How to maintain a Hong Kong company after registration? Read more in one article!

2024-12-14

How rich is Macau? A million dollars in savings per capita, the richest city in Asia

2024-12-20As of October 2024, according to survey data from the Japan Real Estate Institute.Tokyo and Osaka tied at the top of the list of the world's top 15 cities in terms of price increases for new apartments.

This is not only a testament to the strong recovery of the Japanese real estate market after the epidemic, but also reveals a key fact:Japan's real estate continues to be a globally undervalued, high-quality asset.

01

Tokyo and Osaka lead the world

As Japan's capital city and also its number one city, Tokyo's housing prices continue to rise steadily.

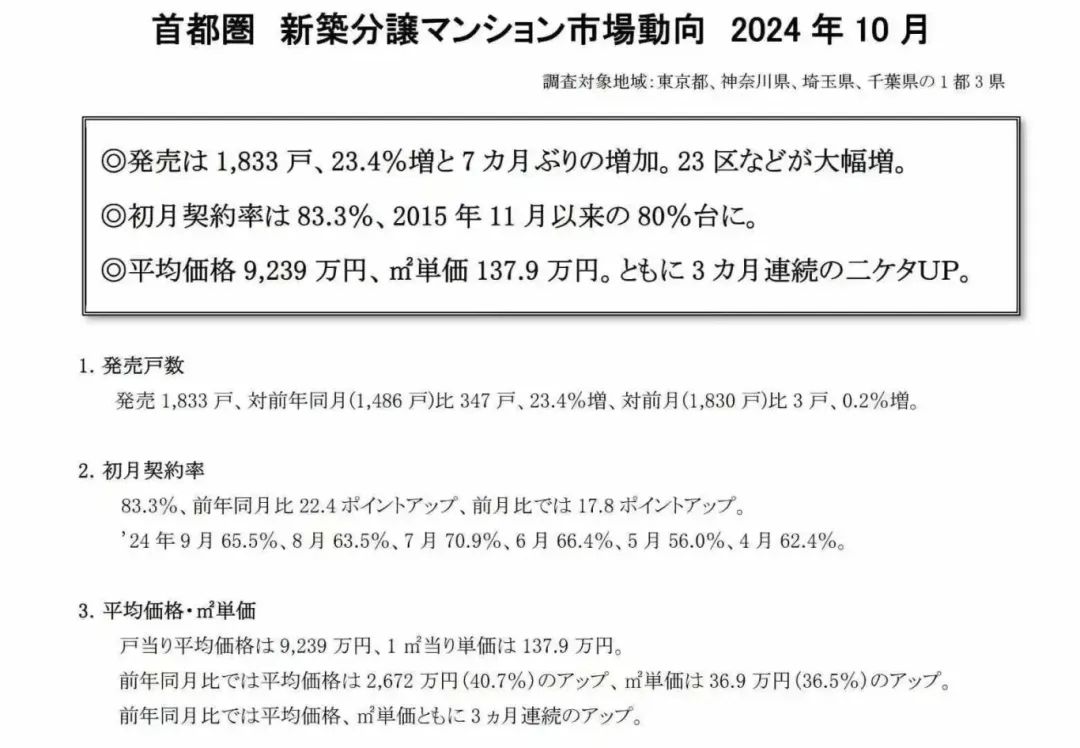

The Real Estate Economics Research Institute of Japan (REIJ) released the "October Market Trends of Newly-Subsidized Condominiums in the Tokyo Metropolitan Area (1 metropolitan area and 3 prefectures)":

The average price per apartment in the Tokyo metropolitan area rose 40.7% year-on-year to 92.39 million yen. This is the third consecutive month of double-digit increases for apartments in the Tokyo metropolitan area.

Among them, the average price of new condominiums offered for sale in Tokyo's 23 wards was 129.4 million yen, an increase of 48.6% from the same month last year.This is the sixth consecutive month in which new condominiums in the metropolis have exceeded 100 million yen per unit.

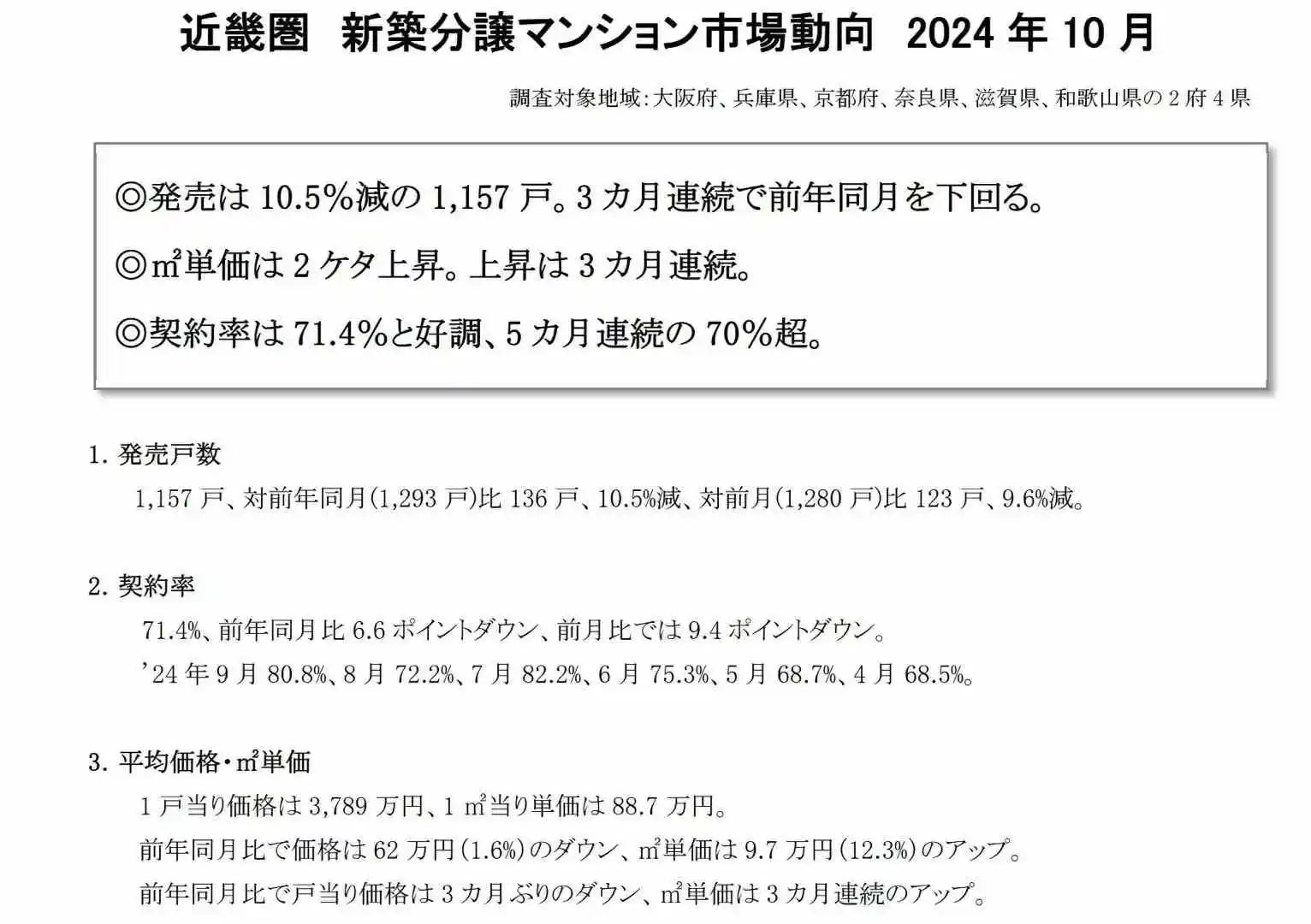

As Japan's second largest city, Osaka, although the overall housing prices are slightly lower than Tokyo, but the rate of increase should not be underestimated.

Osaka's price increases for new condominiums could even equal those of Tokyo.

The latest real estate data for October shows that the average square meter unit price of condominiums in the Kansai region rose by 97,000 yen, or 12.31 TP3T.

Compared with the same month last year, square meter unit prices increased for the third consecutive month.

Osaka, the core city of the Kansai region, continues to see a steady upward trend in housing prices!

In the medium to long term, Tokyo and Osaka house prices remain supportive, and in the context of the global real estate market downturn, theJapanese real estate is a fertile ground that cannot be ignored.

02

Japan Real Estate Investment Value

Amidst a general slowdown in global real estate investment, the Japanese property market stands out as one of the most active in the Asia-Pacific region.

There are multiple factors behind why Japanese real estate is so popular with investors:

✔ Freehold Security: In Japan, land is privately owned, and the purchaser of a home owns the freehold of the land and property, which can be passed down from generation to generation.

✔ Relatively low investment threshold: Compared to other major cities around the world, Japan's real estate is more affordable, especially in emerging cities or non-central areas, with a significant price/performance advantage.

✔ Residence and immigration opportunitiesFor investors who intend to reside or conduct business in Japan for a long period of time, by investing and establishing a company in Japan, investing and holding real estate in the name of the company, and conducting lawful and stable business operations, they have the opportunity to obtain a Japanese Management Visa, and can apply for permanent residence status or citizenship after fulfilling certain conditions.

If you are interested in investing in Japanese real estate, please feel free to contact us!