Why are more and more people investing in Japanese real estate?

2024-03-26

Hong Kong investment migrants heat wave is high, an article to explain the investment rules!

2024-03-29To build Hong Kong as a leading family office hub, the Hong Kong government has introduced favorable policies for family offices since last year, attracting an influx of high net worth individuals.

On March 18, Invest Hong Kong, the HKSAR Government, released a report, "A Study of the Family Office Market in Hong Kong," which shows thatHong Kong has more than 2,700 single-family offices, which already exceeds the number in Singapore.Hong Kong has become the home office of choice for an increasing number of ultra-high net worth individuals.

Why do so many UHNWIs choose Hong Kong? What are the advantages of setting up a family office in Hong Kong? There are a number of factors at play.

New Trends in Family Offices

Recently, the Hong Kong University of Science and Technology (HKUST) and Ernst & Young recently jointly released the "Research Report on the Status of Family Offices in Greater China 2024", in which some of the trends are noteworthy:

✔ Mainland Chinese families dominate single family office development in Greater China

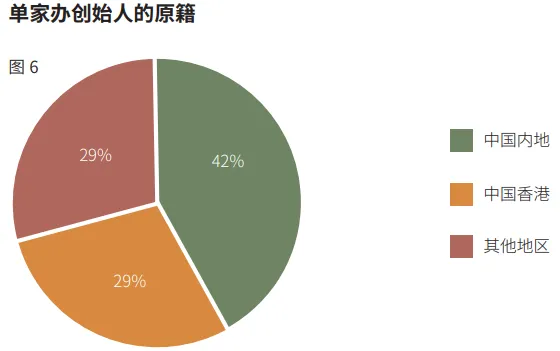

The report shows that the proportion of single family office founders from Mainland China (42%) is significantly higher than in Hong Kong (29%).

Source: EY

✔ Hong Kong has both old and new wealth families

The analysis found that the generational range of the founder or head of a single family office in Hong Kong encompasses one, two, three and even four generations of the family, while in Mainland China it is usually one or two generations.

✔ Single family offices in Hong Kong are more mature than those in the Mainland

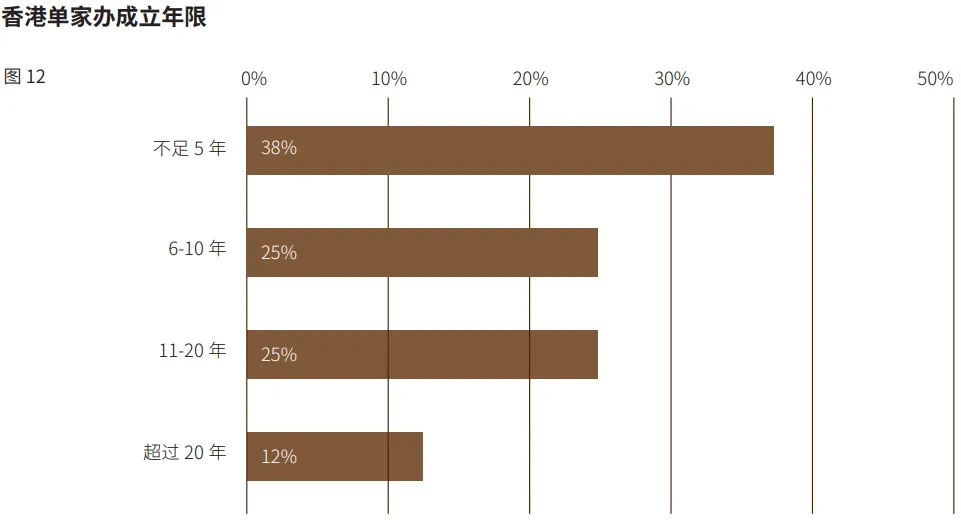

The report shows that 37%'s single family offices in Hong Kong have been in operation for more than 10 years, while the single family offices in the Mainland have all been created in the last 10 years. Single Family Offices in Both Placesmaturity leveldiffer fromdiscriminateIt reflects the fact that the two places are at different stages of economic development and wealth transmission.

Source: EY

✔ Increasing number of non-family professionals entering single family offices

The report shows that about 45% of single family offices have a team size of more than 10 people, indicating that single family offices in Greater China hire non-family professionals to participate in their operations in order to enhance the management and professional capabilities of the family office.

✔ Family offices tend to diversify risk through diversified investments across regions and asset classes

The report shows that about half of single-family offices use a balanced investment strategy. Most single-family offices have seen investment returns of 5%-20% over the last three years.

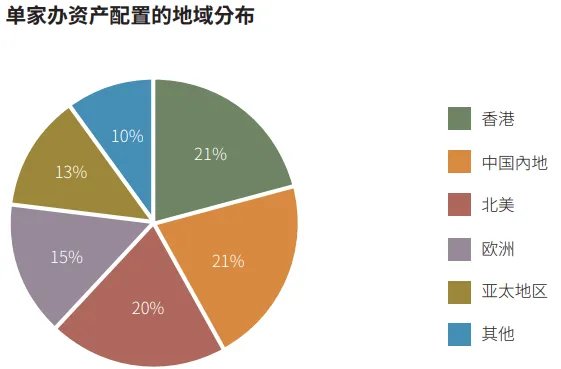

The Single Family Office not only invests locally, but furthermore through theIn different regions and countriesInvestments are made to diversify investment risk.

Source: EY

In addition, the Single Family Office diversifies its investments based on different asset classes. In addition to popular asset classes such as equities and fixed income, private equity, and venture capital, the Single Family Office also invests in a variety of other alternative investments and digital asset programs.

✔ Increasing importance of family governance and non-financial functions of family offices

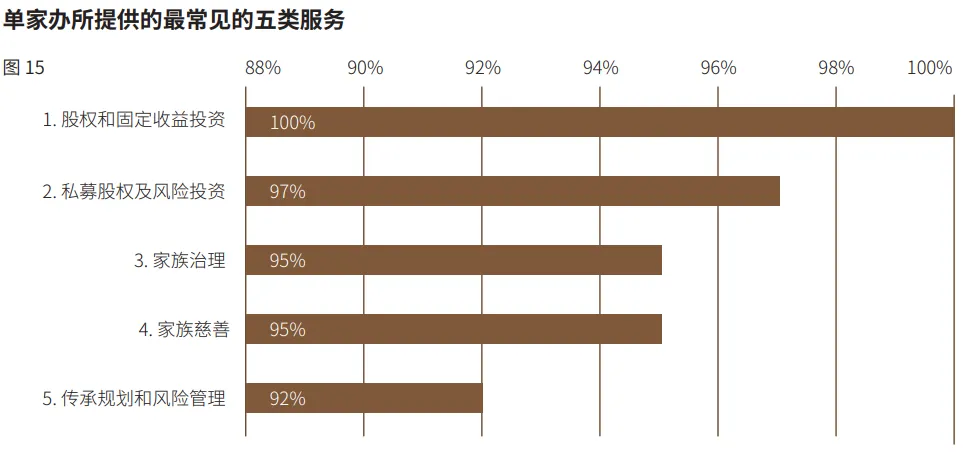

The findings show that single family offices offer comprehensive and systematic products and services to families, designed to meet both financial investment and non-financial requirements. Family governance is in the top three of the services offered by single family offices.

Source: EY

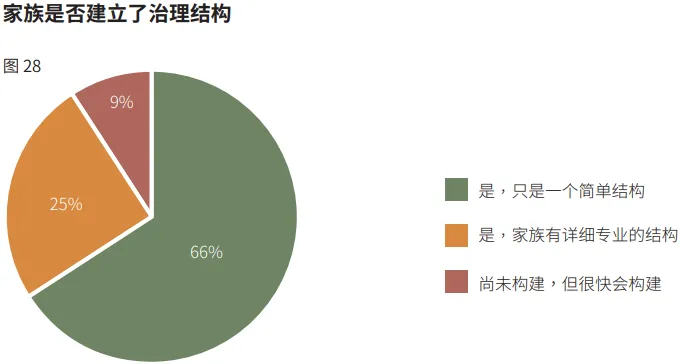

In terms of family governance, the vast majority (91%) of single family offices in Greater China have constructed governance structures, both simple structures and more specialized ones.

Source: EY

Through a family governance structure and family governance process, a single family office can improve the effectiveness of decision-making and communication, and effectively resolve conflicts among family members while maintaining the transmission of family values and family influence.

What are the advantages of setting up a home office in Hong Kong?

It is clear from the report that Hong Kong is becoming the preferred location for more and more ultra-high net worth individuals to set up family offices. So why do they choose Hong Kong?1

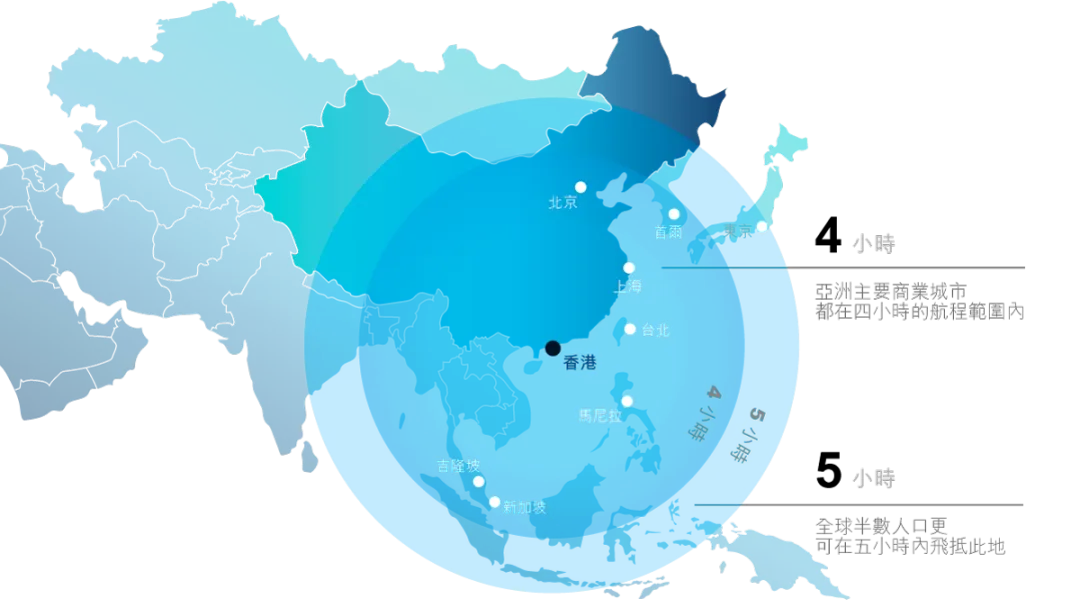

Excellent location

Hong Kong is located inThe Heart of AsiaIt is not only closely integrated with the Mainland, but also maintains efficient transportation links with the rest of the world, such as being only four hours' flight away from most of the major financial markets in the Asia-Pacific region and less than five hours' flight away from more than half of the world's population.

This makes Hong Kong aAn important bridge between East and WestIt provides a convenient environment for family offices to conduct international business.

2

Policy guidance and support from the Hong Kong Government

On March 25, 2023, the HKSAR Government issued aPolicy Declaration on the Development of Family Office Business in Hong Kong(math.) genusEight measures were proposed to facilitate the development of global family offices.These initiatives provide strong policy protection for the establishment and operation of family offices in Hong Kong.

✓ The eight measures are:

New Capital Investment Entrant Scheme, provision of tax relief, market facilitation measures, establishment of the Hong Kong Wealth Transfer Institute, promotion of art storage facilities at the airport, development of Hong Kong as a philanthropic center, dedicated team of FamilyOfficeHK of InvestHK, new family office service network.

3

A sound and complete legal system

Hong Kong has a sound legal system withWell-established regulatory framework,Good rule of law environmentcap (a poem)Clear legal processThe family offices are provided with a stable and transparent legal environment.

4

Favorable tax policies

Hong Kong is practicingLow tax rates and simple tax systemIn addition, there is no business tax, value-added tax, investment withholding tax, capital gains tax, property tax and dividend tax. At the same time, Hong Kong adopts the territorial source principle of taxation, whereby only profits derived from Hong Kong are taxed.

This makes it easier to set up a family office in Hong Kong toFinancial planning and tax managementThe

These are the many advantages of setting up a family office in Hong Kong.

Hong Kong has many unique advantages as a place to set up a family office.With the efforts of InvestHK and the favorable measures introduced by the GovernmentHong Kong will leapfrog toThe world's premier family office centerIf you are interested in setting up a family office in Hong Kong, please contact Timeless Group. If you are interested in setting up a family office in Hong Kong, please contact Timeless Group!