How to choose Hong Kong insurance? These 6 points are critical!

2023-11-30

What tax benefits can I enjoy by having Hong Kong status?

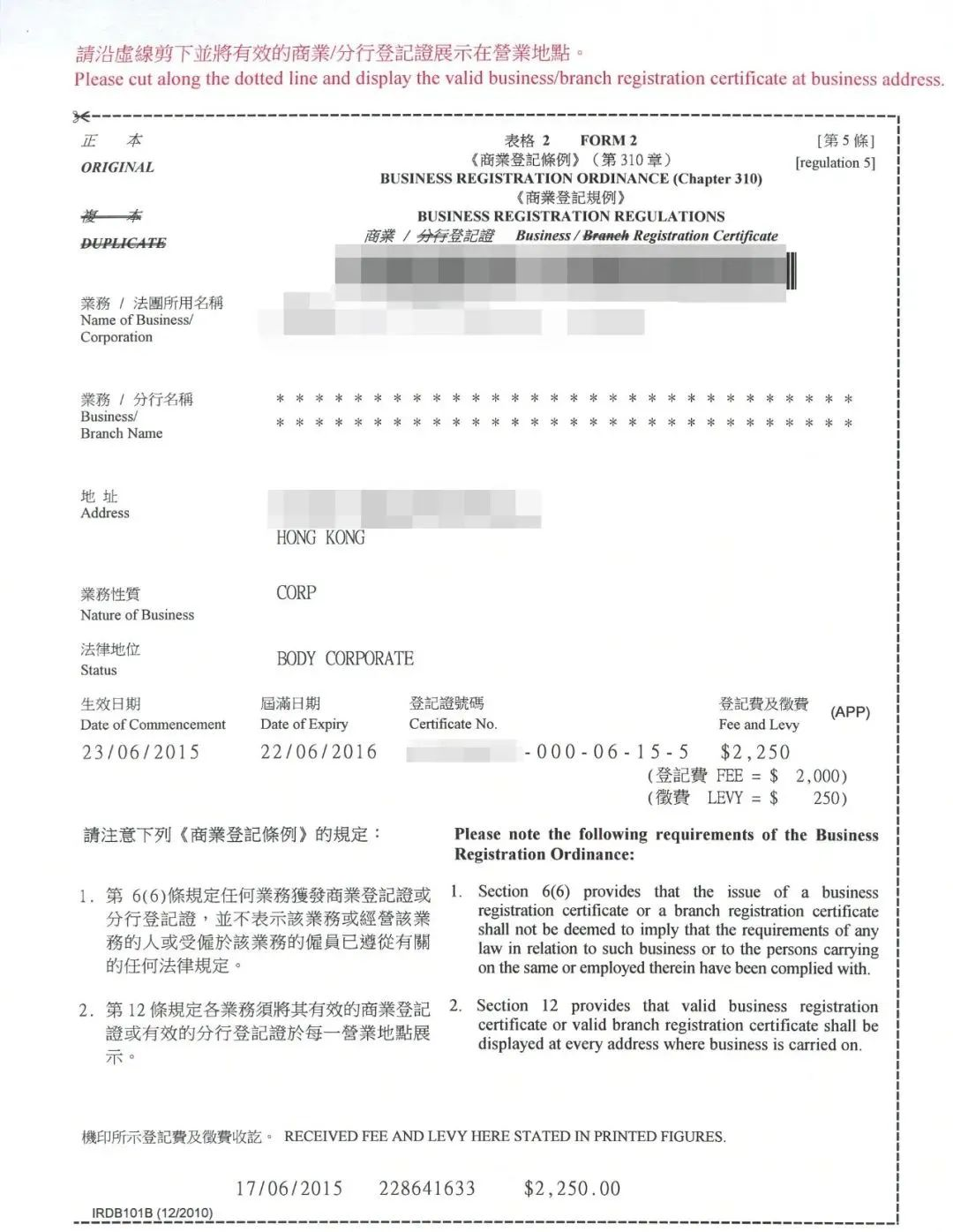

2023-12-08Hong Kong company business registration certificate and certificate of incorporation as an important document for the establishment of the company, the two are often confused, in the end, what is the business registration certificate and certificate of incorporation, what is the role of the company, the difference between which?

01

Business Registration Certificate for Hong Kong Companies

1️⃣ What is a Hong Kong Company Business Registration Certificate?

Business Registration Certificate (BRC) is issued by the Business Registration Office (BRO) under the Inland Revenue Department of Hong Kong and is the tax reference number of the business entity in Hong Kong. According to Hong Kong law, any enterprise conducting business in Hong Kong is required to apply for a Business Registration Certificate.

2️⃣ The role and purpose of a business registration certificate

1. Tax declarations and refunds: The Business Registration Certificate is the basic basis for making tax declarations and refunds to ensure tax compliance.

2. Hong Kong bank account opening must: in Hong Kong bank account opening, usually need to check the business registration certificate to verify the identity of the enterprise. Usually the bank KYC due diligence needs to be used.

3. Legal proof of contracting: Business registration certificates are often used to conclude contracts and participate in legal matters.

4. Full and simple notarization of companies: the commercial registration certificate is one of the documents required to prove the legitimacy and identity of your business when applying for full and simple notarization of companies.

The Business Registration Certificate (BR) number is issued by the Business Registration Office (BRO), where the first 8 digits are the BR number and the next 3 digits are the branch number. If there is no branch or the branch and the head office are under the same BR, the default number will be 000, and the subsequent numbers and letters represent the effective month and year of the Business Registration Certificate and other data used by the Inland Revenue Department. It should be noted that Hong Kong Business Registration Certificate needs to be renewed every year.

02

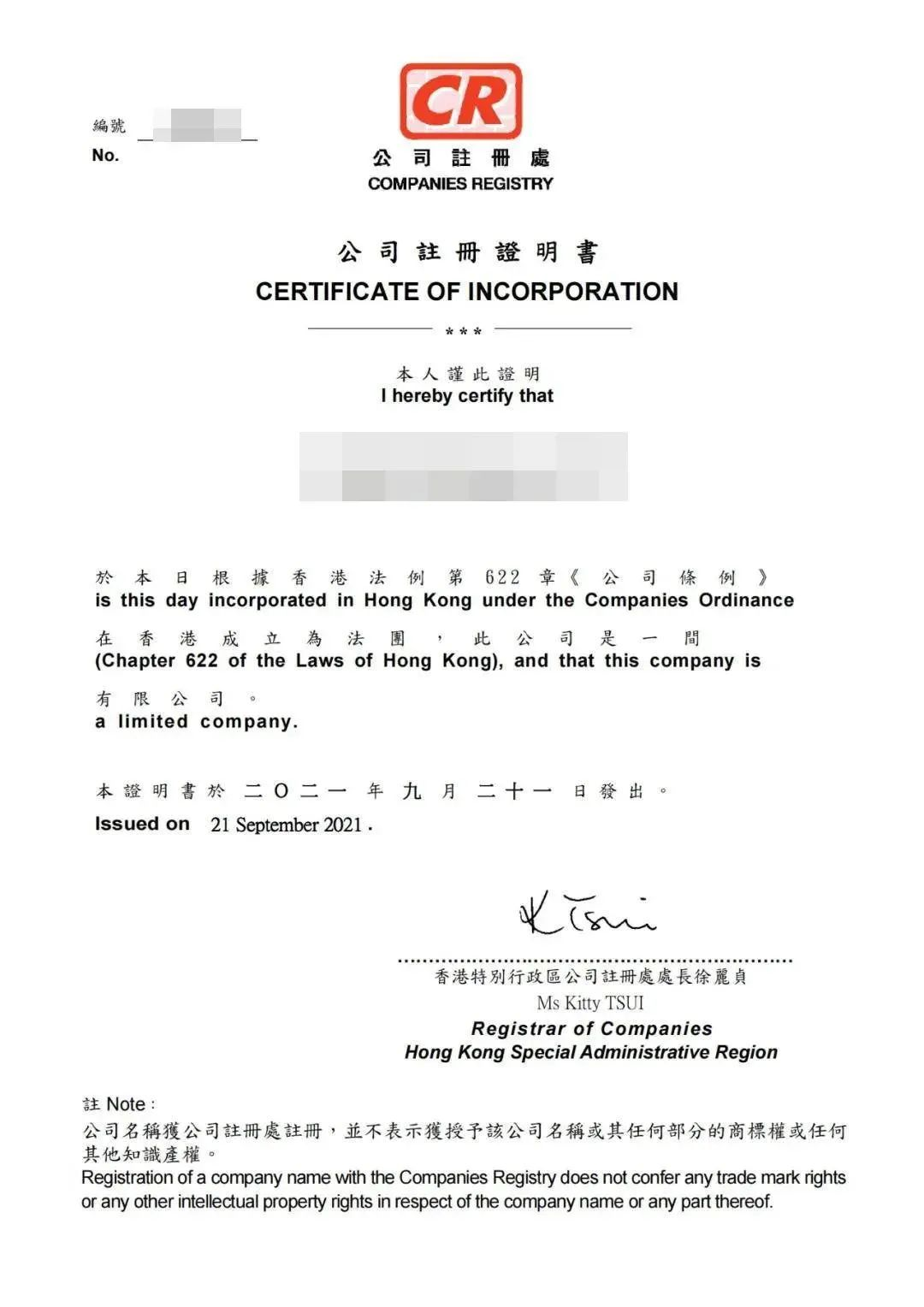

Certificate of Incorporation of Hong Kong Company

1️⃣ What is Certificate of Incorporation of Hong Kong Company

The Certificate of Incorporation is issued by the Hong Kong Companies Registry for the incorporation of local limited companies and overseas companies with a place of business in Hong Kong. The Certificate of Incorporation number is a 7-digit number located at the top left corner of the certificate.

2️⃣ The main roles of the Certificate of Incorporation

1. Like the registration certificate of a business, the certificate of incorporation of a company is an important proof of lawful business operation and is one of the necessary documents for a Hong Kong company to open a bank account, and it is also often used for signing contracts and participating in legal affairs.

2. Company name protection: The certificate of incorporation contains the name of the company, ensuring that your company name is legally registered in Hong Kong and avoiding conflicts with other companies.

03

Difference between Certificate of Registration and Business Registration Certificate

Certificates of Incorporation are issued and administered by the Registrar of Companies.It is similar to a company's birth certificate. It is aroyalty-freeValid supporting documents that, if lost, cannot be reclaimed in their original form.

Business registration certificates are issued and administered by the Business Registration Department of the Inland Revenue Department.A Business Registration Certificate is a document used as a taxpayer identification and tax number. The business registration certificateValid for one year, which needs to be renewed every year. Renewal of the Business Registration Certificate is the main process in the annual review of a Hong Kong company in a business.

When registering a limited company in Hong Kong, the business operator needs to apply for a Certificate of Incorporation from the Companies Registry. In the case of unlimited companies (such as sole proprietorships or partnership businesses), Hong Kong societies and Hong Kong foundations only, only the Business Registration Certificate is required to be applied for at the Business Registration Office. When applying for a Certificate of Incorporation for a limited company, an application for a Business Registration Certificate can be submitted at the same time so that these two important certificates can be processed at the same time.

Business registration certificates and certificates of incorporation differ in terms of issuance and administration.Business registration certificates are issued byCommercial Registryis responsible for issuing and administering it for tax and business purposes; whereas the certificate of incorporation is issued by theCompanies RegistryResponsible for the issuance and management for ensuring the legal operation and legal personality of the company.

If you have company registration, bank account opening needs or other questions, welcome to inquire!