How to choose the most suitable offshore company domicile?

2023-12-15

What are the offshore RMB and onshore RMB?

2023-12-22As 2023 draws to a close, the much-anticipated"New Capital Investment Entrant Schemehas finally released details and is scheduled toMiddle of next yearBegin accepting applications.

Photo credit: Point News

#01

Threshold HK$30 million assets

✍ Details of the Capital Investment Entrant Scheme 2023 are set out below:

★ Applicable people: Foreign nationals aged 18 or above, persons of Chinese nationality who have acquired permanent resident status in a foreign country, residents of the Macao Special Administrative Region, and residents of Chinese nationality in Taiwan.

★ Investment amount:An investment of HK$30 million or more is required.

★ Investment category:Financial assets, non-residential properties, industries and projects conducive to the long-term development of Hong Kong, such as start-ups and venture capital enterprises, etc., excluding property investment.

★Processing cycle and renewal mode:Upon approval in principle, the Immigration Department will grant the applicant a visitor's visa for a maximum of six months to facilitate the applicant's investment in Hong Kong; upon formal approval, the overall renewal pattern is 2+3+3.

🚨 注意:The applicant must, at all times during the two years prior to the date of application, be in absolute beneficial ownership of thea net worth of not less than HK$30 million.Have no adverse record and meet the general immigration and security requirements.

#02

Can invest in stocks, bonds, investment-linked insurance, etc.

Under the program, the permitted investment assets consist of two components:

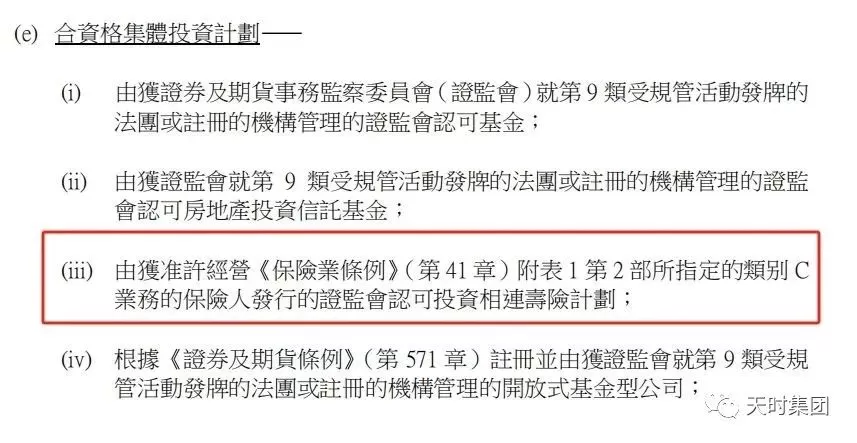

1)financial assetIncludes stocks, bonds, certificates of deposit, subordinated debt, joint venture collective investment schemes, limited partnership funds, or nonresidential real estate involvingHK$27 million.;

(2) Supporting the development of the innovation and technology sector and other key sectors, namelyFunded Investors Entry Scheme PortfolioneedHK$3 millionThe

It is clear from the guidelines thatInsurance-related investment-linked insurance is listed."SFC authorized issued by an insurer authorized to carry on connected long-term business as specified in the Insurance Industry Ordinance".Investment-linked life insurance plans."

That is, investment-linked insurance, in the middle of next year.The whole family has the opportunity to obtain Hong Kong status!

#03

What is investment-linked insurance in Hong Kong?

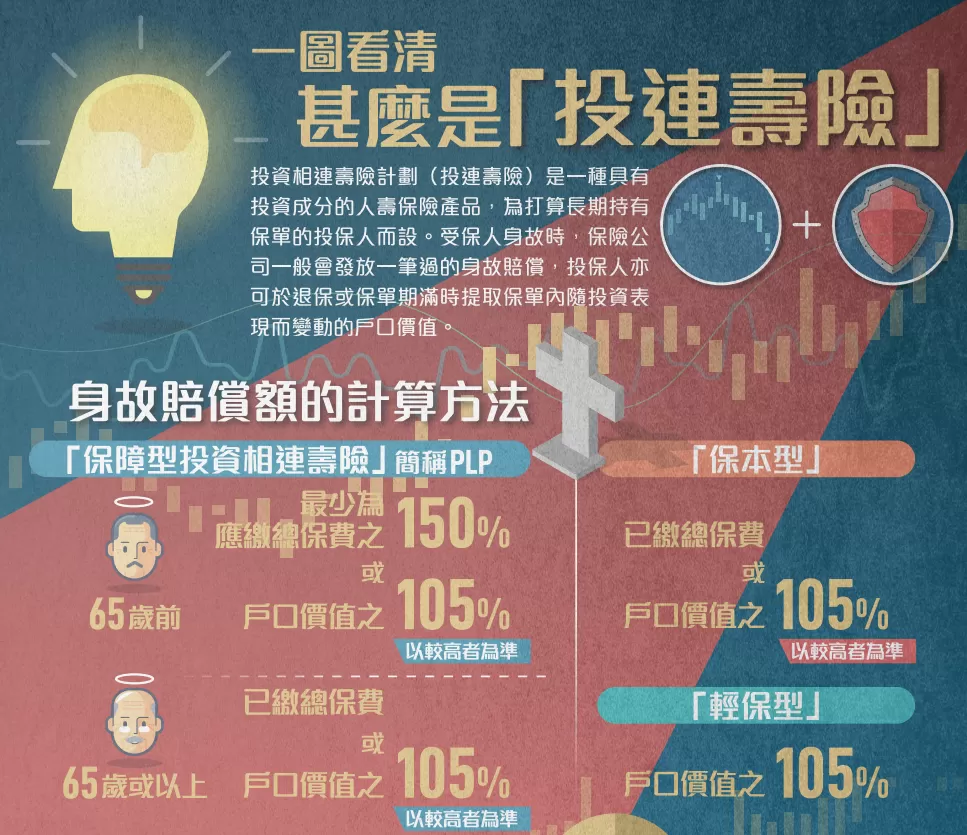

"Investment-linked insurance"As the name suggests it is aCombining insurance and investmentof financial products.

It is a very large piece of the insurance company's business that consolidates products from major fund companies and packages them into new products that are generally sold in two forms:

① Fixed investment funds (mostly on a monthly basis);

② A lump sum investment that receives a fixed monthly payout while the fund price fluctuates.

The "traditional participating insurance" that we usually come across is equivalent to leaving a sum of money in the hands of a professional. "Investment-linked insurance"It is equivalent to making your own investment choices based on the laws of the market and investing in a basket of funds.

One of the best features of investment-linked insurance compared to participating insurance is thatHigh risk, high reward.

Hong Kong investment migrants restarted in the middle of next year, for investors in investment-linked insurance, equivalent to high potential returns outside, but also comes with aHong Kong Permanent Resident StatusWhy not invest in your own business and get your own identity? Welcome to contact Timeless Group~