Japan's birth rate has plummeted, but Tokyo is "the ideal place for Chinese families to live."

2025-06-06

It takes 30 years to get your money back, so it's no longer cost-effective to buy a house in Japan?

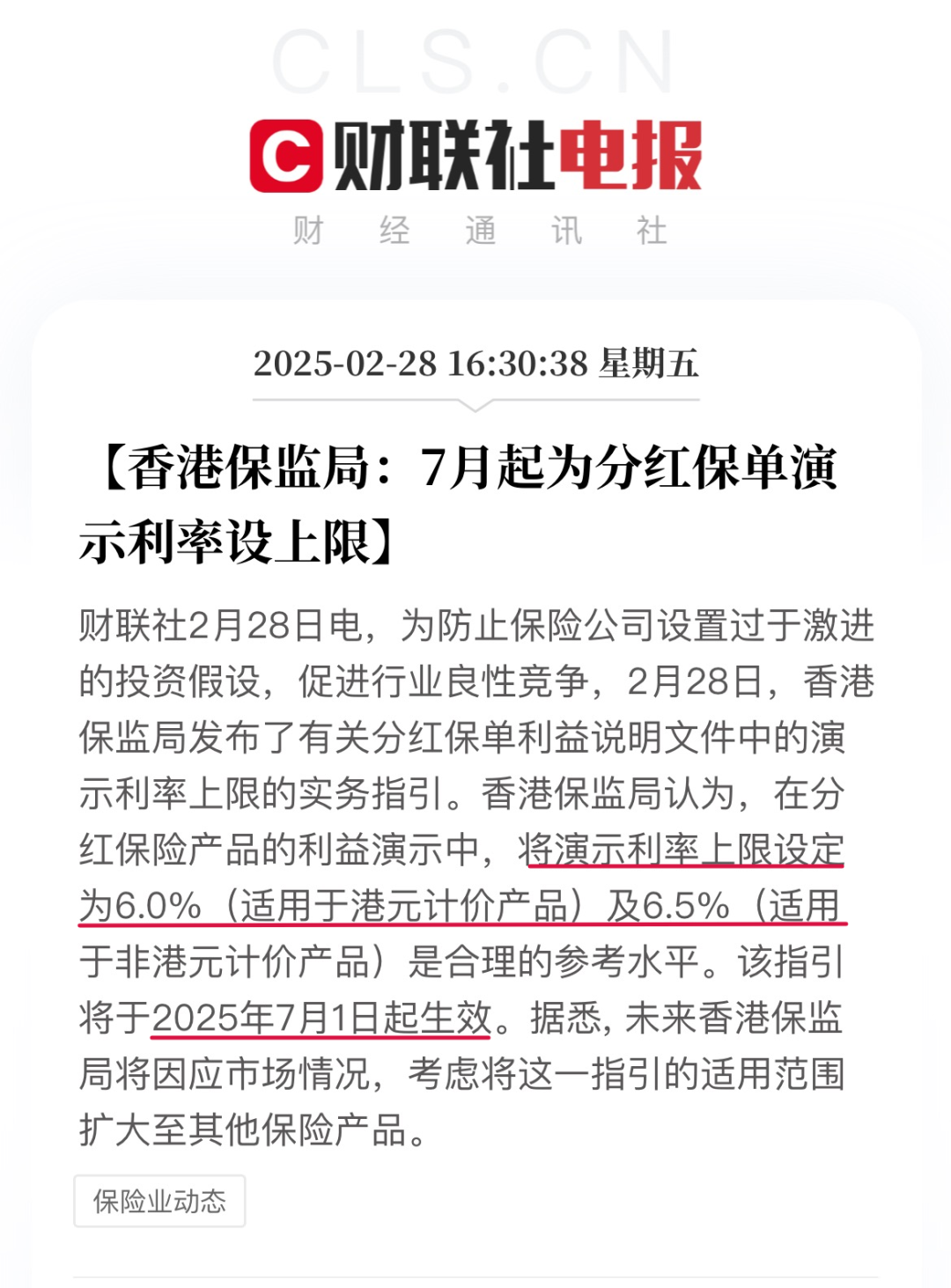

2025-06-13At the end of February this year, the Hong Kong Insurance Authority issued a circular to clarify thatStarting from July 1, the expected IRR demo for non-Hong Kong dollar participating policies, such as US dollar, should not exceed 6.5%, while that for Hong Kong dollar participating policies should not exceed 6%.

In other words, Hong Kong participating insurance products with an expected IRR7%+ currentlyLess than one month window remaining.

01

Expected interest rate cuts

What are the implications?

In the case of investors who are already insured, they are not affected in any way, and policies that are already in force remain at the expected interest rate.

For investors who plan to allocate Hong Kong participating insurance policies, this will affect the policy'sLong-term benefits.

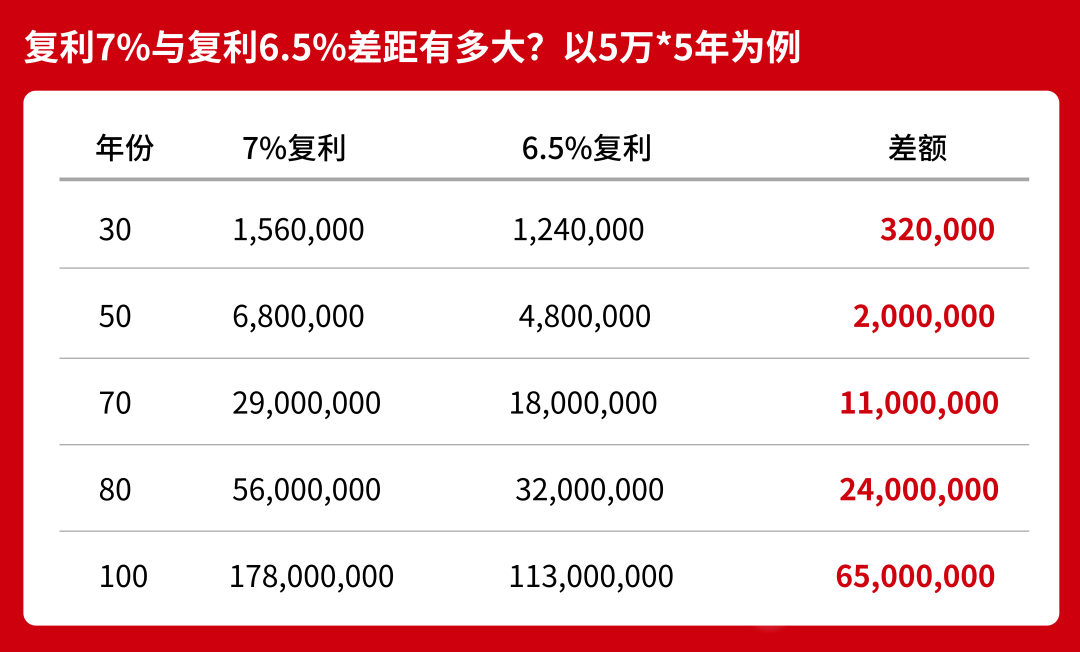

With the new rules in place, policyholders will faceSignificant decline in expected returns.👇 以下图为例

The difference between the expected IRR of 7% and 6.5%, for example, is $50,000 per year for 5 consecutive years. When the policy rolls over to 100 years, theThe difference in expected earnings between the two would be as much as $65 million!

That'scompound interestThe power of this may seem like a good difference in interest rates, but with enough time, it's enough to make a world of difference in dividend values.

02

Seize the window

Allocate early and benefit early

It is understood that the vast majority of products will not be taken off the shelves after the new regulations are implemented, but theThe expected dividends of the product will be adjusted downwards.Once the demo income of Hong Kong insurance is adjusted, insured customers will not be affected, but new policies will be implemented according to the new rules.

Therefore, it is the right time to allocate Hong Kong insuranceFinal "window".The difference between allocating to Hong Kong insurance on June 30 and allocating on July 1 is only one day, but the expected returns will be vastly different.

Why act early? At the heart of it all is the "magic of time" - compound interest:

▼ Locking in a Higher Start

Taking out a policy now will still allow for long-term compounding based on current higher demo rates (e.g., 71 TP3T+). For every 0.5% higher at the starting point, the difference in eventual returns could be significant when compounded and accumulated over decades.

▼ Seizing the Time Dividend

The compounding effect takes time to develop. The earlier you invest, the longer the "snowball" of capital appreciation will roll. The same amount of capital, a few years earlier allocation, the final harvest may be very different.

▼ Seizing the Window of Opportunity

The last window to lock in high demo rates is before July. Early allocation is not only a good opportunity to lock in potentially higher yield expectations, but also to lay out dollar-denominated assets and diversify your allocation ahead of time.

The magic of time is that it makes tiny starting differences thatGrowing into a huge end-value chasm with compound interest addedAct before the interest rate "ceiling" falls. By acting before the interest rate "ceiling" falls, you are making decisions today that will put you in a better position to grow your wealth for decades to come.

If you are interested in configuringHong Kong insuranceIn order to ensure the smooth operation of the insurance, it is recommended to act as early as possible! Welcome to contact us!