Exploring the differences between Hong Kong and Mainland insurance from an investment perspective

2024-01-25

Over 130,000 new local companies to be formed in Hong Kong in 2023, a five-year record high!

2024-02-01Asset allocation is a science that helps us to allocate different types of assets in certain proportions to reduce the volatility of the overall portfolio. Through asset allocation, we are able to better plan our family finances and prepare for future emergency expenses, insurance costs, etc.

Here are 4 practical asset allocation methods to help you easily master the art of asset allocation!

01

life cycle approach

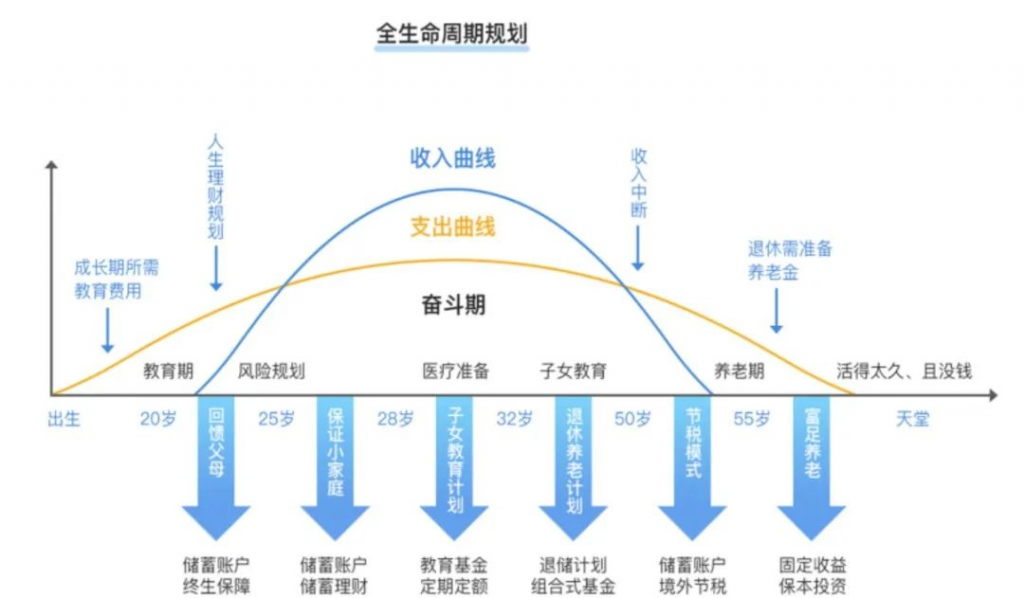

The Life Cycle Approach is a classic asset allocation method that determines the amount of money that can be used for medium to long term investments based on the emergency reserves, insurance expenses, etc. required at different ages.

for reference only

02

Targeted Risk Strategy

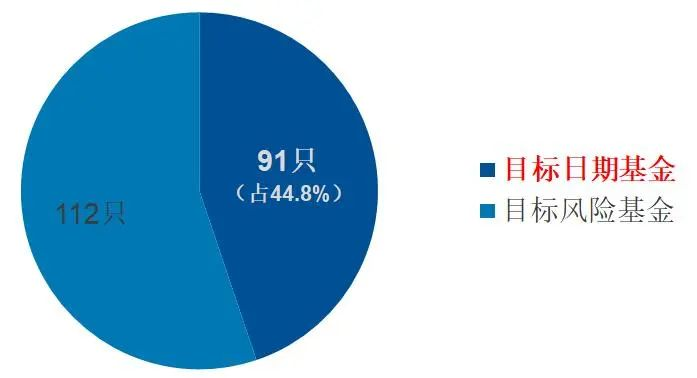

The target risk strategy is to set a fixed investment ratio based on your risk appetite, allocating to equity and bond assets.

An example is a 50/50 split between equity and bond assets, with a fixed ratio over time. This strategy regulates portfolio risk through equity ratios and is relatively easy to strategize and operate.

for reference only

03

Core-Satellite Strategy Configuration

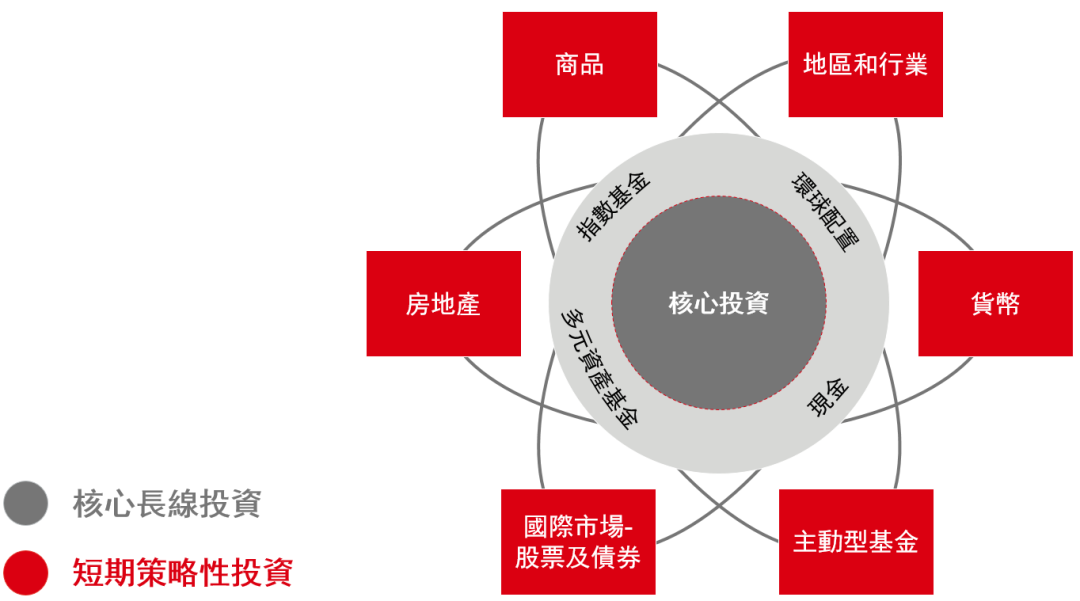

The core-satellite strategy divides the portfolio into two components, core and satellite assets, and seeks primarily higher returns with solid and manageable risk.

This is done by allocating core assets to asset classes that are predominantly solid long-term performers, such as fixed income, fixed income-plus and broad-based indices, and by allocating satellite assets to classes that seek higher returns and take on more risk, such as equity products.

This strategy requires the ability to analyze economic cycles and it is still advisable to develop a plan with the assistance of a professional wealth advisor.

for reference only

04

Standard & Poor's Household Asset Allocation

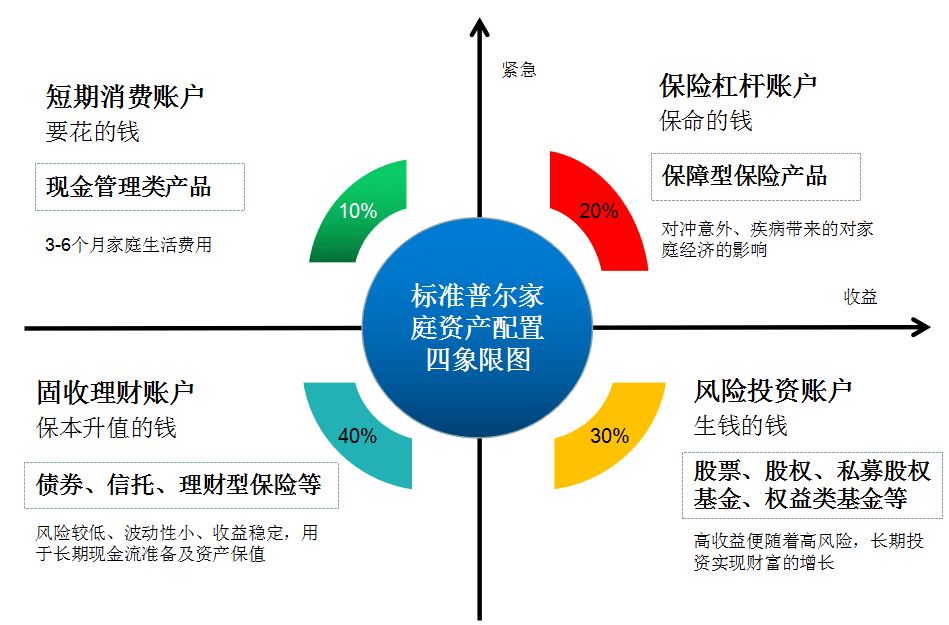

The Standard & Poor's Household Asset Allocation Method is based on allocating assets as a whole, dividing them into four categories and differentiating them in a 1:2:3:4 ratio.

This approach is simple to understand, but has very limited relevance in practice. However, this classic model can still remind investors to divide their household assets according to their needs and allocate assets with different functions to financial products with different risks and liquidity.

for reference only

Gary Brinson, the father of global asset allocation, said, "The most important thing to do when making investment decisions is to look at the market and identify good investment categories. In the long run, about 90% of investment returns come from successful asset allocation."

If we can clarify the financial goals of each stage as early as possible, formulate an asset allocation plan that matches our lives, and adhere to the implementation, we will be able to reap the benefits of "steady happiness" and face life with ease!