How do Jack Ma and Li Ka-shing use Hong Kong insurance to realize wealth inheritance?

2023-09-06

Over 72,000 new registrations in six months! Why entrepreneurs are choosing to register Hong Kong companies?

2023-09-13In August, Evergrande Real Estate's parent company, Evergrande Group, filed for bankruptcy protection in the U.S., sparking concerns among many industry insiders and investors about China's real estate industry.

Following the plunge in BGN's share price, Evergrande Group's filing for bankruptcy protection further hints that the domestic real estate market is currently facing greater challenges.

This has caused investors to worry about the overall development and sustainability of the industry, so many investors in the real estate industry have begun to shift their investment focus, broaden their investment channels, expand their investment scope, and explore more diversified investment options.

1

"Finance & Real Estate"

Aside from the traditional house made up of a mixture of steel and concrete, there is another type of house that is worth considering - the"Finance & Real Estate"The

"Financial real estate" is invisible and cannot be used for living, but it can also be used for appreciation, inheritance, liquidation and rent collection, and the key threshold is low.

A "financial property" with these functions is "Hong Kong insurance".

Examples:

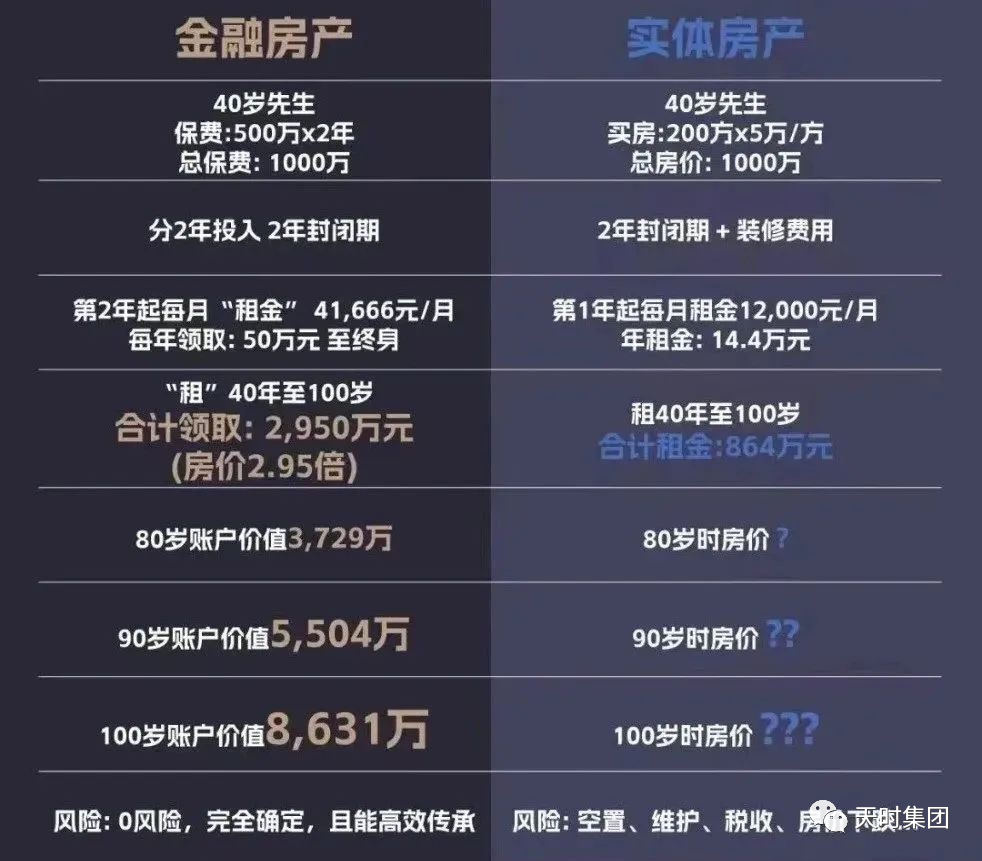

Buying a physical property for $10 million, the rent is only about $12,000/month, and there is a risk of vacancy, and you need to come up with funds to maintain it on a regular basis. At the same time, once the price falls, there is a risk of asset depreciation, and it is more difficult to realize.

While choosing "financial properties" and using this money to purchase a policy with a total premium of $10 million, the "rent" can reach $41,666/month, which is a higher return, and the dividend realization rate of Hong Kong insurance companies is stable, so this part of the "rent" is very safe. At the same time, the policy can be efficiently inherited by switching the insured.

2

"Benefits of "Financial Real Estate

1. Preservation of value

For inheritance, all property will be depleted, not appreciated.

For insurance, the assets of insurance can increase in value and can continue to increase in value according to the agreement. Especially at present, many insurance products in Hong Kong maintain a long-term return at 6%-7%, which is a very considerable return in the type of stable products.

2. Easy to realize

The value of "financial real estate" is relatively low at the beginning, but after holding it for a few years, it will exceed the premiums paid. If there is a need at this time, you can liquidate it, either by "selling" it in its entirety, that is, by choosing to partially surrender the policy, "selling" a portion of the policy and retaining a portion of it; Or withdraw part of the dividends every year.

It's very quick to realize and can arrive in a few business days. Physical houses, however, are more troublesome to realize.

If it is only a short-term cash flow problem, you don't have to "sell" the financial house to realize the cash, you can get a mortgage to get emergency funds.

3. Can continue to "collect rent"

"Financial properties" can also receive "rents".

If there is an interruption in income, such as a mid-life crisis, the "rent" from the "financial property" can be used to make ends meet. Assuming a monthly charge of US$1,500 (about RMB 10,000), basic living can be maintained.

Or perhaps when you retire at 60, you can use the 'rent' from the 'financial property' to supplement your pension, or use it to enhance your quality of life such as traveling and shopping, or to stay in some good quality nursing homes.

4. Segregation of assets

"Financial Real Estate" Because of the special structure of the policy, which contains four legal subjects, namely the insured, policyholder, insurer and beneficiary, it can serve to isolate assets to a certain extent, such as against marital risk and debt risk.

For example, parents configure a large Hong Kong policy for their children, with the parents as the policyholder and the children as the insured, the policy belongs to the property of the policyholder until it is paid out, and will not become the children's marital property, effectively avoiding the outflow of wealth.

On the whole, "Hong Kong Insurance", as a high-quality "financial property", is a more secure means of overseas asset allocation; with the advantages of risk diversification, steady appreciation, convenient insurance, flexible conversion, multi-currency and US dollar-denominated, etc., it can help the middle class and high net-worth families to realize more possibilities in terms of wealth inheritance, marital planning, asset segregation and taxation!