurance can change the insured person to family members, the proceeds of this policy can continue to enjoy, so that the family can continue to obtain long-term income from the policy. One policy, passed on from generation to generation.

Hong Kong Savings and Participation Insurance is not only for children's education fund, but also for future wedding fund, pension and other financial arrangements on life events. And then you can pass on the policy to the next generation by changing the insured person to achieve three generations of wealth.

If you are interested in Hong Kong insurance, please contact Timeless Group for more details!