Gold is in demand again, is it for "risk aversion"?

2022-01-31

Multiple Benefits! Hong Kong's Insurance Industry Welcomes New Opportunities

2022-01-31Albert Einstein said, "Compound interest is the eighth wonder of the world."

What is compound interest thinking? How to use compound interest thinking and realize wealth freedom?

Let's look at one question first:

A small piece of floating weed has appeared in a pond, it grows twice as much every day and is expected to fill the entire pond in 10 days, how many days will it take to fill half of the water surface?

The answer is the ninth day.

That means that when you look at it on the ninth day, it only covers half of the pond, but in just one day, it covers all of it, which sounds magical, but it is.

That's the power of compound interest.

The essence of the so-called compound interest thinking is that doing thing A, leads to result B; and result B, in turn, strengthens A, in a continuous cycle.

Just like a snowball, the snowball sticks to more and more snow and becomes bigger and bigger, and the bigger and bigger snowball is able to stick to more and more snow, and so on and so forth, the snowball will be so big that it is unimaginable.

Economists express the compound interest effect in an equation:(1+r)n The

r stands for what you are doing and n stands for time.

When r is positive, for example, if you insist on reading a book for half an hour every day, maybe in a day or two, the difference between you and others can't be revealed, but after thirty or forty years, the difference is something you can't imagine.

As long as r is positive, i.e. you are doing the right thing, time will work wonders for you.

Compound interest on wealth

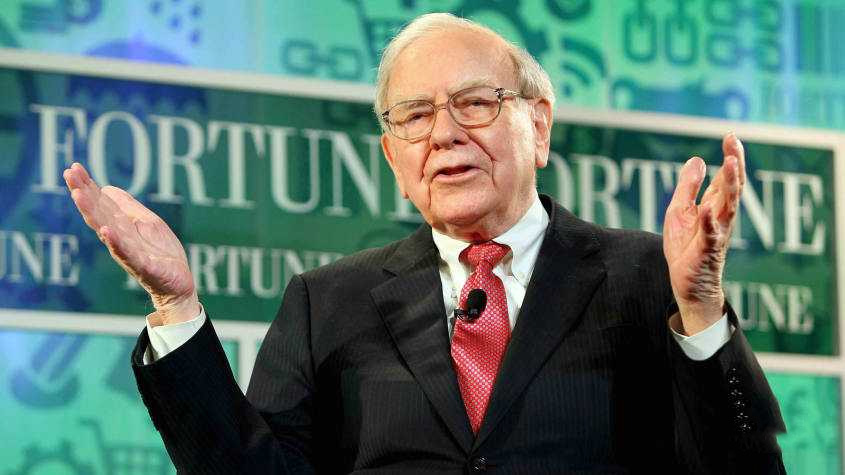

The best example of understanding compound interest thinking in the area of wealth building is Warren Buffett.

Everyone knows that Warren Buffett was once the richest man in the world, but few people know that Warren Buffett's 99% fortune in his life was acquired after he was 50 years old.

That is to say, by the age of 50, he might have been an ordinary middle-class man, like the rest of us.After 50, there is an explosion of wealth.

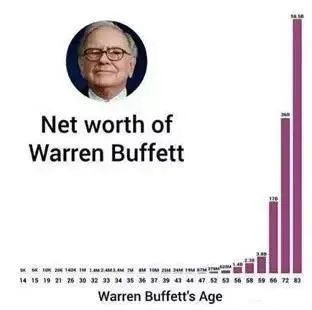

Regarding wealth accumulation, Warren Buffett gave an example in his 2006 Letter to Shareholders:

From January 1, 1900 to December 31, 1999, the Dow Jones Index rose from 65.73 points to 11,497.12 points, an increase of 176 times, is not very impressive?

And what is its compound annual growth? The answer is not admirable, only just 5.31 TP3T.

This growth rate means that you have $10,000 and are only adding $530 per year. It doesn't take Warren Buffett for every average person to achieve that growth rate, but there's only one Warren Buffett in this world thatBecause he's the only one who's been doing it for decades.The

Any tips for wealth?

No, it's a very simple application of compound interest thinking, simple things done over and over again, repeated things done carefully, that's all.

If it's easy to make money according to the effects of compound interest thinking, why do so many people still fail to make money?

There's a big misunderstanding here:Many people think that compound interest is centered on the rate of return, but in fact the real heart of compound interest is time.Even the annual 5% return, 100 years from now, is an incredible number.

The question is: how many people, consistently, can achieve a return of 5% per year for 100 years. It's not the ability to do it, it's theI don't have the patience.The

Either you think the return is too low to bother, or you think the return is too low to hold down a stupid, crazy move.

Stocks in the 90's, real estate in the 10's, bitcoin and consumer upgrades in the 17's, there is no shortage of opportunities in this era. As long as you pay attention and have patience, you may not become the richest man , but it is not difficult to realize the ordinary people's asset appreciation and preservation.

It's always hard to get rich overnight, but it's relatively easy to earn money slowly. It's just a shame that the vast majority of people in this world, prefer to do the hard things rather than the easy things.

identity compounding

Identity planning is also a compound interest model.

The 2022 Knight Frank Wealth Report, which was just recently released, states that despite the global pandemic with numerous countries closing their borders, international travel by UHNWIs is not declining, but is showing more demand.About 15% of UHNWIs plan to apply for an overseas passport or new citizenship.

Click below for a breakdown of investment trends among the world's wealthy:

More and more investors, are realizing the importance of identity planning.

A high-quality second identity, which has the advantages of global access, asset distribution, tax planning, children's education, wealth inheritance and so on.

And these advantages, in turn, will continue to accumulate more wealth for us.For example:

Having a second overseas identity diversifies investment risk, not only effectively avoiding the volatility risk arising from a single market, but also hedging the risk by allocating a reasonable proportion of assets in different markets, thus realizing long-term returns.For example:

The value and utility of having a second overseas identity that can be passed on to children, grandchildren and other generations is priceless.

For more advantages of identity planning, check out:

In the age of globalization, allocating yourself and your family with a second identity that suits your family's needs is a vision and a comprehensive investment in the future of your life, with the belief that the returns you get will increase in value the longer you live.

That's the power of identity planning compounding.