From Tokyo to Osaka: Exploring the Golden Opportunity for B&B Investment in Japan

2024-08-23

Hong Kong Insurance 2024 H1 data is out, with the ranking of Hong Kong insurance companies!

2024-09-05Recently, the Hong Kong Insurance Authority announced that under section 35(2)(b) of the Insurance Ordinance (Cap. 41).Take full control of all affairs and assets of Thai Harvest Life Insurance Company Limited (THLIL).

All existing policies of Terra Life, totaling approximately 90,000 policies.It continues to be valid and will not be affected.

THL will continue to fulfill its policy commitments. At present, THL has sufficient assets to meet the $18 billion insurance liabilities and the company can continue its operation, while the best practice for policyholders is not to wind up the company, and will look for effective repair options, including finding new investors to take over.

As an international financial center, Hong Kong occupies a pivotal position in the global insurance market. With the changing global economic environment and the various uncertainties that have arisen in recent years, a key concern has emerged:Will insurance companies in Hong Kong face the risk of closure?This paper will delve into this topic and analyze the factors involved.

Hong Kong insurance companies can breakestate, but will not go bankrupt easily.This is because from a legal point of view, no insurance company holding a long-term life policy can dissolve itself, whether under the insurance laws of the Mainland or international practice.

⭐ The Hong Kong Insurance Ordinance has already provided a detailed explanation of the insolvency of insurance companies:

Hong Kong Insurance Ordinance

01

Hong Kong Insurance Company

Eight reasons why it's hard to go out of business

1. Historical deposits and experience

Hong Kong's insurance industry has a long history, and since the Opium War in 1841 has spent theOver 180 years of history.

This historical underpinning provides a solid foundation.

Even during the global financial turmoil of 2008, when many world-class investment banks went bankrupt, insurance companies remained robust.

This stems from the wealth of experience gained from the industry's history, which gives insurers plenty of resilience when the storm hits.

2. Support from economics

Insurance companies operate independently on a self-financing model, so the collapse of an individual company does not mean the collapse of the entire industry.

Even if some companies are in trouble.regulators will also step in to carry out mergers or asset transfers.to keep the policy in force.

This is the essence of a "risk-free policy".

3. Financial sector pillar

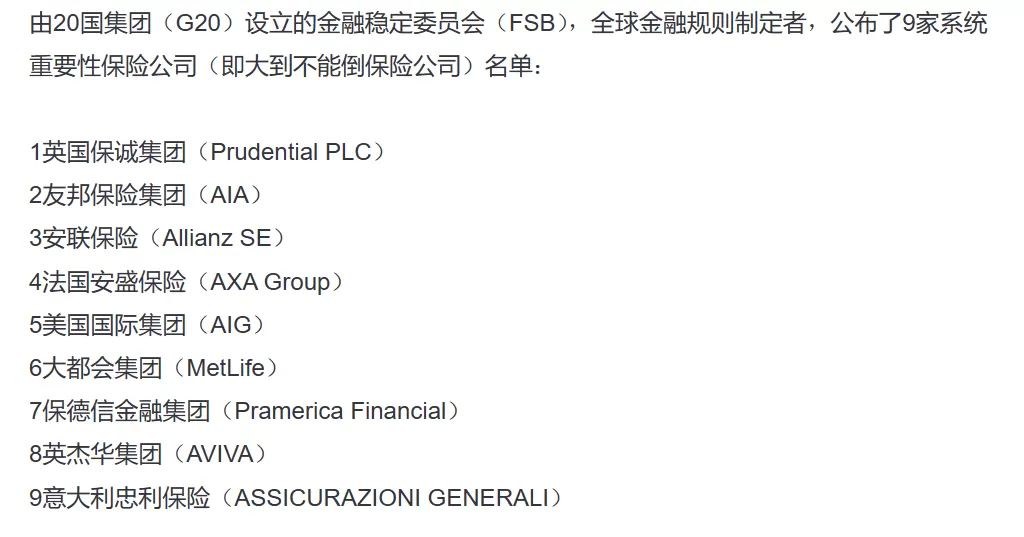

Insurance companies across the globe are seen as the backbone of the financial system; they are the last line of security and do not fail easily.

this kind of"Too Big To Fail."The phenomenon is particularly pronounced in the insurance industry.

As an important part of the financial industry, Hong Kong insurance companies are even less likely to face the risk of closure easily.

4. Precise actuarial analysis

Precise actuarial calculations also provide stability for Hong Kong insurance companies.

Insurance companies use actuarial analysis to spread risk over a broader insured population toEnsure that risks are accurately assessed and diversified.

This process involves professional actuaries who take into account several variables, such as life expectancy, probability of illness, future interest rate trends, etc., so as to safeguard the sound operation of the insurance company.

5. Proper reinsurance arrangements

Reinsurance isTransferring part of the risk to other insurance companiesbehavior used to diversify risk.

Even in unpredictable situations, reinsurers will share a portion of the liability, ensuring that insurers can effectively respond to unexpected risks.

6. Strength of international insurance companies

The Hong Kong insurance market is dominated by international insurance companies, which operate across borders, have a long history and huge assets.

They diversify their investments globally.The investments behind it are mainly low-risk investments, such as government treasury bonds.Making the risk of these companies going out of business extremely low.

7. Tightness of government regulation

Strict government regulation goes to the heart of an insurance company and is one of the most important safeguards to ensure its safety.

The Hong Kong Government will station government-appointed actuaries in the core actuarial department of each legally operating insurance company.Regulating the operations of insurance companies from withinin order to protect the interests of our customers.

In addition, the Government also restricts insurance companies to investing only in low-risk investment instruments recognized by the Government to ensure the safety of their funds.

8. Adequate equity and solvency reserves

Insurance companies must meet certain capital requirements to ensure that their assets are sufficient to cover their liabilities and protect policyholders' interests.

Source: Official website of the Office of the Commissioner of Insurance of Hong Kong

In addition, insurers need toMaintenance of adequate solvency marginsto ensure that commitments are honored in a timely manner when claims need to be paid.

In short, the safety of Hong Kong insurance companies is ensured by a combination of factors.

Strict regulation, fine actuarial precision, robust reinsurance arrangementsas well asStrength of international insurance companiesAll of them provide solid protection for the stable operation of the Hong Kong insurance market.

The interplay of these factors has enabled the Hong Kong insurance market to remain standing in a volatile financial environment.

02

Six regulatory requirements for insurance in Hong Kong

Regulatory instruments I: Authorization provisions

Regulation 6 of the Insurance Companies Regulations provides that, except for theAcquisition of authorizationNo person or organization other than an insurance company, Lloyd's or an organization of underwriters recognized by the Insurance Authority shall carry on insurance business in Hong Kong.

This means that companies wishing to conduct insurance business in Hong Kong mustComply with authorization provisions and meet high threshold capital requirements.

This provision aims to ensure that insurance companies have sufficient capital strength to provide a solid foundation for their stable operations.

Regulatory tool II: solvency reserve requirements

The Insurance Industry Regulations for insurance companiessolvency reserveEstablishes requirementsand to adopt higher standards in actual regulation.

These reserve requirements ensure that policyholders are protected in the event that an insurer's assets are insufficient to cover its liabilities.

The setting of the solvency adequacy ratio and regular reporting to the regulator ensures the transparency of the company's solvency.

Regulatory tool III: Requirements for reinsurance arrangements

Reinsurance plays an important role in the insurance market by transferring part of the risk to other insurers, thus reducing the risk exposure of a single company.

The Insurance Companies Ordinance provides thatInsurance companies must have adequate reinsurance arrangements in placein order to diversify the risks they assume.

Such a provision ensures that the company remains stable in the event of increased risk exposure.

Regulatory tool IV: Appropriate selection of managers and shareholders

The Insurance Companies Ordinance makes it clear that a person who is a director or controller of an insurance company must be a fit and proper person.

The regulator will examine the character, curriculum vitae and experience of these persons to ensure that they are qualified for the positions they hold.

The guidelines developed further enhance the transparency of the fit and proper requirement.

Regulatory instruments V: Intervention in insurance companies

The Insurance Companies Ordinance confers supervisory powers on the insurance industry to safeguard the interests of policyholders and potential policyholders.

Regulators can take appropriate action in case of anomalies in insurance companies, such as limiting premium income and mandating asset custody. These interventions have ensured the stable functioning of the market.

Regulatory tool VI: The role of the Insurance Complaints Authority

To safeguard the legitimate rights and interests of policyholders, Hong Kong has established theInsurance Complaints BureauThe

The agency provides policyholders with an efficient and inexpensive way to resolve disputes related to private policies.

It will conduct fair arbitration to ensure that the policyholder's rights and interests are properly safeguarded.

Organizational structure of the Insurance Authority of Hong Kong

All in all, the six major provisions of insurance regulation in Hong Kong have built up a tight regulatory network to ensure the health and stability of the insurance market.

These provisions start with theAuthorization, solvency reserve, reinsurance, fit and proper, interventionsas well asComplaint resolutionand many other aspects, providing a full range of protection for the insurance market and providing solid protection for the interests of policyholders and insurance companies.

To summarize, while the risk of Hong Kong insurance companies failing exists, on the wholeIts robust operating history and strict regulatory regime provide a strong guarantee of stability in the industry.

Insureds and policyholders can minimize their risks by choosing their insurance companies carefully. Meanwhile, government support and market diversification have also provided strong support for the sustainable development of Hong Kong's insurance industry.

If you would like to know more about Hong Kong insurance, please feel free to contact us!