Difference between Business Registration Certificate and Certificate of Incorporation of a Hong Kong Company

2023-11-30

Latest|Hong Kong Investment Immigrants may include Private Equity

2023-12-08In 2004, Tencent Group was listed in Hong Kong; in 2007, Beyoncé was listed in Hong Kong; in 2018, Xiaomi Group was listed in Hong Kong; in 2019, Alibaba was listed in Hong Kong; in 2020, China Acer was listed in Hong Kong; in 2021, Baidu Group was listed in Hong Kong; and in 2022, Azalea was listed in Hong Kong.

In addition to this, a series of famous mainland enterprises such as Meituan, Jingdong, Haidilao, Ping An of China, etc. have beenEntering the door of "Hong Kong Stocks".

Mainland companies choose to focus on "going to Hong Kong", in addition to the policy and the general environment, but also because of being Hong Kongsimple taxationcap (a poem)low-taxAttracted.

Hong Kong's tax policy can be quite friendly to high net-worth individuals, as well as people of all income levels with Hong Kong status.

Hong Kong Tax Favors

Avoidance of double taxation

At present, Hong Kong has signed agreements with 34 countries/regions, including the Mainland, Japan, France and the United Kingdom.Agreements for the avoidance of double taxation.

Hong Kong has entered into a Double Taxation Avoidance Agreement (DTA) on shipping income with the United States and similar agreements on air transportation income with Canada, Germany, Israel, Korea, Mauritius, the Netherlands, New Zealand and the United Kingdom.

Under the relevant agreements, Hong Kong shipowners and airlines are exempted from taxation in the contracting States in respect of income from international transportation.

Partial exemption from salaries tax

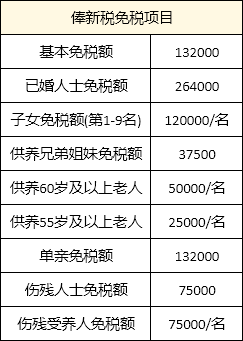

For Hong Kong locals, salaries tax sets up ahow (what extent)ExemptionsAt present, Hong Kong has8 types of tax exemptionscap (a poem)5 deductionsorder (taxonomy)The

Comparison of Hong Kong Taxation with the Mainland

Compared with the Mainland, people with Hong Kong status have quite an attractive advantage in terms of tax payment.Setting up a company in Hong Kong

factLow corporate income tax and fewer taxes. The first HK$2 million is taxed at only 8.251 TP3T and the next HK$2 million at 16.51 TP3T.

There is only one progressive tax rate system in the Mainland, and the richer the person is, the more tax he has to pay, up to a maximum of 451 TP3T, which is nearly half of his income.

Hong Kong business owners pay only as much tax as mainlandersOne-third.

Apart from that, Hong Kong isregional taxationThe amount of money is not a small amount, as profits not generated in Hong Kong are not subject to payment.Working in Hong Kong

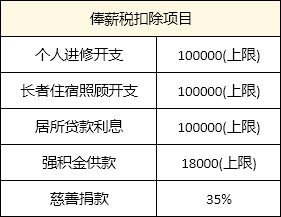

For the same remuneration, Hong Kong paysPersonal income tax (salaries tax) is far less than that in the Mainland.

The formula for calculating salaries tax in Hong Kong:

- Gross taxable income = Annual income - Deductions - Exemptions

- Total tax payable = total taxable income × corresponding tax rate

Mainland Individual Income Tax Calculation Formula :

- Taxable income = amount of salary before tax - five insurance and one pension (personal contribution) - starting point (5,000 yuan)

- Taxable amount = Taxable income × Tax rate - Quick deductions

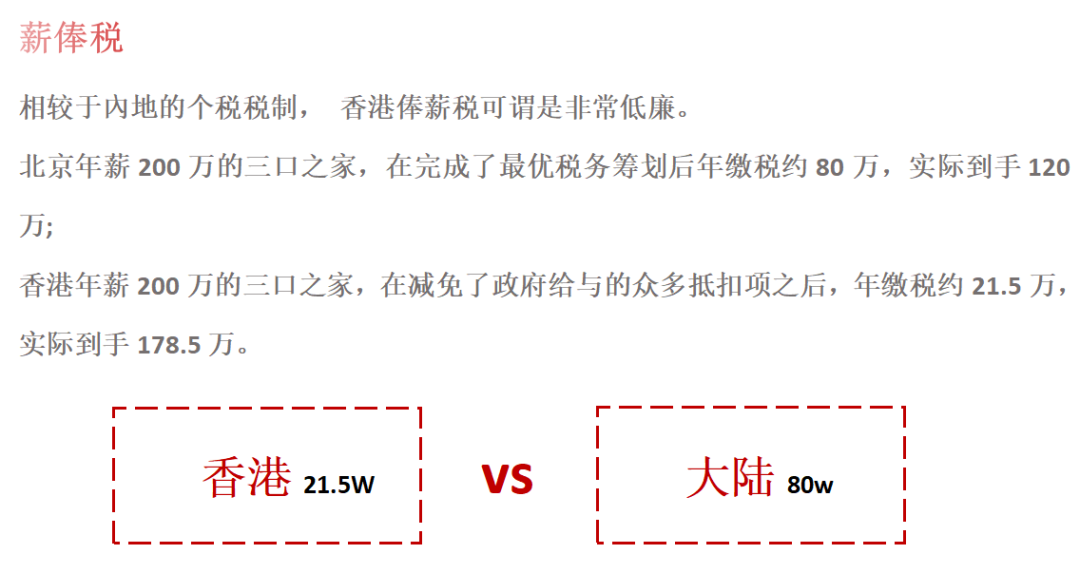

Subsidies available for work in the Greater Bay Area

Hong Kong status holders working in the Greater Bay Area of Guangdong, Hong Kong and Macao have a great advantage in terms of taxation, as the amount of personal income tax they have paid in the nine cities in the PRD exceeds the amount of tax they would pay under the15% calculation of taxable incomeThe people's governments of the nine PRD municipalities will provide financial subsidies for the tax portion of the subsidy, which is exempted from personal income tax.

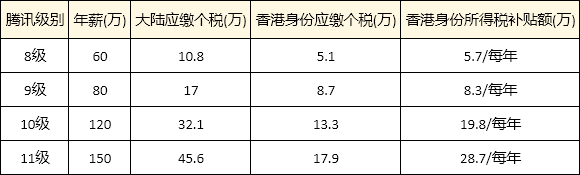

Comparison of Tencent's tax payments for different levels of employees

Take Tencent employees for example:

Higher income earners pay only about the same amount of tax as the Mainlandone-third; working class pay far less tax than the Mainland; working in the Greater Bay Area also entitles you toUltra-high subsidiesThe

Hong Kong status has a unique advantage in terms of taxation.

The context of global tax audits.CRS Agreement countriestax information will be exchanged two by two, and the income of HNWIs will become more and more transparent.

Therefore, in the future, tax will be more transparent, get a legal low-tax region or country status forReasonable tax planning, is the best option for asset preservation and risk resistance.

Obtaining Hong Kong status is a superior choice for personal asset allocation and investment.