What are the offshore RMB and onshore RMB?

2023-12-22

Hot | Hong Kong Announces: Proposed 15% Global Minimum Tax Rate

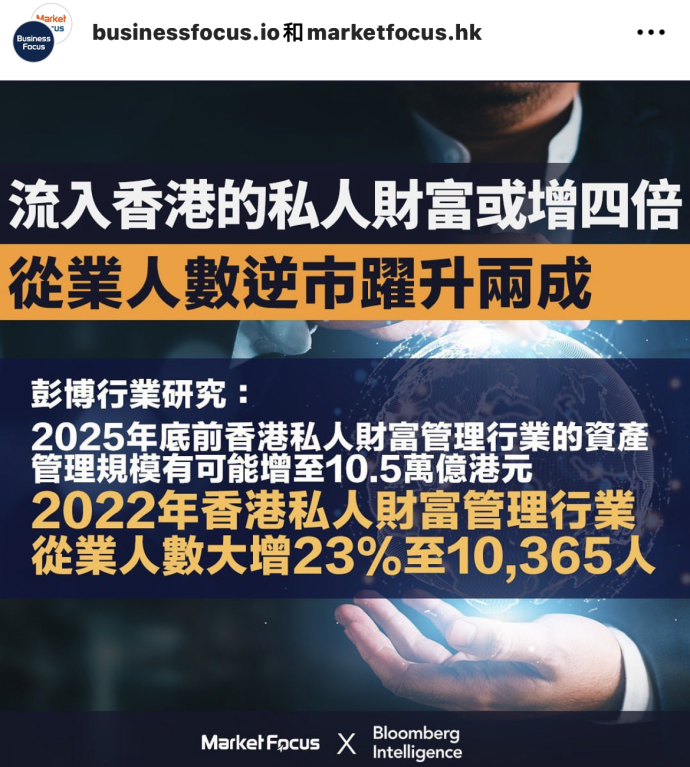

2023-12-29According to Bloomberg industry research, benefiting from easier cross-border investment, driven by the Hong Kong Talent Admission Scheme.Hong Kong's private wealth management industry is expected to see a more than four-fold surge in net capital inflows by 2023, is expected to overtake Switzerland as the world's largest wealth management center.

An interesting phenomenon is that the inflow into Hong Kong's insurance industry has reached a record high in 2023 despite the unstable investment environment in various sectors. In the first half of 2023 alone, the inflow of capital from the Mainland to Hong Kong for investment in insurance, amounted toHK$31.9 billion.Since 2005, when statistics were availableAll-time high!

Mainland investors currently account for a significant portion of Hong Kong's private wealth management industry.16%.Hong Kong has become the center of cross-border wealth allocation for mainlanders.preferred marketThe influx of capital has been a frenzied one. The frantic influx of living capital demonstrates Hong Kong's evergreen international financial status.HONGKONGFive Financial Advantages of Hong Kong

1Wealth and Risk Management Center

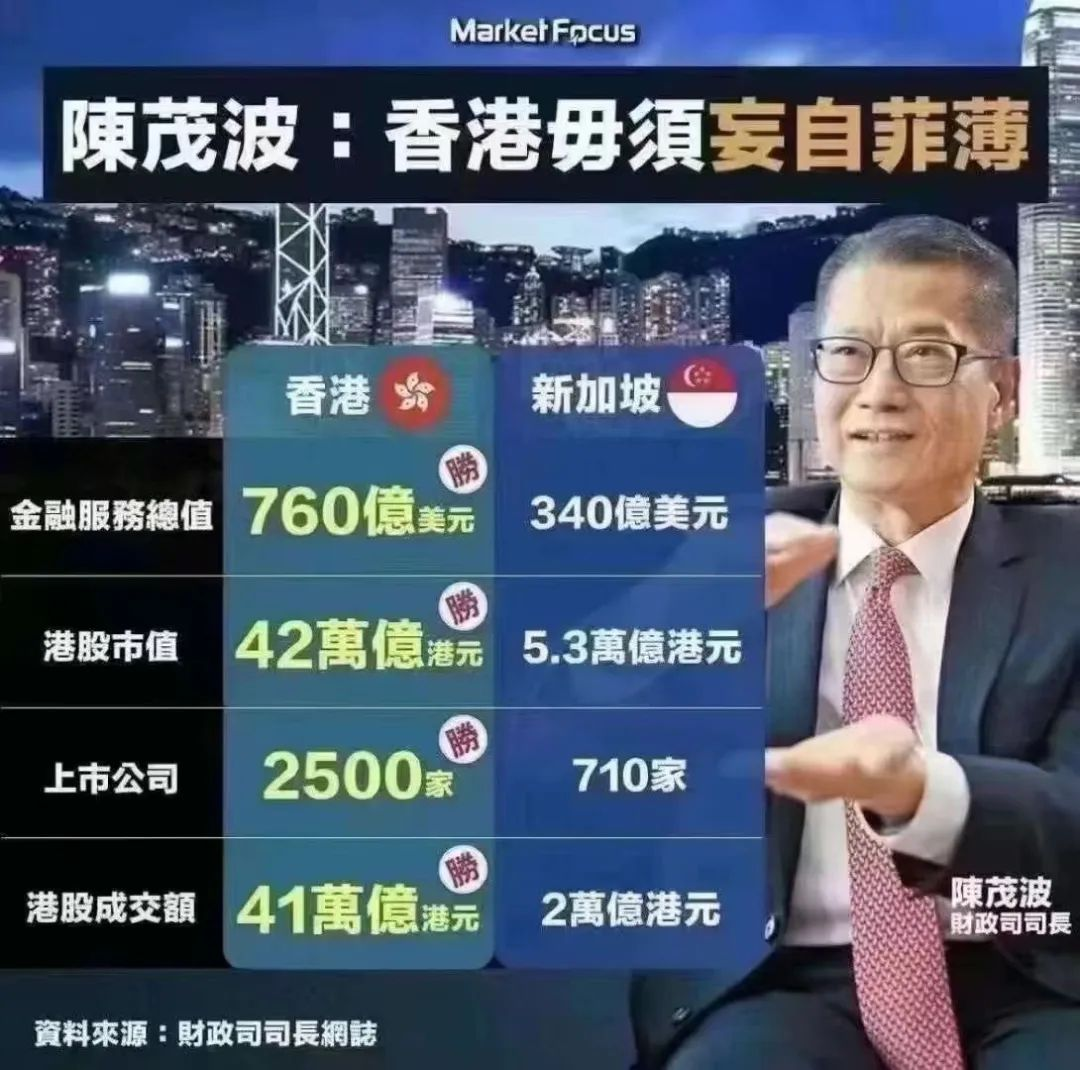

Hong Kong and Singapore are both financial centers in Asia, and the Financial Secretary of Hong Kong, Mr. Paul CHAN, said that there is no need for Hong Kong to be complacent.

By the end of 2021, Hong Kong's asset management had reachedHK$35.5 trillion, of which more than 60 percentFrom abroadThis demonstrates Hong Kong's strength in global asset and wealth management.

Hong Kong has a highly open financial market.73 of the world's top 100 banks and top insurance organizations have set up operations in Hong KongThe company has attracted world-class experts to gather here.

The Chairman of the Hong Kong Monetary Authority (HKMA), Mr. Lee Luk-yan, even predicted that by 2023, Hong Kong is expected to overtake Switzerland to become the largest financial center in the world.Largest cross-border wealth management centerThe

This forecast not only highlights the attractiveness of Hong Kong, but also signals an even more important role for Hong Kong as a global wealth management hub in the future.Insurance penetration rate ranked second globally and in Asia Insurance density ranked first in Asia and second globally

2The world's largest offshore RMB pool

As the core hub of the global offshore RMB business, Hong Kong has the advantage of free flow of capital and has gatheredNearly $1 trillion offshore RMB pool.

Currently, Hong Kong's daily RMB settlement exceeds RMB 1.65 trillion. According to SWIFT data, theOver 70% of global offshore RMB payments are settled through Hong Kong.This not only highlights Hong Kong's pivotal position in offshore RMB business, but also demonstrates its importance in the global financial system.

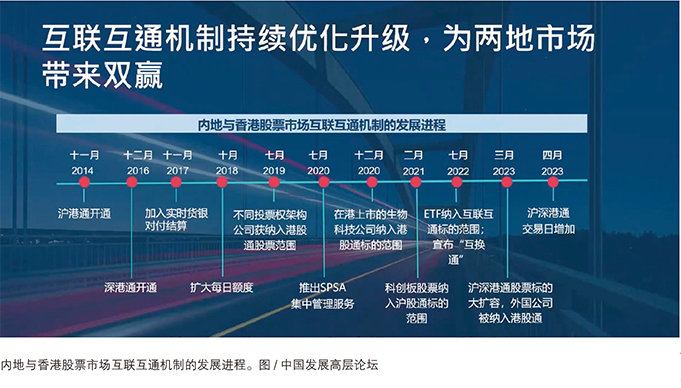

3Connectivity of the capital markets of the two places

Benefiting from national policy support, the financial market interconnection system between the Mainland and Hong Kong has seen rapid development in recent years.

Shanghai-Hong Kong, Shenzhen-Hong Kong, Bond Connect, Swap Connect, ETF ConnectA series of interconnection mechanisms, such as the one launched one after another, have provided diversified avenues for foreign investors to invest in RMB assets in the Mainland.

The Chairman of the Hong Kong Monetary Authority (HKMA), Mr. Lee Luk-yan, has predicted that the next theme of interconnection between the two places will be"Insurance Access"The new system, which covers a wide range of sales and service areas, is expected to be a long-term sustainable interconnection mechanism.

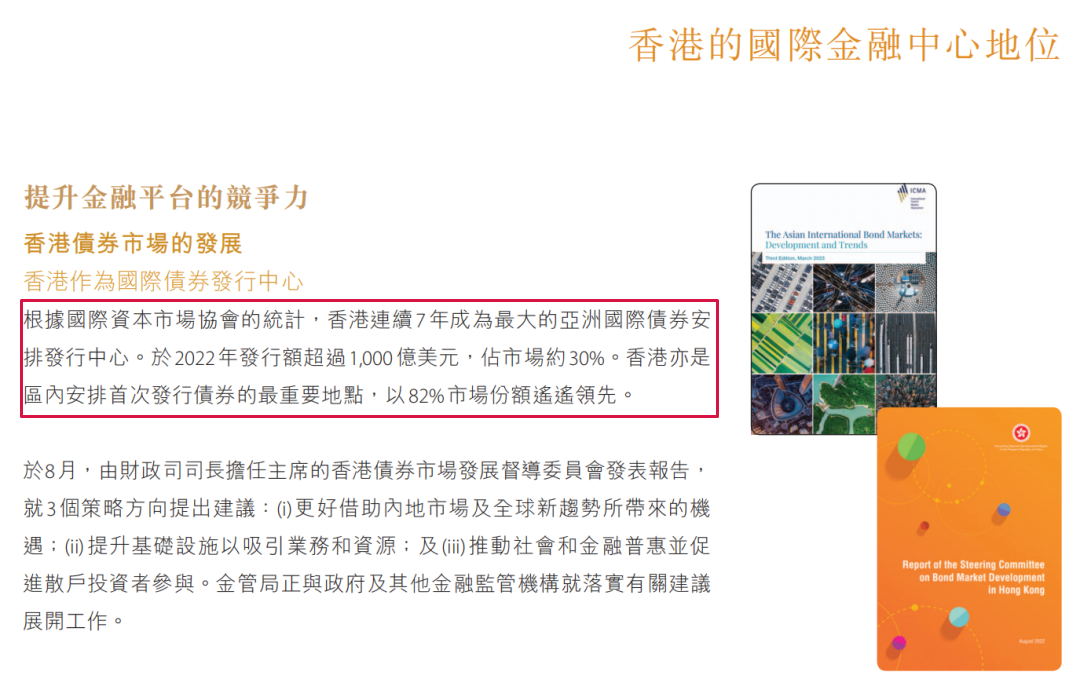

4The world's top investment and financing platform

Hong Kong is the world's top investment and financing platform with a mature financial foundation. In terms of equity financing, Hong Kong has long beenThe world's leading IPO financing centerThe company has been attracting many companies to choose to list in Hong Kong.

And in the area of bond issuance, theFor seven consecutive years, Hong Kong has been recognized as the largest issuer of international bond arrangements in Asia.In addition, Hong Kong is also the most important place in the region for arranging initial bond offerings, and itsWith a market share of up to 82%.Way ahead of the competition.

5Green Financial Center of the Greater Bay Area

In 2023, Hong Kong's Budget clearly states that it aims to proactively build Hong Kong into an international green technology and green financial center to keep pace with the global trend of green development.

Hong Kong's leading green finance market in Asia.The total amount of green and sustainable bond issuance arranged by Hong Kong accounts for more than one third of the Asian market.In addition, Hong Kong's green technology enterprises have a significant advantage in the area of scientific research, which provides strong support for green innovation.

Having gone through the tests of the global economic crisis and the epidemic, Hong Kong's financial system, relying on the support of the Motherland and with the unique advantage of being connected to the world, has always shown great resilience, and its status as an international financial center is as solid as a rock.

With the announcement of the new Capital Investment Entrant Scheme (CIES) rules, Hong Kong will have unlimited opportunities. If you would like to know more about Hong Kong's wealth management, identity planning, etc., please feel free to contact us!