What are the advantages of Hong Kong bank accounts?

2023-08-25

Stamp duty has been cut after almost 15 years! What's the impact?

2023-08-29In March of this year, South Beauty founder Zhang Lan, outside the countryfamily trustThe news of the breakdown triggered the market's attention when a Singapore High Court judge found that Zhang Lan was the beneficial owner of the assets in the bank account where her offshore family trust was held, and therefore granted an application by European private equity firm CVC Capital Partners ("CVC") for the appointment of a receiver. Subsequently, Zhang Lan publicly stated that she would file an appeal.

The latest disclosure of the High Court of Singapore's judgment in July shows that Zhang Lan's appeal was rejected and the court upheld the original judgment.

This means that Zhang Lan ended up losing her multiple lawsuits against CVC, and the $55.37 million (about Rs 400 million) in her Singapore bank account was eventually taken over by CVC.

01

The Beginning of the Trust's Breakdown

On June 3, 2014, Zhang Lan set up an offshore trust as the settlor, with her son, Wang Xiaofei, and his children as the trust beneficiaries and Asia Trust as the trustee.

According to the trust deed, once the assets are loaded into the trust, Zhang Lan will no longer retain any rights over the assets, but she has stayed the course and retained a right to the trust structure, namely the right to terminate and remove the protector role.

At this point, there are no issues and the trust framework is reasonably effective.

Zhang Lan lost her lawsuit against CVC in 2019 and owes the other party a total of $142 million (roughly Rs. 980 million) and interest thereon.

CVC aimed at Zhang Lan's family trust in order to recover the debt. In theory, the creditor cannot recover the assets in the family trust, but CVC hardened itself to find the flaws in it - the actual beneficiary and the actual owner of the property might be Zhang Lan.

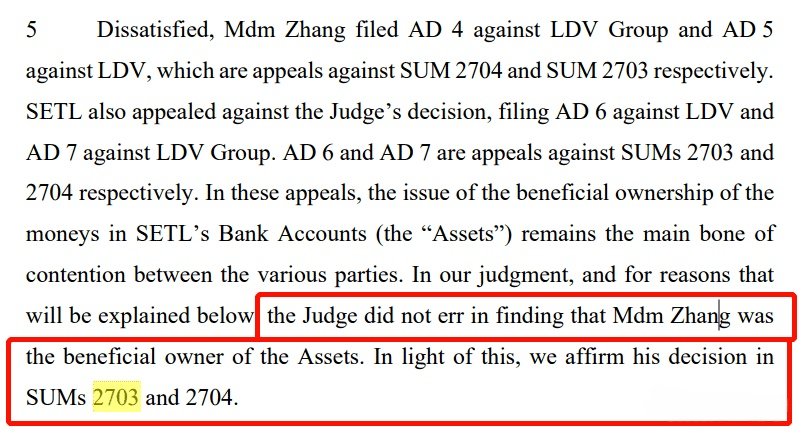

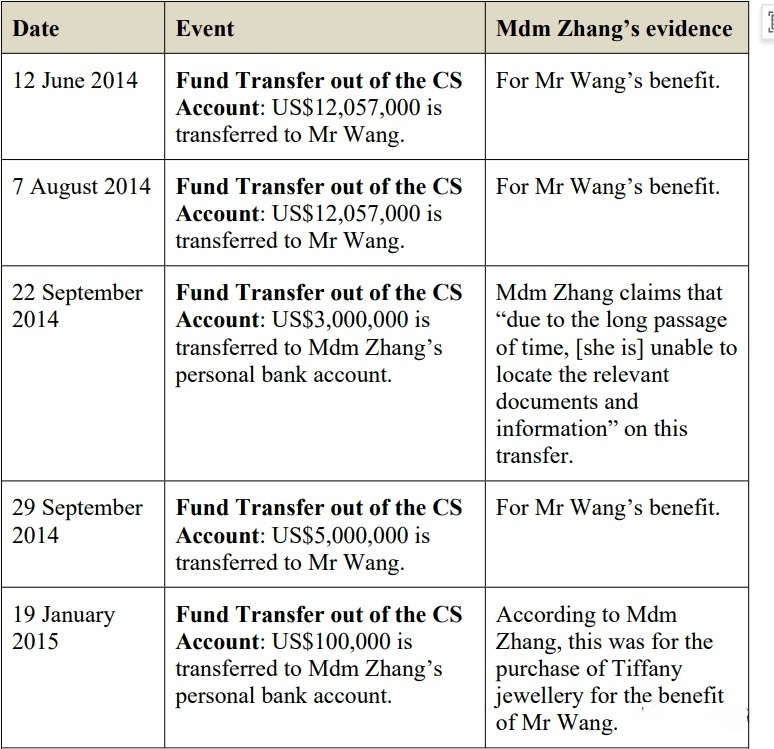

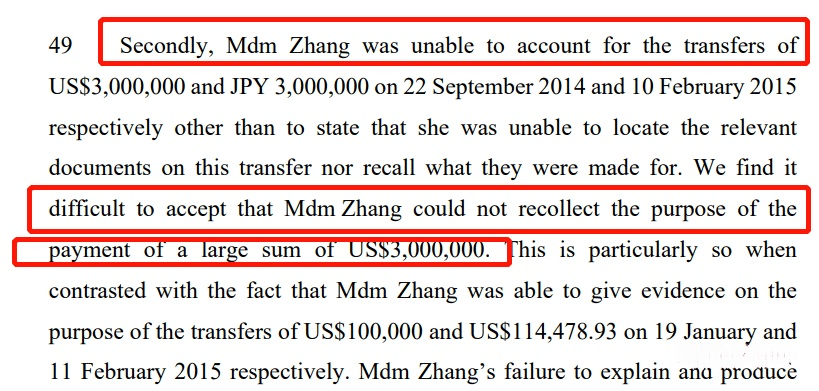

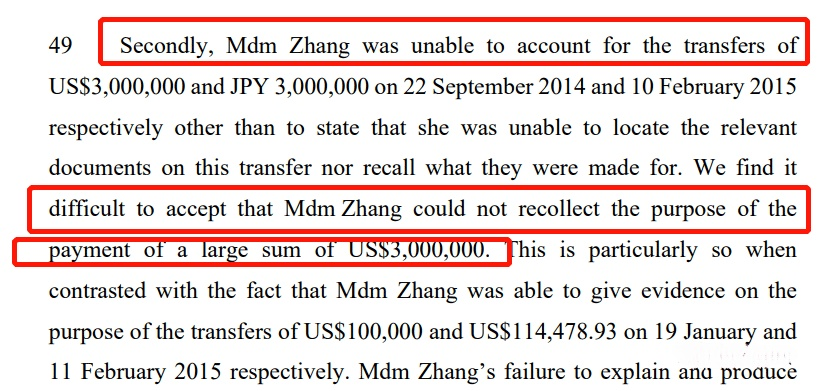

Because, during the existence of the trust, Zhang Lan successively made some operations which left a handle for the breakdown of the trust, CVC collected 7 transfer information of the trust which were all belonged to Zhang Lan, which directly indicated that Zhang Lan in fact held the trust assets and transferred them arbitrarily, and held the absolute control of the trust assets, which was not held by Wang Xiaofei at the beginning of the establishment of the trust and benefited from it.

Zhang Lan explained it in two ways: one is forgetting the purpose and the other is for Wang Xiaofei.

The judge didn't buy it, "it's not common sense to be unable to remember the purpose of a large transfer, and doesn't see any need for Zhang Lan to receive the money on behalf of Wang Xiaofei."

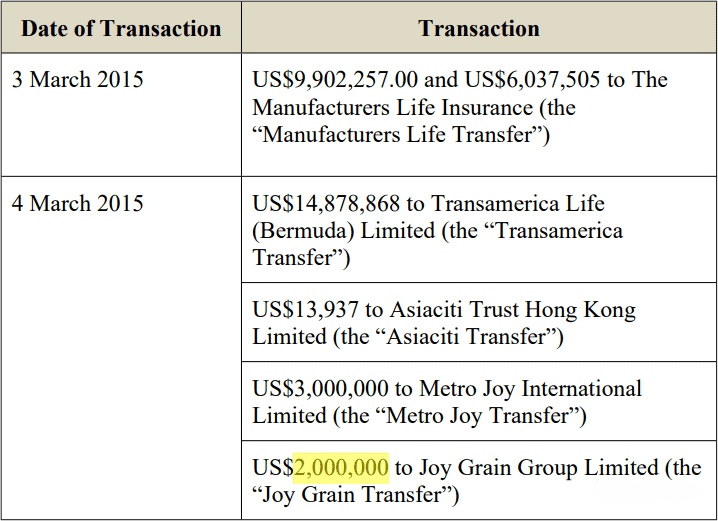

Meanwhile, after the Hong Kong court issued an asset freeze order against Zhang Lan, Zhang Lan transferred a number of sums of money from the SETL Deutsche Bank account (DB account), some of which still do not appear to have been backed up by the appropriate trustee's instructions or resolutions.

Therefore, some of Zhang Lan's material behavior proved that Zhang Lan was the actual controller and beneficiary of the trust, so CVC's debt collection could be repaid with trust assets.

02

Overseas insurance worth $30 million not enforced

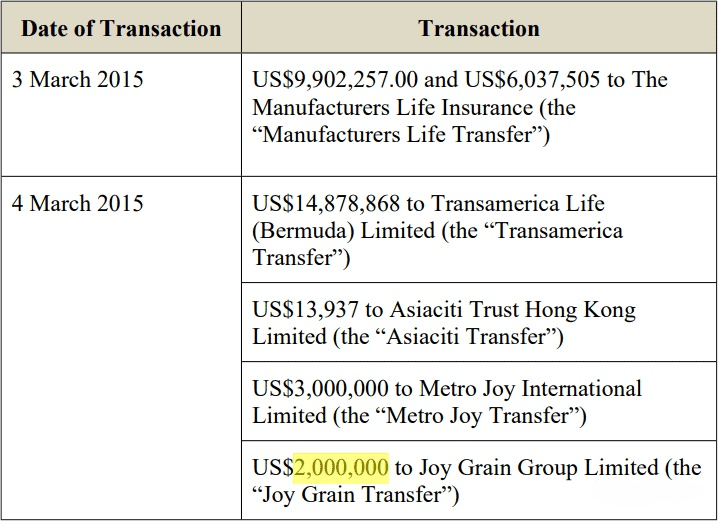

Of the seven transactions by Zhang LanTwo payments were made to insurance companies to purchase insurance:

The two premiums combined amounted to $31 million, which translates to about $200 million +.

With respect to these two policies, the court found that the procedures were legal and compliant to isolate the Zhang Lan debt and that CVC was not entitled to recover.

Top 6 features of a large policy

Rich people are willing to spend a lot of money to buy insurance, just to give themselves a protection? Not exactly, high net worth people, more important to the three dimensions of the function of insurance:Perfect risk protection, optimized asset allocation, and safe wealth inheritance.

1. Yield lock feature

The contractual attributes of an insurance contract and its long-term nature result in a predetermined interest rate that cannot be changed once the policy is signed, thus giving rise to the income-locking feature of life insurance.

2. Leverage function

The leverage function of life insurance is a core function that is also unique to life insurance and can hardly be replaced by any financial instrument. The risk of loss can be passed on to the insurance company by paying a small premium. At the same time, the leverage function of life insurance can be turned into an "amplifier" of wealth.

3. Family wealth transmission function

The policyholder and the insured of a large sum insured policy can flexibly designate the beneficiaries of the large sum insured policy and their beneficiary ratio within the scope of the law, and have the right to change the beneficiaries and their beneficiary ratio before the large sum insured policy is paid out, thus realizing the inheritance of wealth, and even precise inheritance from one generation to the next.

4. Financing function

Insurance policies generally have a cash value, cash value through the policyholder's right to cancel the policy arbitrarily can be realized at any time, is the property belonging to the policyholder's actual and effective control, at home and abroad can be mortgaged or pledged through the policy for loans, to achieve the function of capital financing.

5. Marital wealth planning function

A large policy is a "cash vault" for premarital property, preventing commingling and preserving marital property.

A marital policy with a parent as the policyholder and a child as the insured is the property of the policyholder until the policy pays out and does not become the marital community property of the child. This creates marital property planning.

6. Relative debt segregation function

Insurance is different from trust, the property preservation function of trust is based on the independence of trust property, while insurance is a special contract, the policyholder will give the insurance money to the insurance company, the insured's body as the subject of insurance, the establishment of the insurance contract, the insurance company will pay the insurance money to the designated or legal beneficiaries under different conditions, to achieve the transfer of property legally between the policyholder and the beneficiaries.

HNWIs generally believe that by purchasing insurance on a long-term basis, they can protect their wealth and cope with various emergencies in the future, such as medical care, retirement, children's education, and intergenerational wealth inheritance and other financial needs. Insurance, as the financial instrument most directly linked to "protection", is favored by HNWIs.