Beyond Switzerland, Hong Kong is expected to become the new benchmark for global wealth management!

2024-06-28

Why is the Japanese stock market at record highs despite the depreciation of the yen?

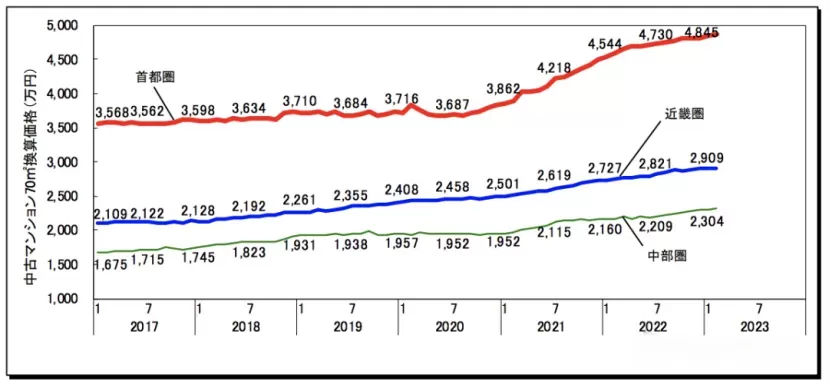

2024-07-11JapaneseMature and stable real estate market(math.) genusSound laws and regulations, providing investors with a favorable investment environment. In recent years, with the recovery of the Japanese economy and the increase in the foreign population, the real estate market has continued to be active, with rental returns steadily rising.

In addition, the Japanese real estateGreat potential for value retention and appreciationIt is an ideal investment choice for those who are looking for a solid return on their investment.

in the wake ofdepreciation of the Japanese yencap (a poem)Stabilization of the Japanese real estate marketMore and more investors are interested in Japanese real estate.

#01

Japanese Real Estate Types in Detail

Apartments (Mansion)

Features: reinforced concrete or steel structure, good sound insulation and safety.

Suitable: Convenient transportation, good supporting facilities, suitable for self-occupation or investment.

Low-rise Apartments (Apartment)

Characteristics: 1-3 story wood or light steel frame buildings with relatively low rents.

Ideal for: investors with limited budgets, usually located in suburban or sparsely populated areas.

Ichidokken (Ichidokkenて)

Characteristics: Detached houses with separate land and house titles, large size and flexible design.

Suitable for: family ownership or long term investment, one-family construction in major cities such as Tokyo is more expensive.

Towers (tawa mansions)

Features: High-rise condominium with full amenities and great views.

Ideal for: High-end investors with high rental returns.

#02

Home Buying Process

1. Define the needs of home purchase

Clarifying your budget, location, size, floor plan and other needs will help you find the right property faster.

2. Finding the right intermediary

Choose a reliable agent who provides a wealth of information on properties and assists with the home buying process.

3. Viewing and selecting a house

Pay attention to whether the actual condition of the property is consistent with the advertised description, and find out important information such as the ownership status and development restrictions of the property.

4. Submit a purchase request and pay a deposit

Submit a purchase request to the seller, containing information such as the requisition price and payment terms. Pay a percentage deposit (usually 5-10% of the total price of the property) to confirm your willingness to purchase.

5. Prior review of bank loans

If you need a loan to purchase a home, submit a loan application to the bank for prior review to determine the loan amount and interest rate.

6. Conclusion of a contract of sale

Sign a contract of sale with the seller, detailing the rights and obligations of the buyer and seller, including the price of the house, payment methods, and the timing of the closing.

7. Handling of transfer procedures

Submit the transfer application to the Legal Affairs Bureau, pay the relevant taxes and fees, and complete the transfer procedures to become the legal owner of the property.

#03

One-time expenses for buying a house

1. Intermediary handling fee:House price of 3% + 60,000 yen.

2. Property acquisition tax:Land Fixed Asset Valuation x 2% + Building Fixed Asset Valuation x 2%.

3. Judicial clerks' fees: 60,000 to 100,000 yen.

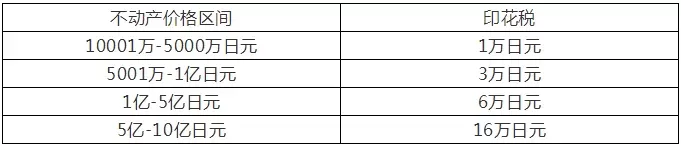

4. Stamp duty on contracts:As shown, it is set according to the amount of the property.

5. Insurance premiums::Fire and earthquake insurance.

#04

Fixed expenditure held

1. Property Taxes (Fixed Asset Tax and Metropolitan Planning Tax)

▶ Fixed asset tax: assessed price of land × 1.4%, assessed price of property × 1.4%.

▶ Metropolitan program tax: assessed price of land × 0.31 TP3T, assessed price of property × 0.31 TP3T.

▶ Annual property taxes are approximately 0.31 TP3T - 0.41 TP3T of the property's selling price.

2. Rental income tax::20% withholding tax.

3. Local taxes:Applicable to foreign companies and individuals engaged in real estate leasing business in Japan.

4. Management fee (applicable to apartments):Commissioning fees for management companies, cleaning fees for common parts, utilities, inspections of common equipment, etc.

5. Repair costs (applicable to apartments):Accumulated funds for large-scale renovation projects.

#05

Home Buying Tips

1. Knowledge of land types and housing structures

Ensure that the property meets the needs and purpose of the use, such as seismically sound RC- and SRC-built homes.

2. Checking the completeness of all types of documents

Ensure that documents such as real estate certificates and architectural drawings are complete to avoid future disputes.

3. Adequate communication with sellers

It is important to communicate fully with the seller during the real estate buying process. Through communication we can better understand the reality of the property and the seller's true intentions to make a better decision.

4. Finding reliable agents and hosting companies

A reliable agency has quality properties on hand, while an escrow company can provide professional property management services to help rent out the property and get a stable rental return.

Buying a home in Japan is full of opportunities, but you need to proceed with caution. ByComprehensive understanding of relevant regulations, careful examination of property details, rational financial planningAs well as seeking professional help at the right time, you can effectively avoid many potential problems and realize your dream of buying a home overseas.

If you are planning to buy a home in Japan, please feel free to contact us!