Beyond Singapore, what makes Hong Kong Asia's most cosmopolitan city?

2025-07-04

Hong Kong attracts $160 billion in capital! The truth about the global capital frenzy

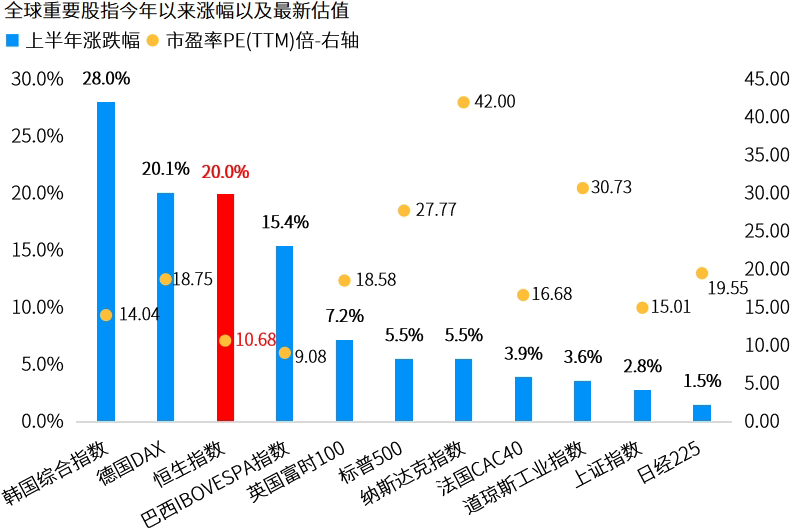

2025-07-10In the first half of 2025, the global capital markets diverged amidst volatility, with the Hong Kong stock market standing out as a "dark horse".

So far this year.Hong Kong stocks outperformed investors' expectations, leading the world's key stock indexes in gains.As of June 30, the Hang Seng Index closed the year with a cumulative gain of 20.00% and a valuation (PE-TTM) of only 10.68 times, making it an outstanding investment value.

Source: Wind, as of 2025.6.30

#01

Why do Hong Kong stocks lead the world?

The data tell you the answer.

In the first half of 2025, the Hong Kong stock market delivered an eye-catching report card in the form of a "technical bull market", with the Hang Seng Index rising by a cumulative total of 20.00%, ranking third among the world's major markets.

Behind this performance is the resonance of multiple drivers:

From the financial sideThe southbound capital net inflow in the first half of the year exceeded 730 billion Hong Kong dollars, a year-on-year surge of 90%, accounting for the proportion of the total turnover of Hong Kong stocks amounted to 19.3%, becoming an important market pusher; during the same period of Hong Kong IPO fund-raising amounted to more than 1070 billion Hong Kong dollars, regained the top of the global list.

In terms of market structureNew consumer, biomedicine, science and technology manufacturing three major sectors to become the leading line, the old store gold, three pharmaceuticals, Hong Kong Robotics Group and other stocks rose more than 200%, traditional financial stocks, such as the Bank of Communications, the Bank of China has also hit a new record high, the plate rotation characteristics are obvious.

On the deep drive logicThe US dollar index plunged 10% in the first half of the year, promoting capital flows to emerging markets, Hong Kong stocks as the core carrier of "offshore Chinese assets" benefited significantly.

At the same time, the Hang Seng Index outperformed the Shanghai Composite Index by more than 15 percentage points during the year, and the underlying Hong Kong Stock Connect has become the first choice of mainland funds for allocating overseas Chinese assets, with valuation repair and asset revaluation effects highlighted.

#02

Hong Kong Stocks Attraction Code

Hong Kong's institutional dividend and market depth

Hong Kong's unique advantage as an international financial center is its core code for attracting global capital.

At the institutional level.Under the framework of "one country, two systems", the currency system of pegging the Hong Kong dollar to the US dollar and the mechanism of free entry and exit of funds without foreign exchange control make it a natural bridge for global funds to allocate assets in China; and the dual application of the common law system and international accounting standards provides enterprises with the flexible option of dual listing of A+H shares.

In terms of market depthThe average daily turnover of the main board of Hong Kong stock market exceeds HK$240 billion, and the focus of southbound funds in areas such as AI, innovative medicines and new consumption has resulted in significant pricing power over new economy industries.

In the first half of this year, the Hong Kong stock market completed 42 initial public offerings (IPOs), raising a total of more than HK$107 billion, temporarily ranking first in the world.

Risk Hedging FunctionThe exchange rate hedging mechanism and short-selling system of Hong Kong stocks, together with the "5-minute cooling-off period" of the market volatility adjustment mechanism, have constructed a multi-level risk buffer system; and the "24-hour trading chain" formed by Hong Kong stocks and A-shares and U.S. stocks has satisfied the demand for all-weather allocation of cross-border capital. Its "24-hour trading chain" with A-shares and U.S. stocks also meets the needs of multinational capital for all-weather allocation.

This in-depth integration of institutional design and market functions has made Hong Kong stocks not only a "safe haven" for global capital, but also a "strategic location" for sharing the dividends of China's new economy.

#03

Hong Kong stock trading rules:

Five core points

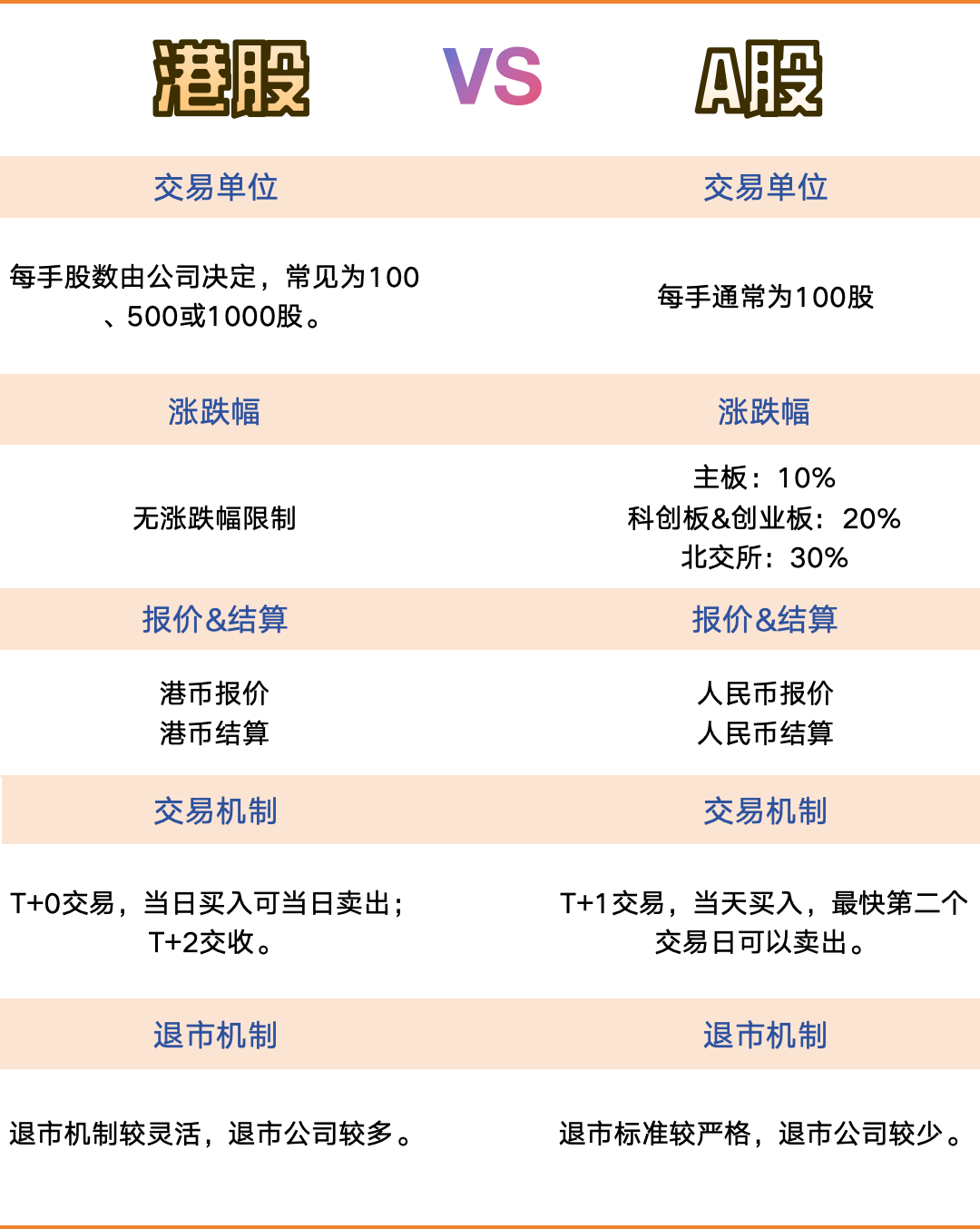

The flexible trading mechanism of Hong Kong stocks combined with a mature regulatory system provides an efficient and transparent investment environment for global investors.

By comparing Hong Kong stocks with A-shares, learn about theFive core points of Hong Kong stock trading rules👇

In the first half of 2025, Hong Kong stocks proved their global competitiveness with a "technical bull market" and Hong Kong's role as a "super-connector" became clearer.

For investors, Hong Kong stocks offer a window to share the dividends of China's new economy, but they also need to be wary of the risks associated with high volatility. If you are interested in investing in Hong Kong stocks, please feel free to contact us!